Onchain Highlights

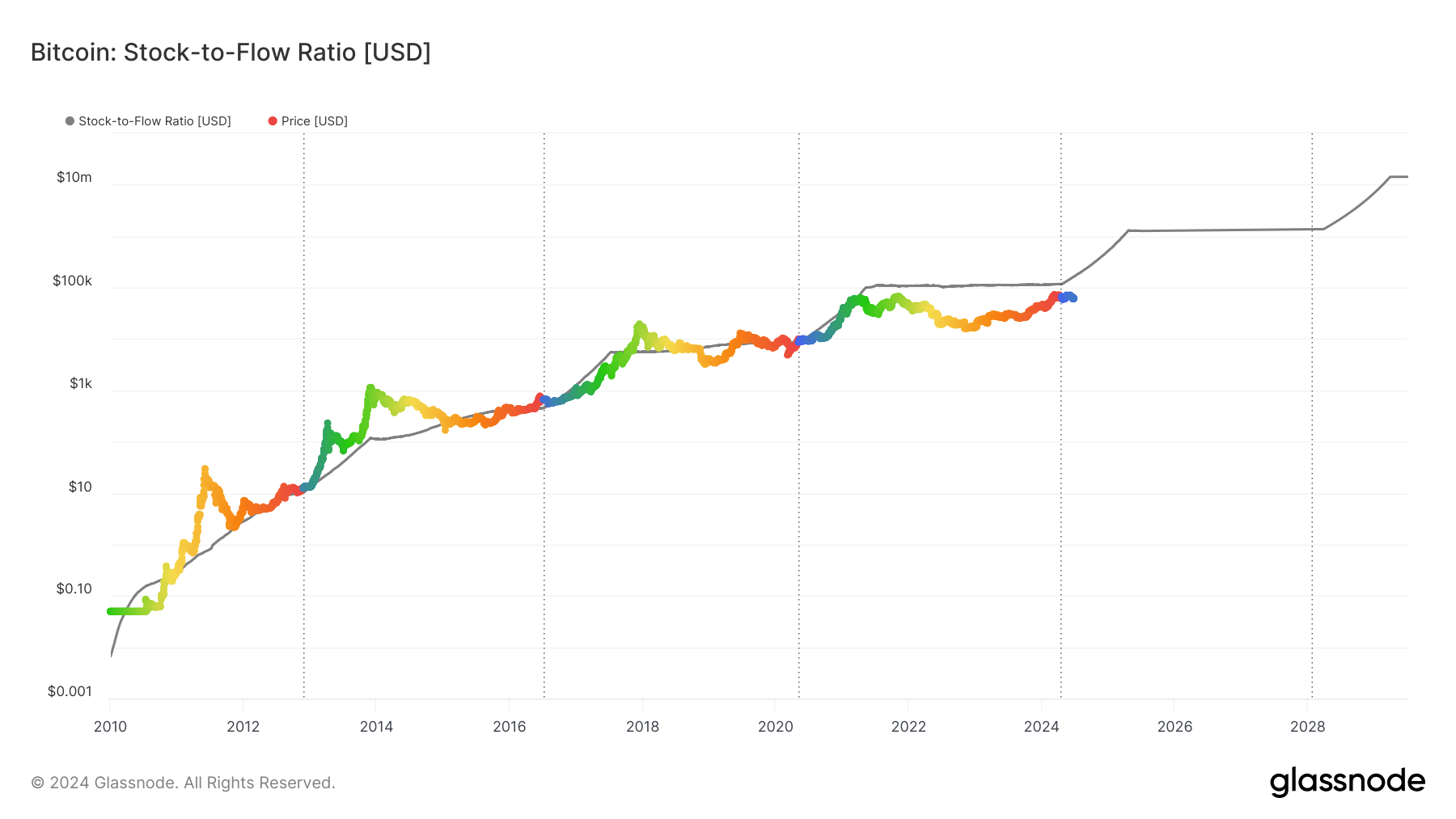

DEFINITION: The stock-to-flow (S/F) Ratio is a well-liked mannequin that assumes shortage drives worth. It’s outlined because the ratio of the present inventory of a commodity (e.g., the circulating Bitcoin provide) to the circulate of recent manufacturing (e.g., newly mined bitcoins). Bitcoin’s worth has traditionally adopted the S/F Ratio, which is why it’s a well-liked mannequin used to foretell future Bitcoin valuations.

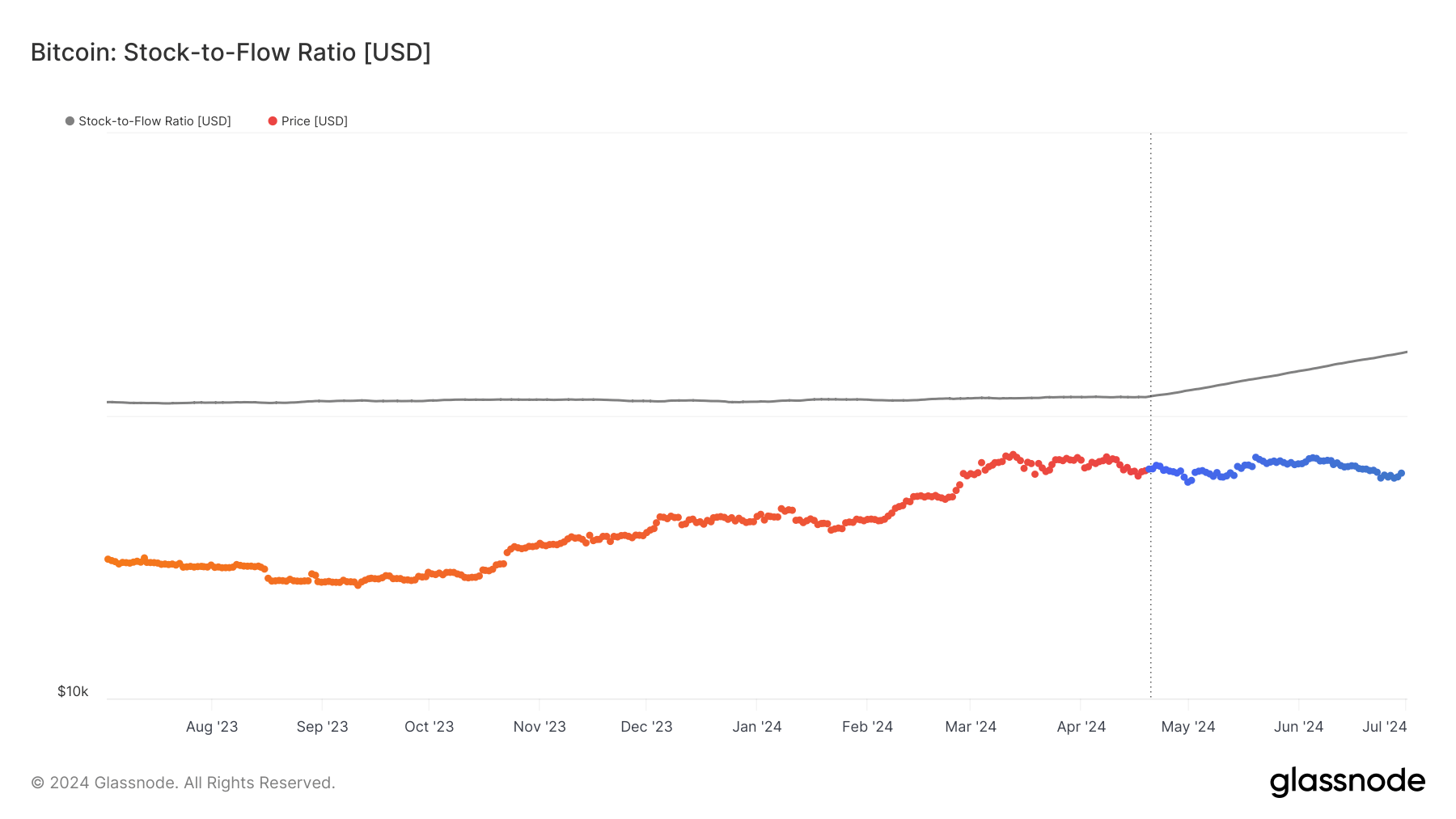

Bitcoin’s stock-to-flow ratio chart has to date illustrated a historic correlation between shortage and worth. Nevertheless, latest knowledge from Glassnode confirmed a deviation from this mannequin over the previous few years. Regardless of the April 2024 halving, which lowered the circulate of recent Bitcoin and elevated shortage, Bitcoin’s worth has not aligned as carefully with the projected stock-to-flow values because it did in earlier cycles.

This deviation means that different market components are influencing Bitcoin’s worth past the stock-to-flow mannequin’s shortage premise. Whereas halvings have traditionally boosted costs by highlighting Bitcoin’s restricted provide, present market situations mirror a extra advanced interaction of influences, together with regulatory developments and macroeconomic traits.

The latest development emphasizes the need for buyers to contemplate a broader vary of things when assessing Bitcoin’s future worth trajectory. The stock-to-flow ratio stays a helpful instrument, however its predictive energy has been tempered by the market’s maturity and complexity.