On-chain information exhibits the Bitcoin miners have participated in a 3,000 BTC selloff not too long ago, one thing which will clarify the asset’s newest pullback.

Bitcoin Miner Reserve Has Taken A Plunge Lately

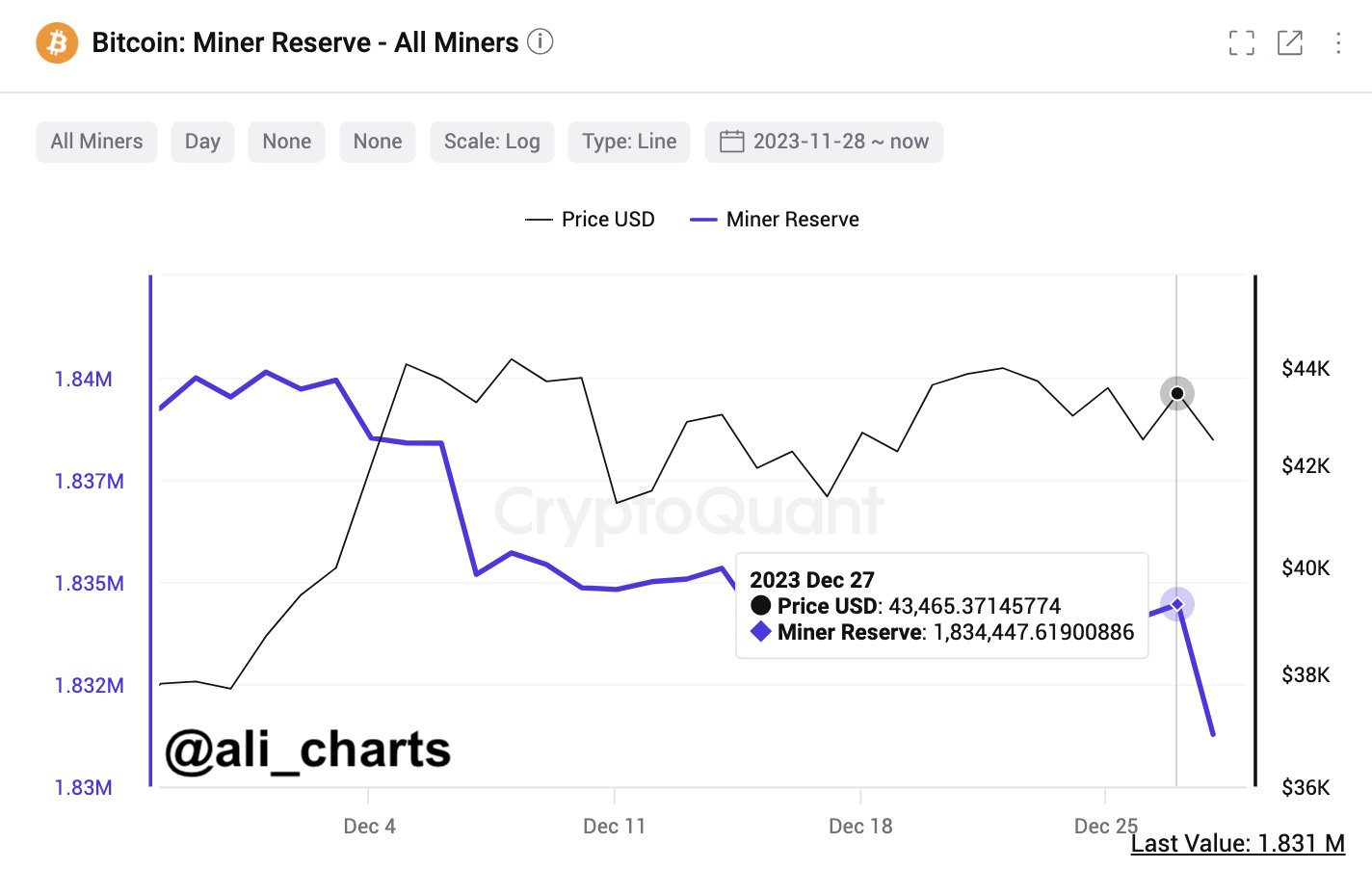

As identified by analyst Ali in a brand new submit on X, the BTC miners have participated in some promoting not too long ago. The indicator of curiosity right here is the “miner reserve,” which retains monitor of the overall quantity of Bitcoin sitting within the wallets of all miners.

When the worth of this metric goes up, it implies that the miners are receiving a web variety of cash of their addresses proper now. Such a development means that these chain validators are selecting to build up the asset at the moment, which might naturally have bullish results on the worth.

Then again, a decline implies that this cohort is transferring cash out of their wallets for the time being. Typically, the miners make such outflows after they want to promote their BTC, so this type of development can have bearish implications for the cryptocurrency.

Now, here’s a chart that exhibits the development within the Bitcoin miner reserve over the previous month:

The worth of the metric appears to have sharply dropped in current days | Supply: @ali_charts on X

As displayed within the above graph, the Bitcoin miner reserve has registered a pointy drop through the previous couple of days. Throughout this withdrawal spree, these chain validators transferred out greater than 3,000 BTC from their wallets, value round $128 million on the present trade charge.

Bitcoin had recovered to the $43,800 degree earlier after information had come out about Microstrategy finishing one other substantial buy. Because the miners made these outflows, although, the cryptocurrency witnessed a drawdown in the direction of the $42,000 mark.

Given the timing, it will seem potential that the miners had made these transfers to money in on the restoration and this additional promoting stress could have contributed to the decline that the asset ended up seeing.

Miners are a bunch that has to pay fixed working prices within the type of electrical energy payments, in order that they usually promote a few of the BTC they mine and earn from transaction charges with a view to cowl these bills.

Extra typically not, although, the miners solely take part in comparatively low ranges of promoting, which is quickly absorbed by the market and the cryptocurrency doesn’t really feel an excessive amount of affect

This time round, although, these chain validators have bought a sizeable quantity inside a slender window, which is probably why Bitcoin has appeared to have been affected.

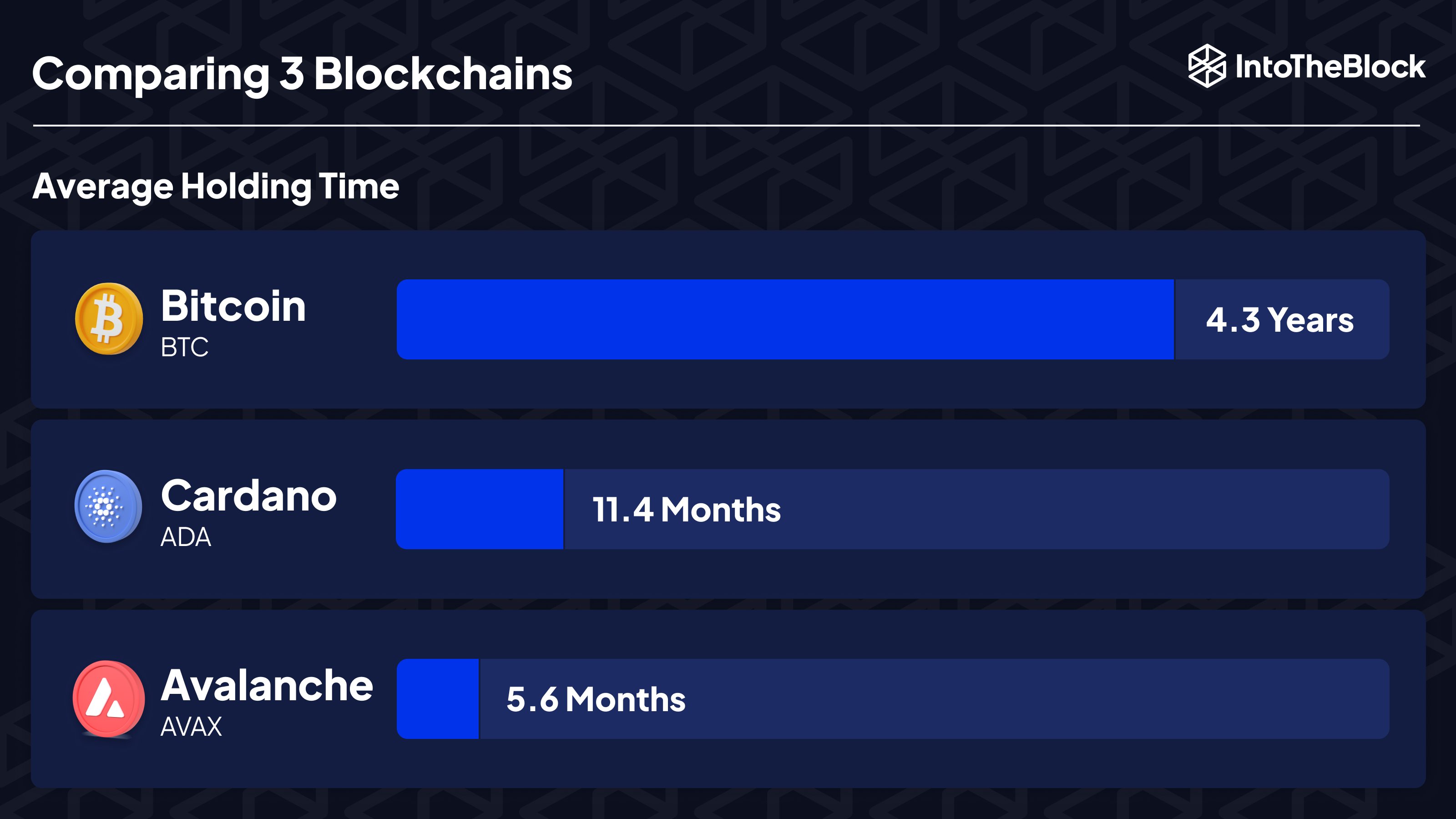

In another information, the market intelligence platform IntoTheBlock has revealed the typical holding time on the Bitcoin blockchain and the way it compares towards different networks.

The common holding time throughout three networks | Supply: IntoTheBlock on X

As is seen above, Bitcoin holders carry their cash for 4.3 years on common, which is way higher than what Cardano (ADA) and Avalanche (AVAX) blockchains observe.

Whereas miners don’t are inclined to HODL due to their working prices, it will seem that the traditional buyers on the BTC community are greater than making up for it by holding for very prolonged durations.

BTC Worth

The market doesn’t appear to be too discouraged after the drop because of the promoting stress from the miners, as Bitcoin is now as soon as once more making a restoration push. To this point, BTC has climbed again to the $42,900 degree.

Seems to be like BTC has been general transferring sideways not too long ago | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com, IntoTheBlock.com

Disclaimer: The article is supplied for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site solely at your individual threat.