Up to now few weeks, following a collection of corrections, Bitcoin and the broader crypto market have skilled a big surge from the decrease costs of 2024.

Associated Studying

The momentum picked up notably on Friday after Jerome Powell, Chairman of the Board of Governors of the Federal Reserve System, introduced a shift in coverage, hinting at a possible rate of interest minimize in September. This announcement has fueled optimism amongst buyers, resulting in elevated market exercise.

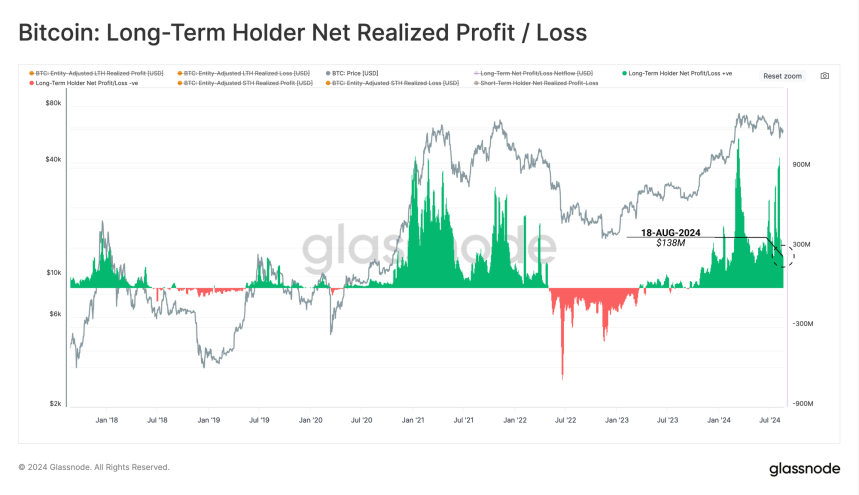

Moreover, invaluable information from Glassnode reveals that long-term holders (LTH) are locking in constant features of $138 million in revenue per day. However what does this imply for the market shifting ahead?

Bitcoin Every day Capital Inflows Essential For Value Stability

Bitcoin long-term holders (LTH) have been persistently locking in features over the previous few months, even amid the market’s uncertainty and volatility. In line with the Bitcoin Lengthy-Time period Holder Web Realized Revenue/Loss chart from Glassnode, LTH are at present promoting Bitcoin at a charge of roughly $138 million per day. This promoting strain serves as an important benchmark for the market, indicating the quantity of recent capital that should movement into Bitcoin each day to counterbalance the promoting and stabilize the value.

If each day inflows into Bitcoin fall wanting this $138 million benchmark, the value may doubtlessly face downward strain because of LTH’s ongoing gross sales. This dynamic underscores the fragile stability between purchaser demand and LTH’s profit-taking actions.

Because the market continues to navigate this section, Bitcoin’s worth motion might be notably attention-grabbing to look at within the coming weeks. Whether or not new investor inflows can match or exceed this promoting strain might be key to figuring out BTC’s subsequent main transfer.

BTC Breaks Previous $64,900: What’s Subsequent?

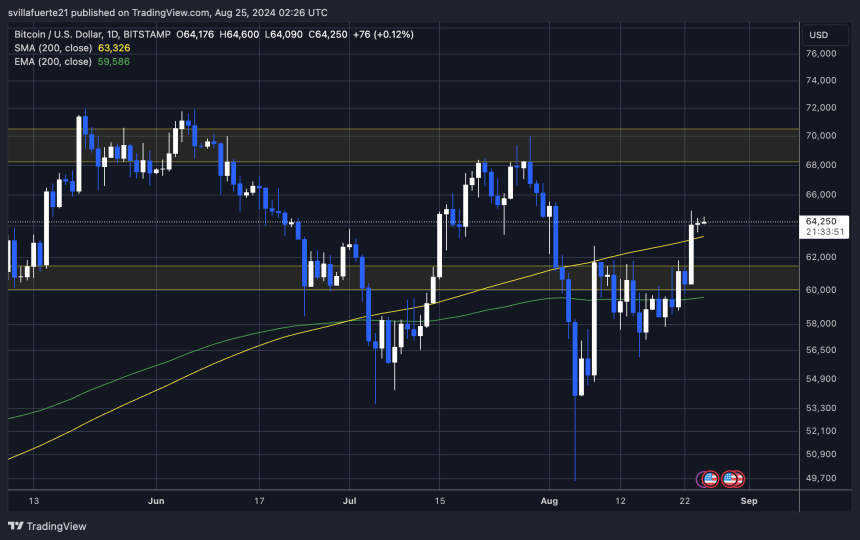

Bitcoin is at present buying and selling at $64,360, as of this writing, after enduring weeks of aggressive promoting strain, worry, and uncertainty that triggered its worth to dip to $49,577 simply 20 days in the past.

Associated Studying

Now, BTC is flirting with the $65,000 mark following two profitable each day candles closing above the essential 200-day shifting common—a key indicator that buyers use to establish a bullish or bearish market construction.

This growth means that Bitcoin is regaining power, but it surely should maintain above this indicator and ideally take a look at it as help to maintain the uptrend.

If BTC can preserve this degree, breaking previous $65,000 must be an easy activity, with the subsequent goal seemingly round $67,000. Nevertheless, if the value fails to carry above the 200-day shifting common close to $63,000, Bitcoin could also be liable to retesting native demand ranges round $60,000.

Featured picture created with Dall-E, chart from Tradingview.com