Bitcoin had earlier proven a pointy rally towards the $49,000 mark, however the asset was fast to retrace the whole surge because the Coinbase Premium turned adverse.

Bitcoin Coinbase Premium Hole Plunged Into Unfavourable Throughout Previous Day

As identified by CryptoQuant Netherlands neighborhood supervisor Maartunn in a submit on X, the Coinbase Premium Hole has now turned notably adverse after being principally optimistic for the previous couple of days.

The “Coinbase Premium Hole” refers back to the distinction between the Bitcoin costs listed on the cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

This indicator’s worth principally gives hints about how the shopping for or promoting behaviors on these two largest platforms within the sector differ from one another proper now.

When the metric has a optimistic worth, it signifies that the worth listed on Coinbase is greater than on Binance at the moment. Such a development implies the previous platform’s customers are taking part in a better quantity of shopping for (or decrease quantity of promoting) than the Binance customers.

However, the indicator being optimistic means that Binance is perhaps observing a better diploma of shopping for stress for the time being as the worth listed on the alternate is larger.

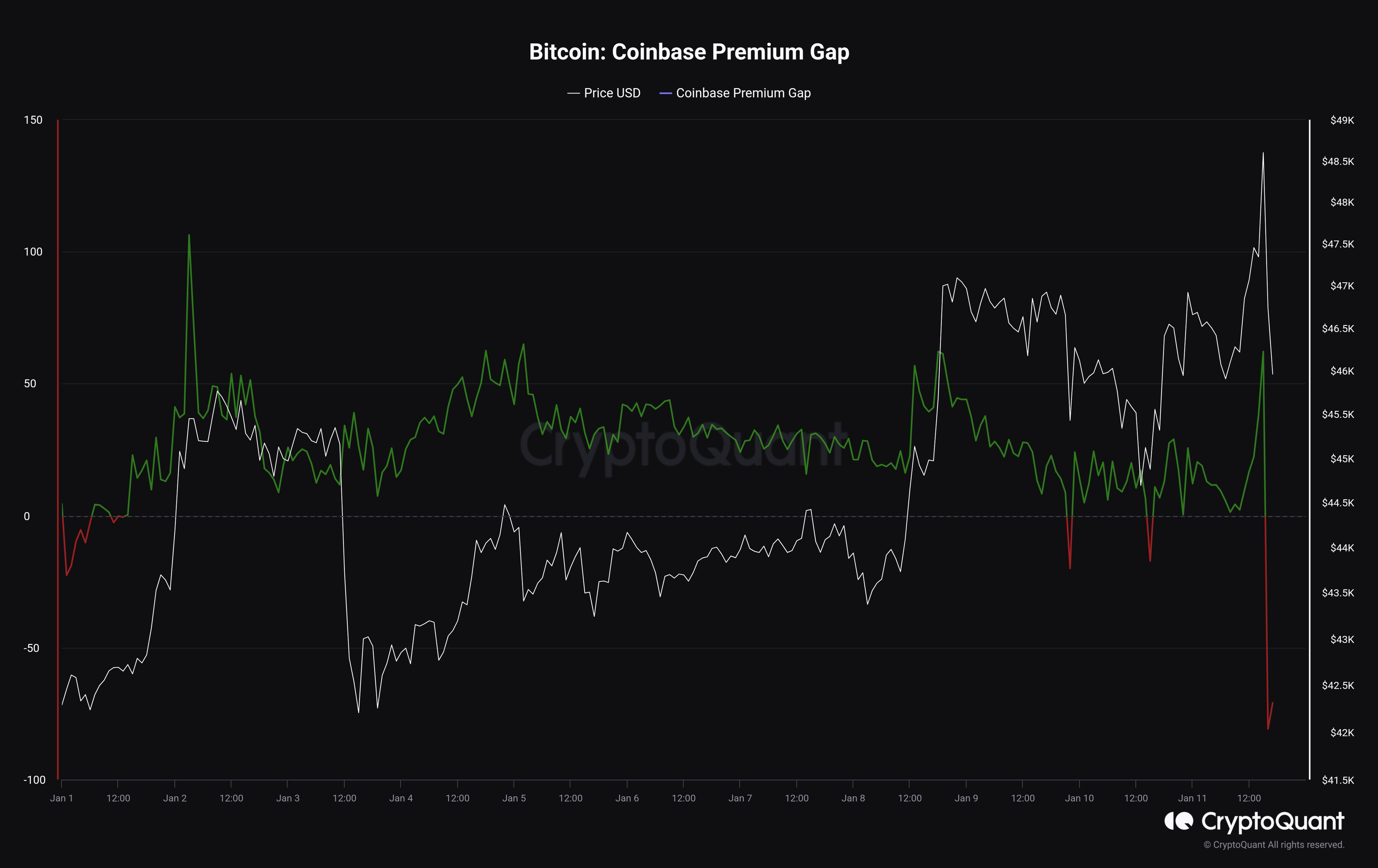

Now, here’s a chart that exhibits the development within the Bitcoin Coinbase Premium Hole because the begin of the 12 months:

Seems like the worth of the metric has taken a plunge throughout the previous day | Supply: @JA_Maartunn on X

As displayed within the above graph, the Bitcoin Coinbase Premium Hole has noticed a pointy plunge down into the adverse territory throughout the previous day or so. Earlier than this plummet, the indicator had been principally at optimistic values because the begin of the 12 months.

There have been just a few dips into the purple zone earlier as properly, however the indicator solely attained minor adverse values throughout these drops. This time, although, the premium is right down to considerably adverse ranges.

The value surges this 12 months have been being pushed by the patrons on Coinbase, as the worth rose each time the premium did as properly. Coinbase is popularly recognized for use by US institutional traders, so the inexperienced premium instructed that these massive entities have been shopping for, almost certainly in anticipation of the ETFs, which lastly gained approval on January tenth.

Some time after this approval, BTC went on to sharply rally towards the $49,000 degree, however the asset’s run was very short-lived as its value plummeted exhausting again in the direction of the worth previous to the transfer, thus erasing all of the beneficial properties.

The Coinbase Premium Hole had been notably optimistic alongside the surge, however the indicator then confirmed its plunge into the adverse territory alongside this fast retrace. It could seem that some American institutional merchants might have used the chance to reap their earnings.

BTC Worth

Bitcoin has been shifting sideways because the fast rally and drawdown, as its value continues to be floating across the $45,800 degree.

The value of the coin appears to have proven an total development of consolidation lately | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, CryptoQuant.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site totally at your personal threat.