The Bitcoin market was swept right into a frenzy following an alleged hack of the US Securities and Trade Fee’s (SEC) X account, falsely claiming the approval of 11 spot ETFs. This misinformation led to a rollercoaster in Bitcoin’s value, which initially soared from $46,800 to $48,000, solely to crash to $45,000 inside a span of 20 minutes.

This incident has turn into a pivotal second for market analysts, offering insights into how the market may react to at this time’s potential Bitcoin spot ETF approvals within the brief time period. So right here’s what specialists from K33 Analysis, QCP Capital, and Daan Crypto Trades need to say.

#1 K33 Analysis: Approval Will Be ‘Promote-The-Information” Occasion

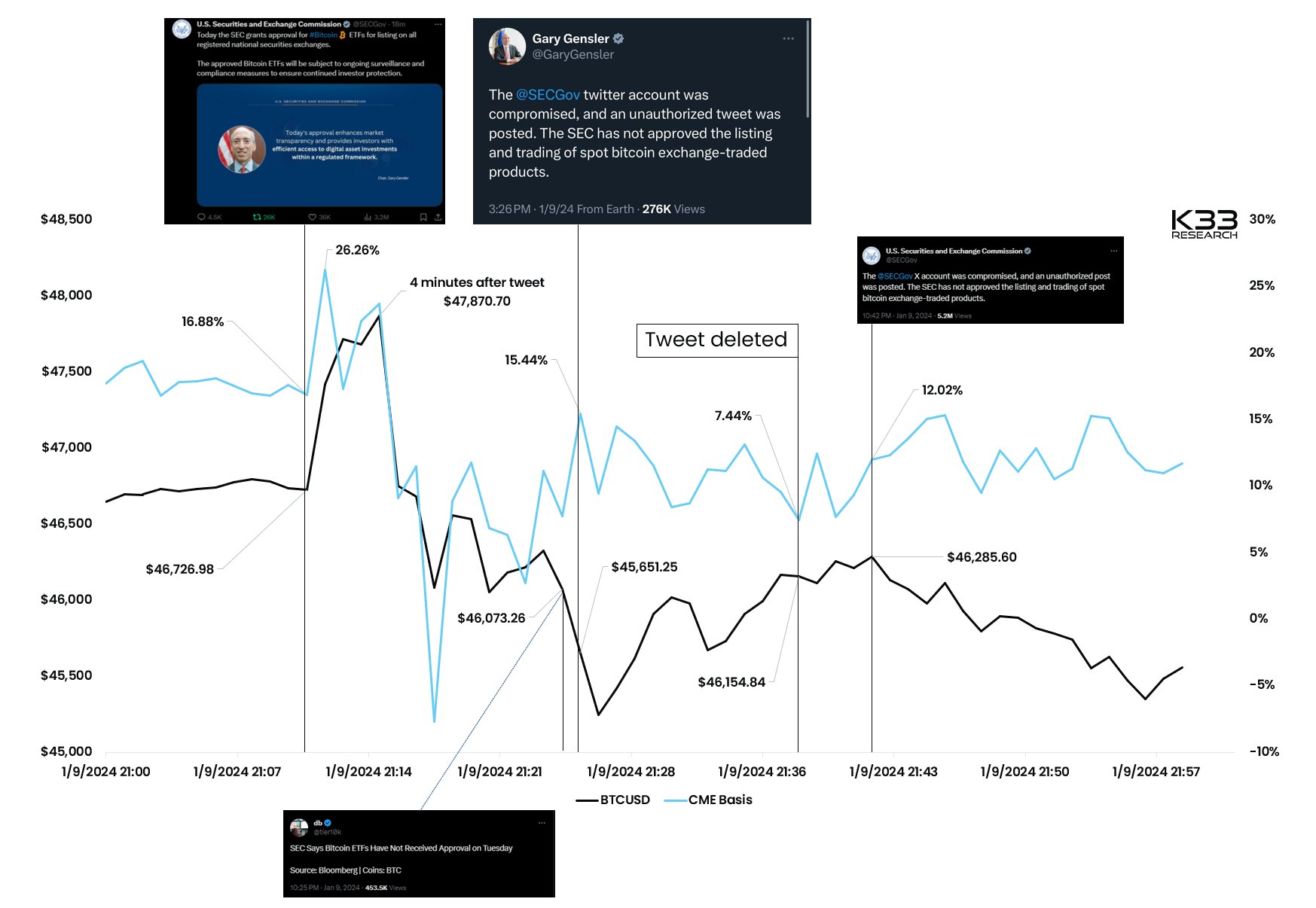

Vetle Lunde, a senior analyst at K33 Analysis, offered an in-depth evaluation of the market’s response to the faulty announcement. He noticed that the market’s instant response was indicative of an inclination in the direction of a ‘sell-the-news’ response. The preliminary surge in Bitcoin’s value was shortly met with a flood of lengthy positions, inflicting a big value fluctuation.

“The market confirmed its arms yesterday; the ETF approval rehearsal favors a sell-the-news response. Instantly after the announcement, longs shortly crowded the market, implementing a whipsaw within the following minutes,” Lunde said.

Lunde additionally identified that till the SEC’s clarification, the market largely accepted the announcement at face worth, triggering an natural response. He outlined the sequence of occasions, noting a 2.4% improve in Bitcoin’s value inside 4 minutes post-announcement, adopted by a 1.4% lower in 14 minutes till Bloomberg debunked the approval information.

The market ultimately stabilized when Gensler confirmed the hack, highlighting the market’s sensitivity to regulatory information and rumors.

#2 QCP Capital: Warning Signal For Bitcoin Merchants

QCP Capital, of their “QCP Market Replace – 10 Jan 24,” mirrored on the weird nature of the occasion with a mixture of humor and evaluation. “We’re on the cusp of a BTC Spot ETF approval, and what transpired within the final 24 hours is one thing you possibly can’t make up,” their replace started.

They identified the lukewarm preliminary response to the ‘approval,’ suggesting that the market might need already priced in the potential of an precise ETF approval.

“The preliminary response to the ‘approval’ was muted with BTC being unable to commerce out of the resistance space. We take this as a warning signal that an approval is generally priced in and there is probably not an enormous rally submit the approval,” QCP warned.

QCP Capital additionally centered on the implications of this occasion for future market traits. “The restrained response to the fake approval indicators a warning – the precise approval of a Bitcoin ETF may not set off the anticipated rally,” they noticed, additionally pointing to the present market dynamics, such because the elevated choices volatility and spot-futures foundation unfold. Notably, the agency sees Bitcoin’s subsequent help at $40,000 to $42,000, and resistance round 48.500.

Daan Crypto Trades: ETH/BTC Might See A Spike

Daan Crypto Trades offered a concise however insightful evaluation. “The false ETF approval information was a litmus take a look at for the market’s post-approval course,” he commented. The evaluation highlights the sample of Bitcoin’s value spiking after which totally retracing following the faux announcement.

“This sample might effectively repeat upon precise ETF approval, however with extra pronounced promoting stress,” he steered. Daan Crypto Trades additionally touched on the broader market implications, particularly for the ETH/BTC ratio, which began rallying instantly after the faux announcement.

He additional remarked:

ETH/BTC began rallying right away which can be what we’ve been in search of. I feel at this time we would get yet another small spike down on ETH/BTC as BTC spikes up however after that I don’t see a lot holding again the ETH/BTC ratio anymore. Particularly if BTC cools off submit ETF.

At press time, BTC traded at $45,346.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use data offered on this web site solely at your individual threat.