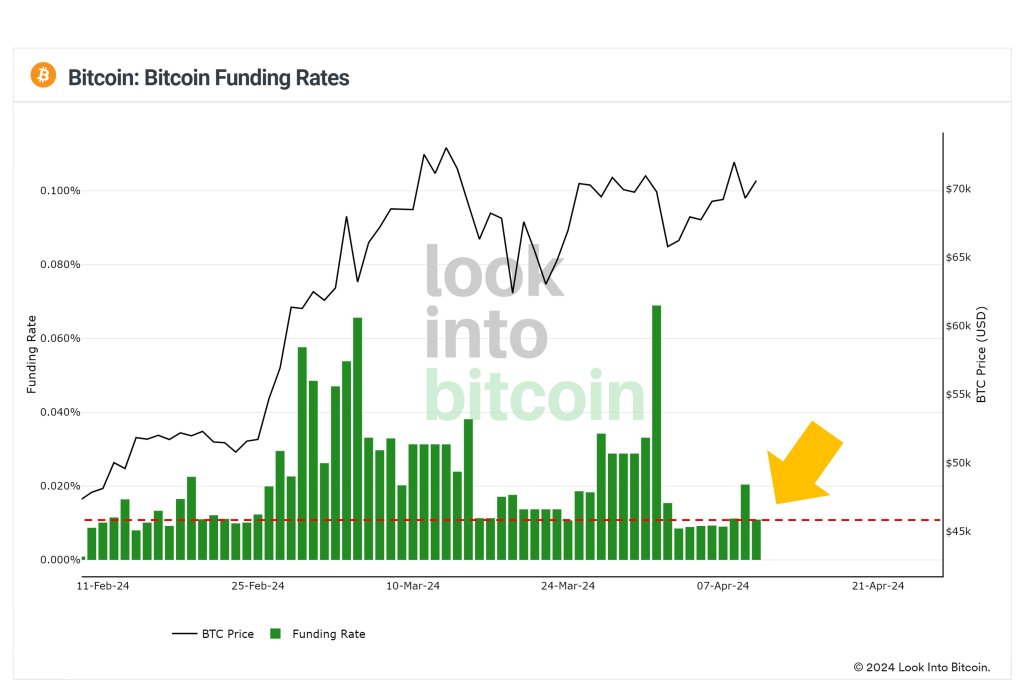

Bitcoin, one analyst notes on X, is wanting wholesome for the primary time for the reason that coin soared to over $70,000, printing all-time highs again in March 2024. The evaluation is because of funding charges dropping to inside strange ranges, an indicator that volatility can be falling and moments of concern of lacking out (FOMO) are fading.

Funding Charges At “Regular Ranges” As FOMO Dissipates

In crypto perpetual buying and selling, the funding price is the price exchanged between market members. These charges are market-determined and are adjusted each eight hours or so.

Relying on market situations, they are often constructive or unfavourable. Nonetheless, they play a essential function in figuring out momentum. Of word, bulls pay a price to bears When perpetual costs are larger than the spot worth. This, in flip, discourages shopping for within the perpetual market and incentivizes shopping for into the spot, bringing costs nearer.

At any time when costs rally, as has been the case for the reason that begin of the yr when Bitcoin has typically been within the inexperienced, those that enter lengthy must pay sellers to maintain costs from deviating, as talked about above.

Nonetheless, at spot charges, the speed leveraged consumers are paying is barely decrease as FOMO drops. As soon as costs quickly develop, ideally above March 2024 highs, this funding price will seemingly enhance to February and March 2024 ranges.

To this point, Bitcoin is altering palms above $70,800 at spot charges and inside a bullish formation. Of word is that consumers are in command of reversing losses posted on April 8.

Even so, for the uptrend to stay, costs should escape above $72,500 and the April 8 excessive on rising quantity. BTC will seemingly float to over $73,800 and enter worth discovery in that case.

Bitcoin Rises After CPI Information In America, Establishments Pouring In?

With FOMO dissipating and “normalcy resuming,” the analyst stated the coin is now higher positioned to soar larger, backed by natural momentum generated from market members. After dipping barely on April 9, the coin rose following constructive information concerning the Shopper Worth Index (CPI) in the US.

Whereas the “scorching” CPI pushed different property decrease, Bitcoin costs bounced to identify ranges. Consultants say the coin may profit as risk-averse merchants shift to safe-haven cash to defend their worth from raging inflation.

Past this, analysts count on demand for spot Bitcoin exchange-traded funds (ETFs) to rise within the months forward. As establishments pour in, shopping for shares of spot BTC ETFs issued by gamers like Constancy, the demand for the underlying coin may soar to recent ranges, lifting costs. Furthermore, some analysts are bullish, saying costs will profit as soon as GBTC stops offloading cash.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site completely at your personal danger.