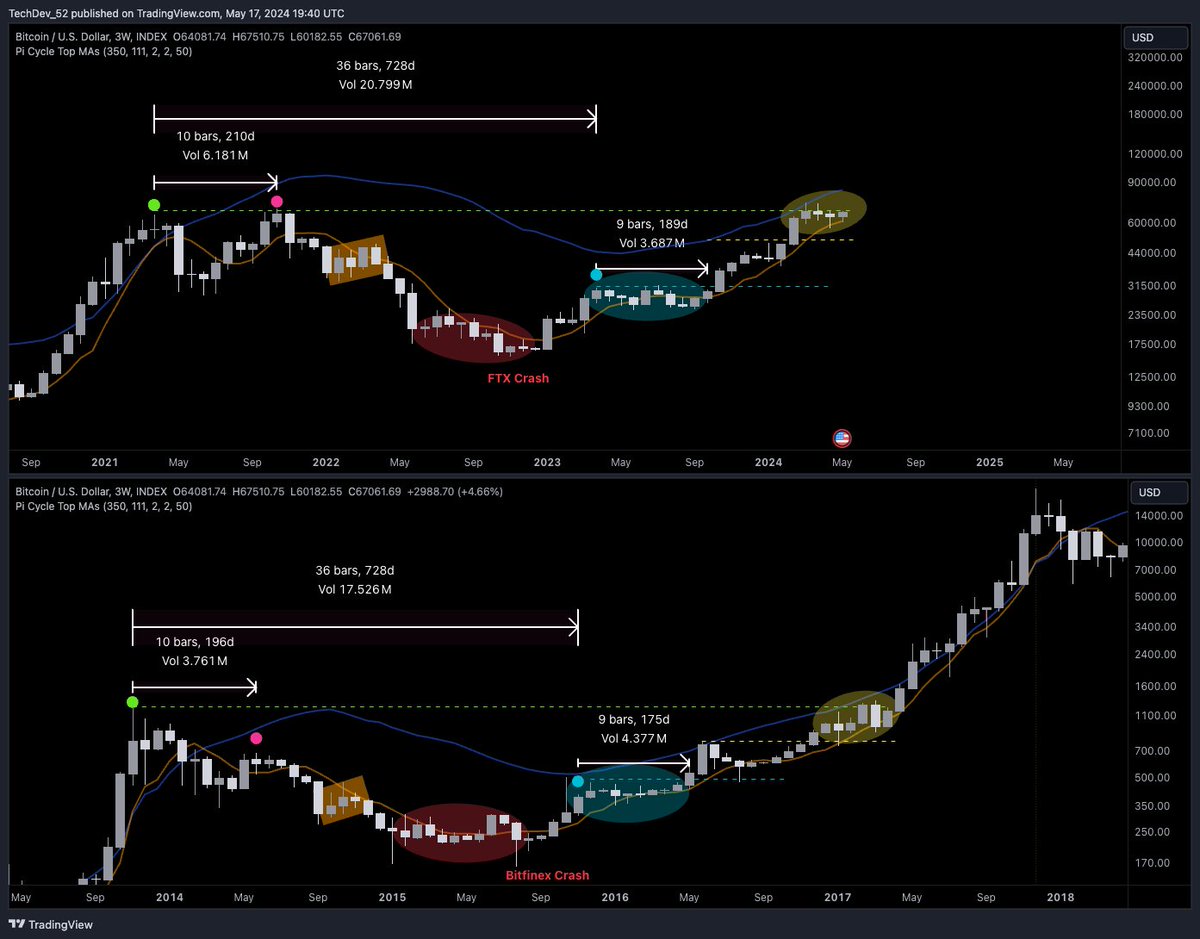

Bitcoin’s (BTC) present market construction appears just like 2017, simply earlier than its large 1,200% rally to its earlier report excessive of $20,000, based on extensively adopted crypto analyst TechDev.

The pseudonymous analyst shares together with his 450,000 followers on the social media platform X a chart that implies the present market cycle has been strikingly paying homage to the 2017 Bitcoin bull run.

TechDev’s chart highlights that each bear markets bottomed out through the crash of two main crypto exchanges, adopted by repeated rallies and consolidation phases.

“The extra issues change, the extra they keep the identical.”

Wanting on the dealer’s chart, he appears to counsel that BTC is at present in a consolidation part just like 2017 when it was buying and selling at round $1,500 earlier than a parabolic run to a cycle excessive of $20,000.

At time of writing, Bitcoin is price $67,060.

The analyst additionally appears at Bitcoin’s relative energy index (RSI), which goals to gauge the momentum of an asset. In line with TechDev, Bitcoin has traditionally topped out when its RSI reaches the highest of a long-term channel, which has not but occurred.

“You’re within the inexperienced zone. Don’t waste it.”

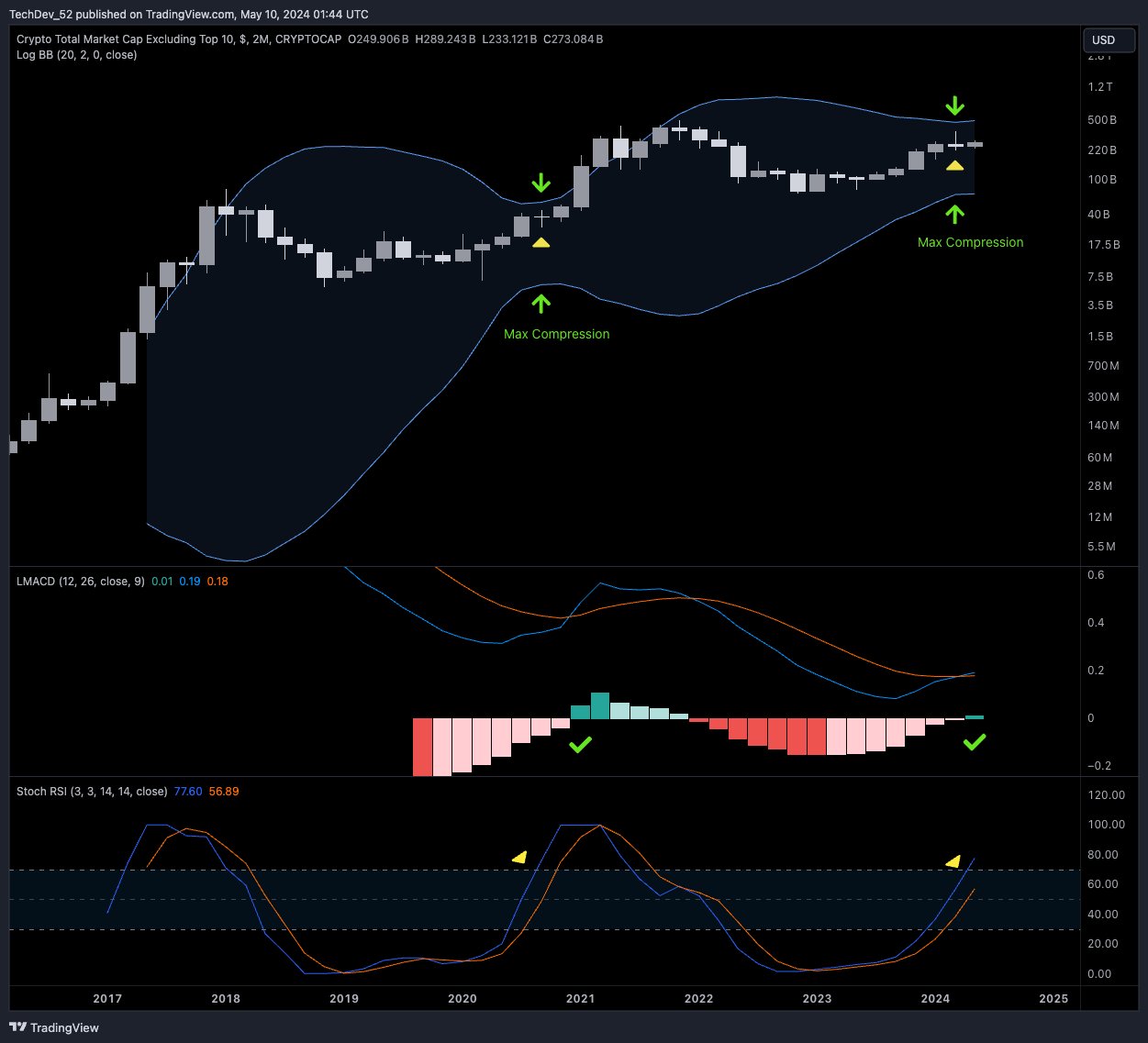

TechDev can also be trying on the OTHERS chart, which tracks the market cap of all crypto excluding the highest 10 digital property and stablecoins. Particularly, he’s trying on the chart’s stochastic RSI, transferring common convergence divergence (MACD) and logarithmic Bollinger Band indicator.

The MACD is historically used to pinpoint reversals based mostly on the convergence or divergence of transferring averages, and the Bollinger Bands are supposed to determine durations of impending sharp value actions based mostly on volatility contraction.

In line with the analyst, OTHERS, which is usually used to gauge the energy of altcoins, has reached a “max compression” zone, suggesting {that a} massive transfer to the upside is on the horizon. He additionally notes that the setup coincides with the return of “Roaring Kitty,” the chief of the motion that pumped the worth of Gamestop (GME) in 2021.

“Roaring Kitty returns as this alt setup reappears.

There are not any coincidences.”

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on X, Fb and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you might incur are your duty. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please notice that The Every day Hodl participates in online marketing.

Generated Picture: DALLE3