Bitcoin is making waves on Wall Road, with BlackRock and Constancy, two of the favored spot Bitcoin exchange-traded funds (ETF) issuers shattering data. current traits, spot Bitcoin ETFs are surging in reputation, indicating that institutional traders, or “whales,” are diving headfirst.

Constancy And BlackRock Spot Bitcoin ETFs Break Wall Road File

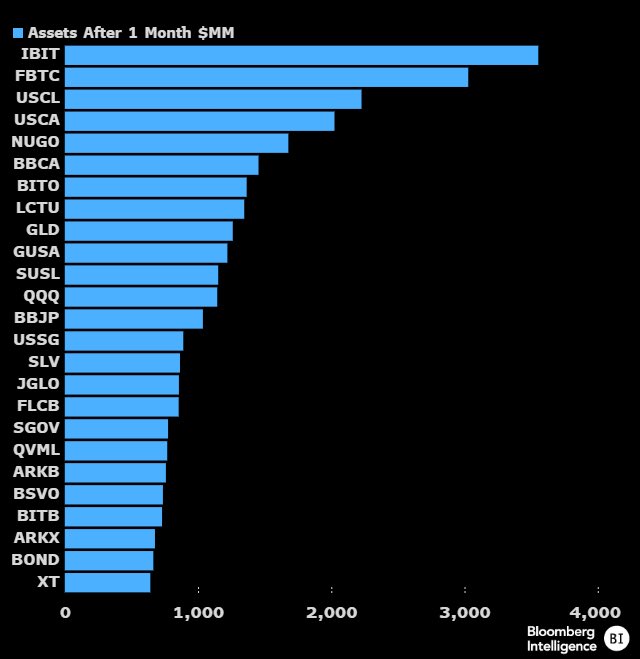

Mark Wlosinski, a crypto commentator, took to X on February 12, highlighting the meteoric rise of BlackRock (IBIT) and Constancy (FBTC) Bitcoin spot ETFs. Each have amassed a staggering $3 billion in property underneath administration (AUM) inside 30 days. This feat is historic, marking the primary time an ETF of any product has achieved such fast progress in such a brief interval.

This unprecedented demand for spot Bitcoin ETFs comes amidst a broader development of institutional adoption. Wlosinski notes that over 5,500 ETFs have been launched all through historical past. Nonetheless, none have but witnessed the extent of enthusiasm at present surrounding spot Bitcoin ETFs.

The tempo at which BTC AUM of spot ETF issuers continues to develop suggests a major shift in investor sentiment. Particularly, Wall Road is more and more recognizing BTC’s potential as a viable asset class.

For years, main Wall Road executives, together with Jamie Dimon, the top of JP Morgan, dismissed the coin, saying it was speculative and a rip-off. Nonetheless, with the USA Securities and Alternate Fee (SEC) approving spot Bitcoin ETFs after greater than ten years of rejecting the product, there seems to be a seismic shift within the funding panorama.

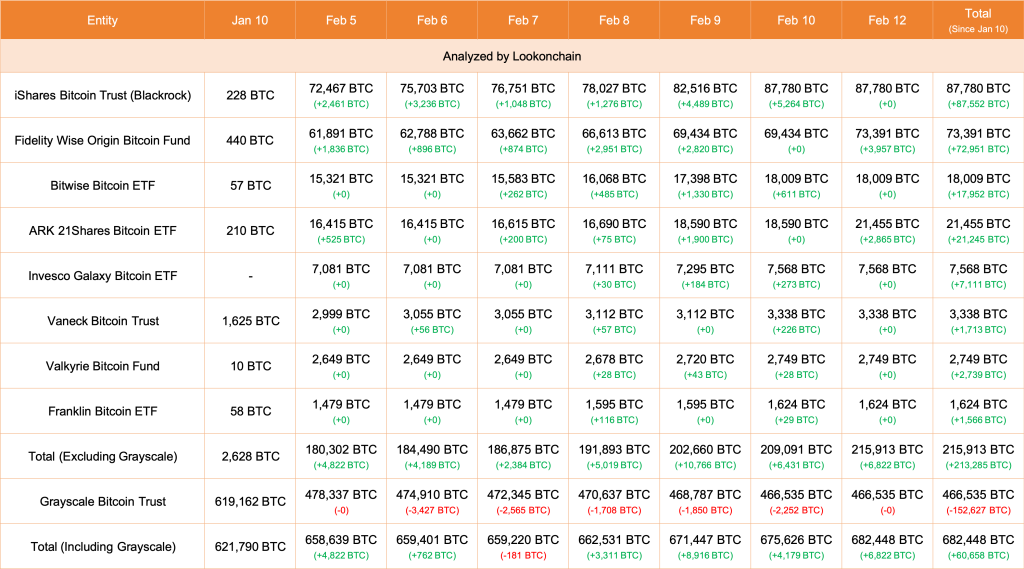

As of February 12, Lookonchain knowledge exhibits that Constancy and Ark21 Shares purchased a further 6,822 BTC value over $339 million. BlackRock’s IBIT stays the biggest spot BTC ETF by AUM, controlling over 87,780 BTC. Nonetheless, spot ETF issuers proceed to build up, pushing their whole haul to 682,448 BTC.

BTC Retests $50,000, Path To November 2021 Highs?

Since spot Bitcoin ETFs observe the spot worth, the extra spot ETF issuers purchase, the upper the demand for the coin turns into. Accordingly, rising demand has considerably impacted costs, because the every day chart exhibits. To date, Bitcoin is buying and selling near the psychological $50,000 mark, the very best degree since 2024.

Technically, the uptrend stays, and consumers are firmly in management. If consumers double down, purchase extra, and take extra cash out of the attain of spot ETF issuers, Bitcoin will doubtless float to $70,000 or higher within the classes forward.

Associated Studying: SOL Worth Surges To $115 – Why Solana Might Rally One other 10%

Function picture from Shutterstock, chart from TradingView

Disclaimer: The article is supplied for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use data supplied on this web site solely at your personal threat.