The current Bitcoin rally, propelling its value to the $52,000 stage, has positively impacted the inventory of US-based cryptocurrency trade Coinbase (COIN). After experiencing a notable dip to $115 firstly of February, Coinbase’s inventory rose to $172 on Thursday, following a major improve by a JPMorgan analyst.

Improved Prospects For Coinbase Amid Crypto Rally

Based on a Bloomberg report, JPMorgan analyst Kenneth Worthington deserted his bearish view on Coinbase weeks after downgrading the inventory.

As Bitcoin traded greater, Coinbase shares gained as a lot as 7.8% following the improve. Worthington believes the trade will seemingly profit from the current rally in digital asset costs, prompting him to shift his score again to impartial.

This transformation in stance comes after Worthington’s January downgrade, the place he predicted a possible deflation of enthusiasm for Bitcoin exchange-traded funds (ETFs).

Nevertheless, opposite to his earlier forecast, Bitcoin ETFs have been profitable by way of buying and selling measures, and the worth of Bitcoin has surged past $52,000, reaching its highest stage since 2021. In a notice to purchasers on Thursday, Worthington defined:

Given the acceleration in current days of flows into Bitcoin ETFs and the numerous value appreciation of Bitcoin and now Ethereum, we’re returning to a Impartial score on Coinbase as we see the upper cryptocurrency costs not solely sustaining however bettering exercise ranges and Coinbase’s earnings energy as we glance to 1Q24.

Coinbase’s inventory skilled an 8% dip at first of the 12 months, following a formidable 400% surge in 2023. Analyst opinions on the inventory stay divided, with purchase, maintain, and promote suggestions being roughly evenly break up.

Worthington maintained his $80 value goal on the inventory forward of the corporate’s earnings report, which is scheduled to be launched after the market closes on Thursday.

Worthington emphasised that Coinbase’s enterprise is intently tied to token costs, with its core income being transaction-based. As the worth of tokens will increase and buying and selling exercise good points momentum, charges primarily based on the worth traded are anticipated to drive greater buying and selling volumes, in the end contributing to improved income for Coinbase.

Bitcoin ETFs Witness Vital Buying and selling Quantity

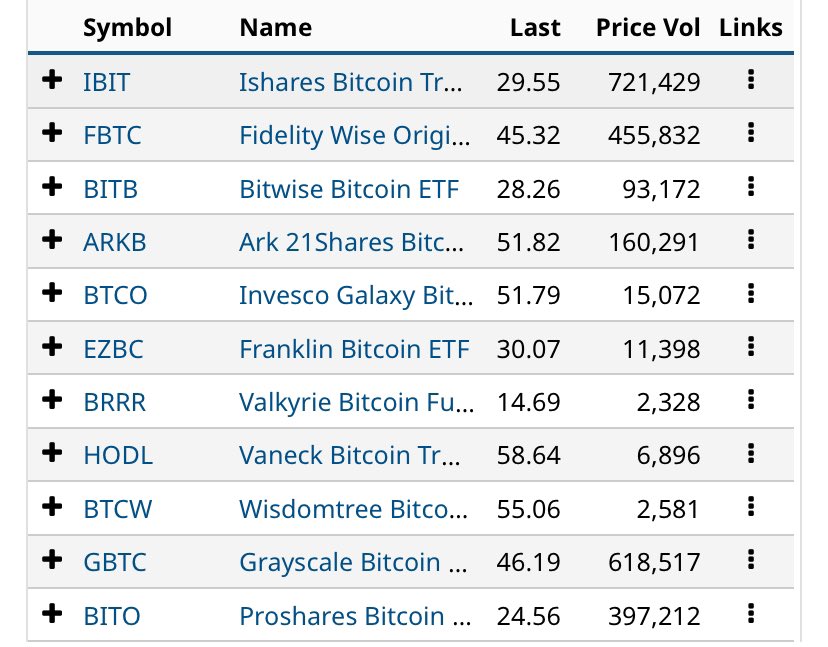

On February 14th, the buying and selling quantity of Bitcoin ETFs showcased notable figures, with Blackrock’s IBIT recording the lead with $721 million in quantity.

Grayscale’s Bitcoin Belief (GBTC) adopted intently with $619 million, whereas Constancy’s FBTC secured the third spot with $456 million. However, Ark Make investments amassed a quantity of $169 million.

The 9 ETFs’ complete buying and selling quantity amounted to roughly $1.5 billion. Notably, the biggest ETFs skilled greater buying and selling quantity than yesterday, with IBIT surpassing $700 million and GBTC exceeding $600 million.

Intriguingly, earlier than the buying and selling session, GBTC despatched lower than half of the Bitcoin it despatched to Coinbase yesterday. Regardless of this lower, GBTC’s complete buying and selling quantity was 50% greater.

Because the demand for Bitcoin continues to surge, ETFs play a vital function in facilitating institutional and retail buyers’ participation within the cryptocurrency market. The elevated buying and selling quantity of Bitcoin ETFs highlights buyers’ rising curiosity and confidence in digital property.

At the moment, Bitcoin is buying and selling at $51,900 and encountering a important resistance stage at $52,000.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site fully at your individual danger.