Bitcoin has been the topic of latest media consideration, not solely resulting from its value improve above $65,000 but additionally as a result of extraordinary inflows into spot Bitcoin ETFs.

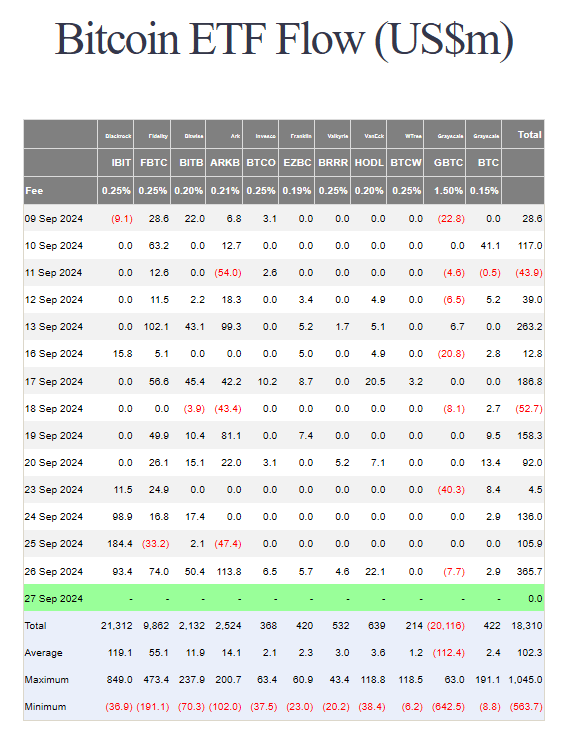

These inflows, in keeping with Farside Buyers, have reached a exceptional $365 million as of September 26, 2024, which is indicative of the rising institutional curiosity within the cryptocurrency market.

Associated Studying

File Inflows Amid Market Optimism

The largest each day move for the month got here from BlackRock’s Bitcoin ETF, which surged about $184 million on September 25, 2024.

This spike coincides with withdrawals from quite a few different ETFs, indicating a major change in institutional traders’ view. Though there have been simply $2.1 million in inflows into different platforms such because the Bitwise Bitcoin ETF, BlackRock’s efficiency is noteworthy and serves as a ray of hope among the many market’s volatility.

For the previous 5 days, there was a optimistic cumulative influx of round $497 million into US spot Bitcoin ETFs. The Federal Reserve’s latest transfer to decrease rates of interest by 50 foundation factors is partly the explanation for this improve because it has prompted traders to search for different property like Bitcoin.

The general digital asset funding merchandise have additionally seen a second consecutive week of inflows, totaling roughly $321 million, with BTC being the first focus, accounting for about $284 million of that complete.

Institutional Belief And Monetary Elements

The current surge of cash into Bitcoin ETFs signifies a much bigger pattern wherein institutional traders are starting to view Bitcoin as a tactical asset. Additional supporting the optimistic outlook are financial elements such the Federal Reserve’s dovish stance, which has calmed traders about seemingly financial stability.

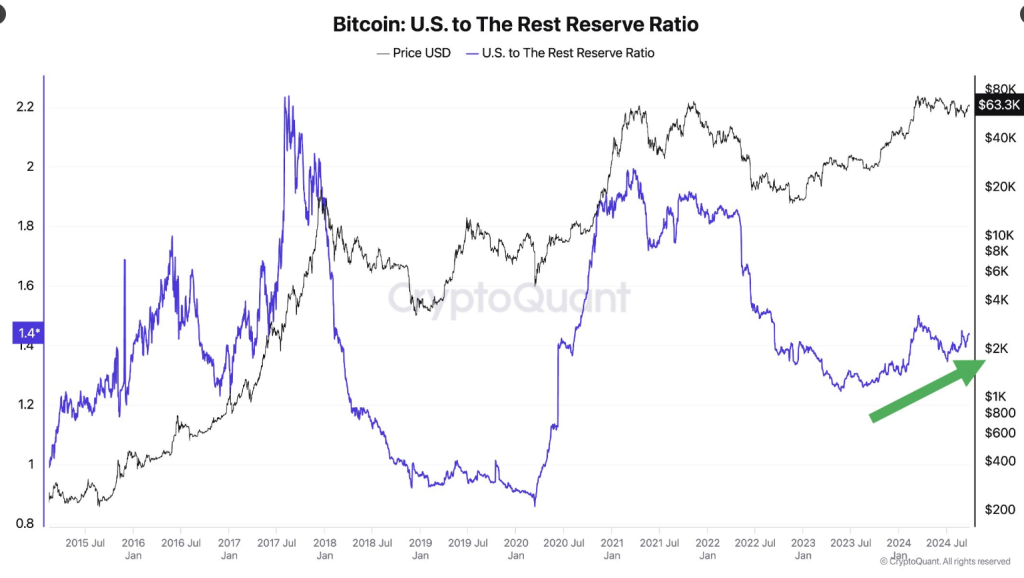

The CEO of CryptoQuant, Ki Younger Ju, harassed that strengthening the US’s standing as a pioneer within the cryptocurrency area is dependent upon the rising demand for spot Bitcoin ETFs.

The 🇺🇸U.S. is regaining dominance in #Bitcoin holdings. Its ratio in comparison with different international locations is rising, pushed by spot ETF demand. Solely identified entities are included. pic.twitter.com/a9XOb5134E

— Ki Younger Ju (@ki_young_ju) September 26, 2024

It’s fascinating to notice that though BlackRock’s ETF performs properly, different ETFs, together with Ark 21Shares Bitcoin ETF and Constancy’s Sensible Bitcoin Origin Fund, have seen giant withdrawals of $33.2 million and $47.4 million, respectively.

Associated Studying

The Funding Panorama For Bitcoin In The Future

As Bitcoin’s worth and recognition proceed to develop, analysts are maintaining a cautious eye on how these inflows might have an effect on future value strikes.

Over 90% of Bitcoin holders are presently in revenue resulting from this value surge, which raises considerations about potential sell-offs as traders look to understand beneficial properties. Based mostly on previous patterns, vital value changes might happen ought to a sizeable fraction of holders present beneficial properties.

To make issues extra difficult, there are about $5.8 billion price of choices contracts which are about to run out. Merchants can be watching $66,000 and different essential resistance ranges carefully, as a break over this degree could spark further optimistic momentum.

Featured picture from WIRED, chart from TradingView