Bitcoin choices information, significantly open curiosity and strike costs, is essential for understanding the market’s expectations for future value actions.

Choices are monetary derivatives that give the customer the best, however not the duty, to purchase (name choice) or promote (put choice) an underlying asset at a predetermined value (strike value) on or earlier than a particular date. They’re a crucial part of economic markets, offering insights into future value expectations and market sentiment.

Open curiosity represents the overall variety of excellent choices contracts that haven’t been settled. For Bitcoin choices, a rising open curiosity signifies elevated market participation and curiosity, displaying that buyers are positioning themselves for future value actions. Analyzing the distribution of strike costs can reveal the place buyers anticipate these costs to maneuver.

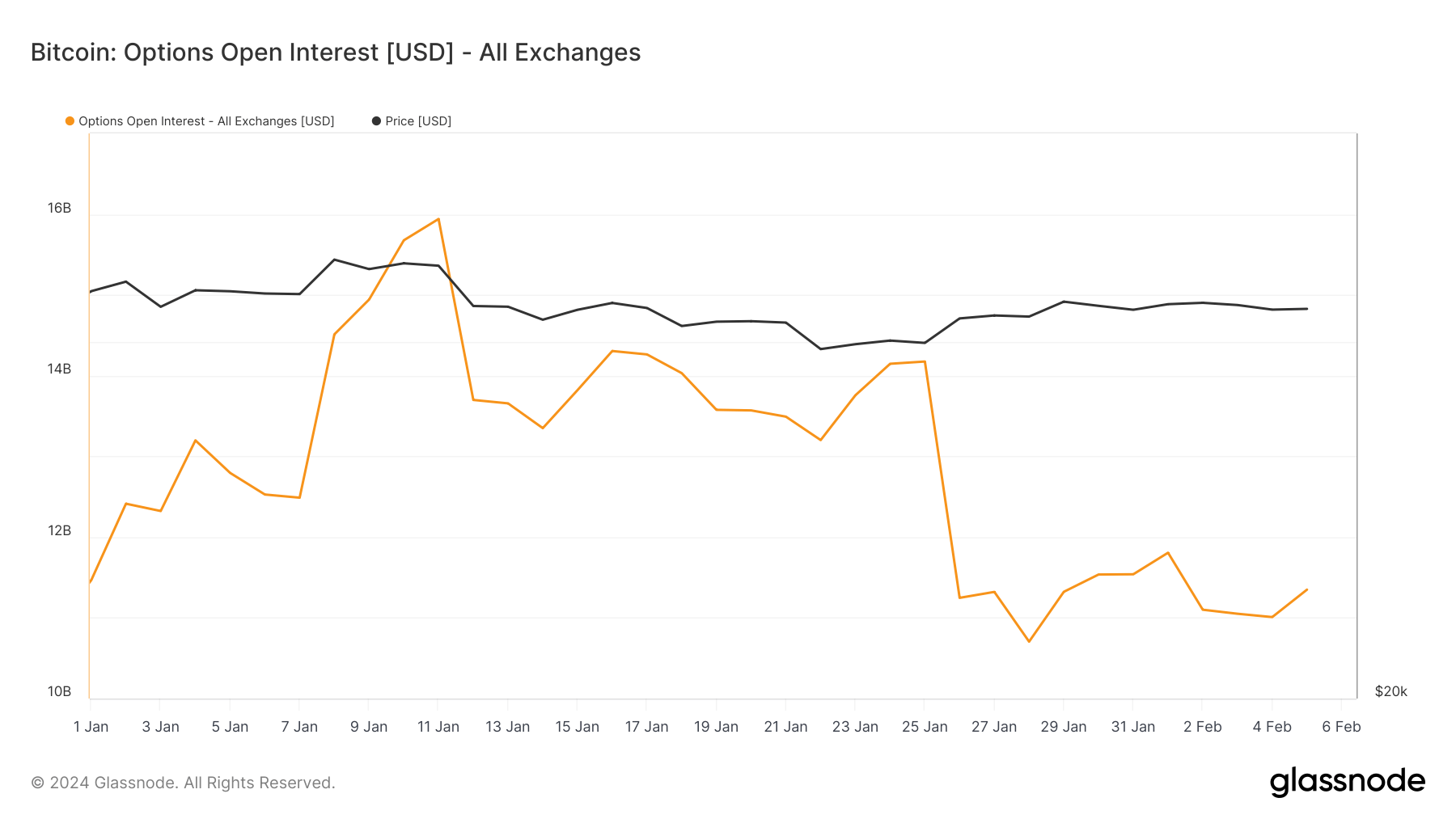

CryptoSlate’s evaluation of Glassnode information confirmed a notable enhance in open curiosity and buying and selling volumes main as much as the approval of spot Bitcoin ETFs within the U.S. Open curiosity spiked to $15.94 billion on Jan. 11, the day ETFs started buying and selling, up from $11.46 billion on Jan. 1.

This surge suggests elevated market participation and doubtlessly a bullish sentiment as buyers may need sought to hedge new positions or speculate on the value path post-ETF approval. Nonetheless, the next decline to $10.704 billion by Jan. 28 and a slight restoration to $11.348 billion by Feb. 5 signifies volatility and probably a reevaluation of market positions as preliminary enthusiasm tempered.

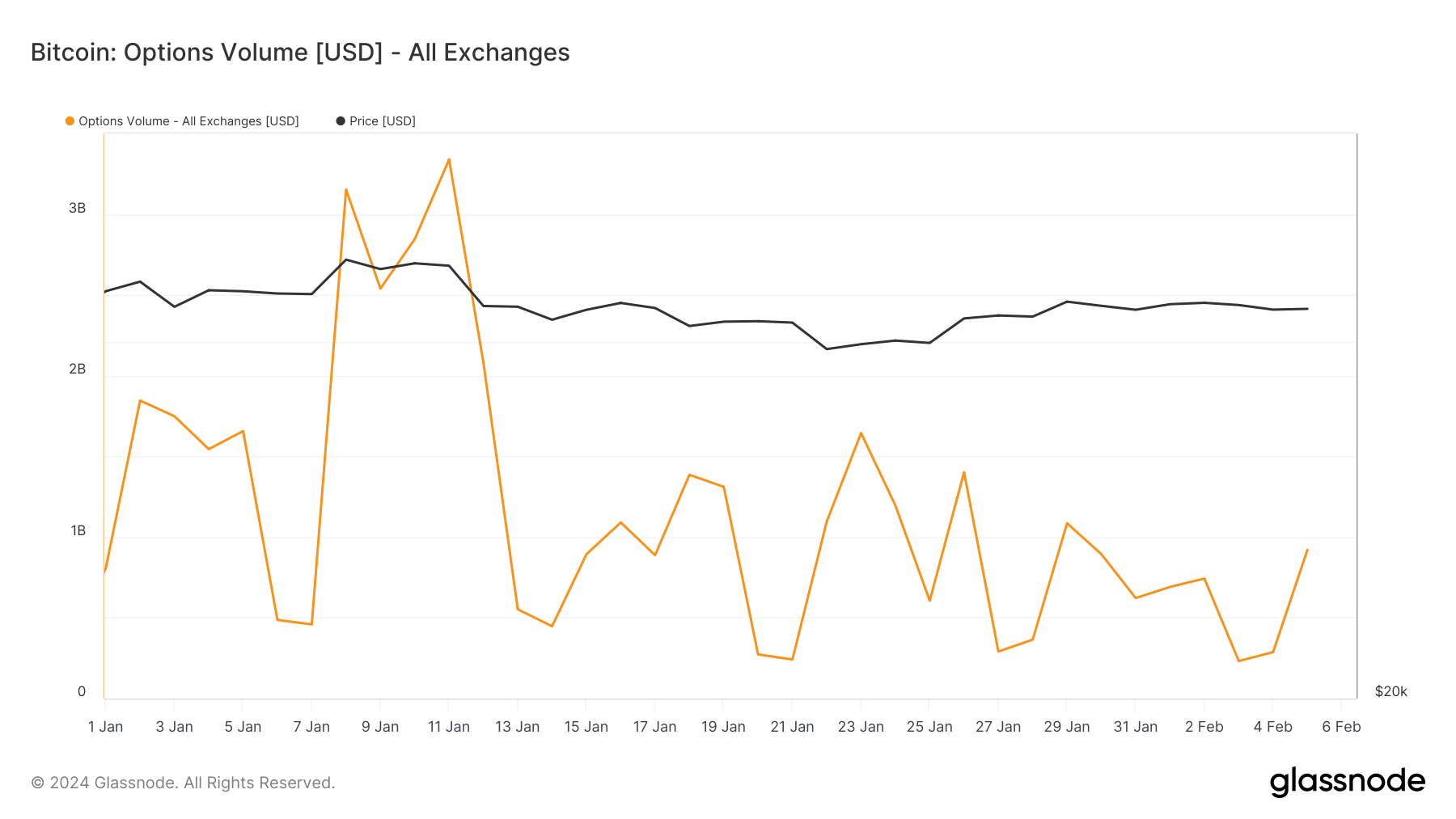

Buying and selling quantity peaked across the ETF launch, with a notable excessive of $3.338 billion on Jan. 11, which aligns with the spike in open curiosity. The fluctuation in volumes, significantly the drop to $364.900 million by Jan. 28, additional underscores the market’s uncertainty and reassessment of methods because the preliminary reactions to the ETF buying and selling normalize.

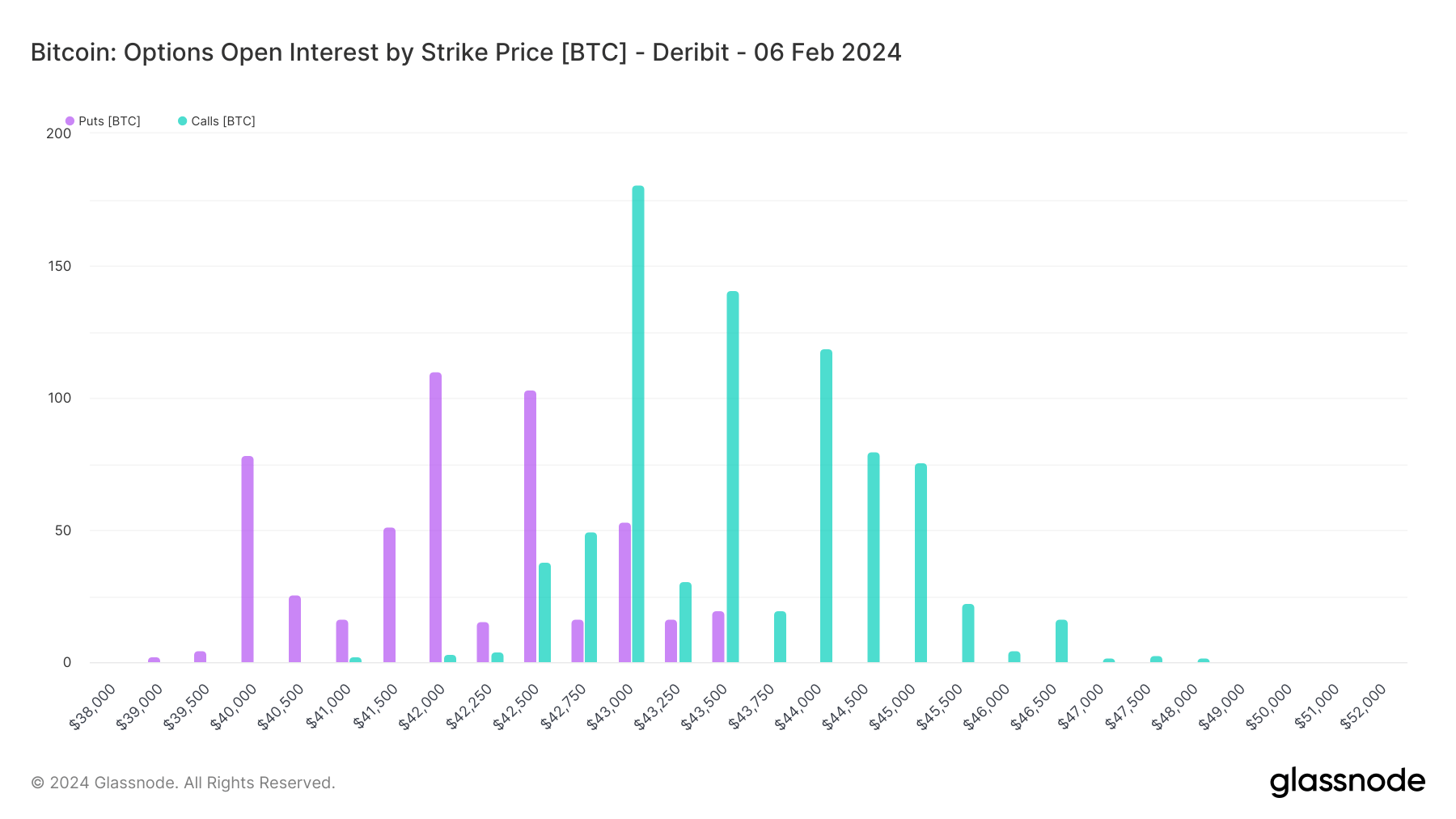

The distribution of open curiosity throughout strike costs on Deribit reveals a various vary of market expectations: near-term pessimism and long-term optimism. Particularly, for contracts expiring on Feb. 6, we observe a focus of open curiosity in places at decrease strike costs and calls at barely larger however not overly bold strike costs.

This sample signifies a near-term bearish sentiment or a protecting stance amongst choices holders. They is likely to be hedging in opposition to potential short-term draw back dangers or speculating on speedy value corrections.

The strike costs for Feb. 6, similar to $43,000 and $43,500 for calls and notably decrease volumes for places, exhibit a cautious optimism for a modest upward motion or stability within the close to time period.

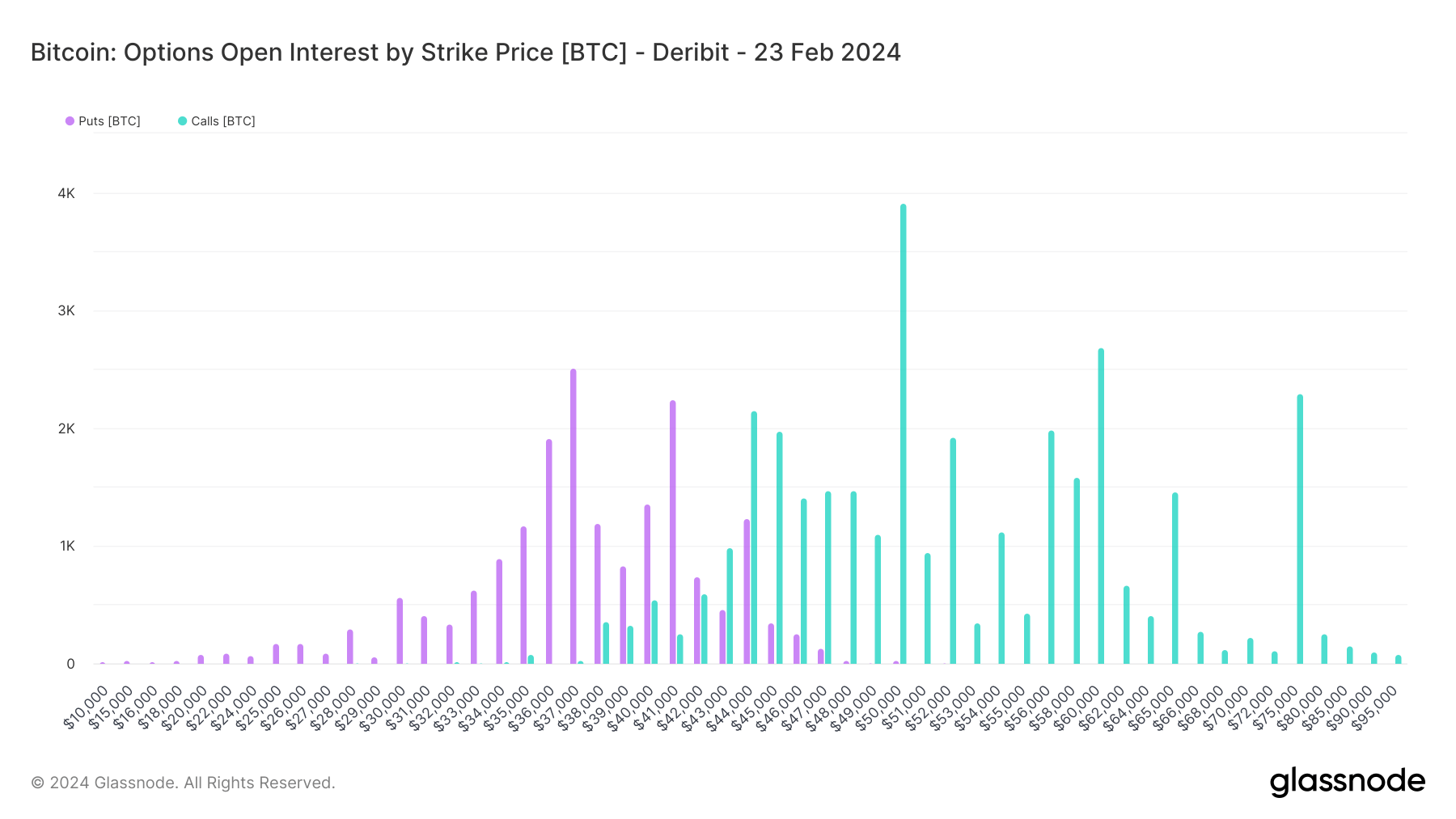

For contracts expiring on Feb. 23, the market sentiment shifts extra dramatically in the direction of optimism. The upper open curiosity in places at decrease strike costs ($37,000 and $41,000) aligns with a protecting stance in opposition to important value drops.

Nonetheless, the substantial curiosity in calls at a lot larger strike costs ($50,000, $52,000, $60,000, and $75,000) underscores a long-term bullish outlook amongst buyers. This means that regardless of near-term uncertainties or volatility, there’s a sturdy perception in Bitcoin’s potential for a big value enhance by the tip of the month.

The put up Bitcoin choices present long-term bullishness and near-term pessimism appeared first on CryptoSlate.