Bitcoin flash crashed on July 4 and 5, extending losses from all-time highs to about 30%. Although there was a reduction bounce over the weekend, forcing the world’s most useful coin up by almost 11%, BTC stays inside a bearish formation.

Bitcoin Correction Not Over: Will Bears Break $50,000?

One analyst who took to X confirmed this evaluation, including that the optimism during the last 48 hours could possibly be quashed within the coming classes. With BTC not out of the woods, not less than from technical formation, the analyst predicted not solely will the coin sink under final week’s lows, however it would doubtless break the psychological $50,000 mark.

Pointing to historic worth motion, the coin mentioned Bitcoin might drop to as little as $48,000 within the coming days, roughly 40% from its all-time excessive.

When this occurs, and following the worth motion seen in 2017, when the coin additionally crashed by 40% after native peaks, the coin will resume the uptrend.

Even so, trying on the analyst’s evaluation, the swing excessive and low anchoring of the Fibonacci retracement instrument is subjective. For now, if September 2023 to March 2024 vary acts as swing and lows, a 40% drop from native highs locations Bitcoin $10,000 decrease at round $37,000.

Cracks are starting to kind on the weekly chart. After final week’s losses, the coin firmly closed under the 20-period transferring common, inserting sellers in management. Affirmation of final week’s losses might set the ball rolling, sparking extra losses within the brief time period, pushing the world’s most useful coin to $50,000 and even $40,000.

How Excessive Will BTC Bounce After The Correction?

Nevertheless, after the cool-off and the depth doesn’t matter, one other analyst predicts the coin will bounce off strongly. If BTC finds assist at across the $47,000 to $50,000 stage, the chance of it floating to not less than $102,000 is excessive.

That is the primary stage of the Fibonacci extension. At its excessive, the coin might soar to as excessive as $242,000 within the classes to return.

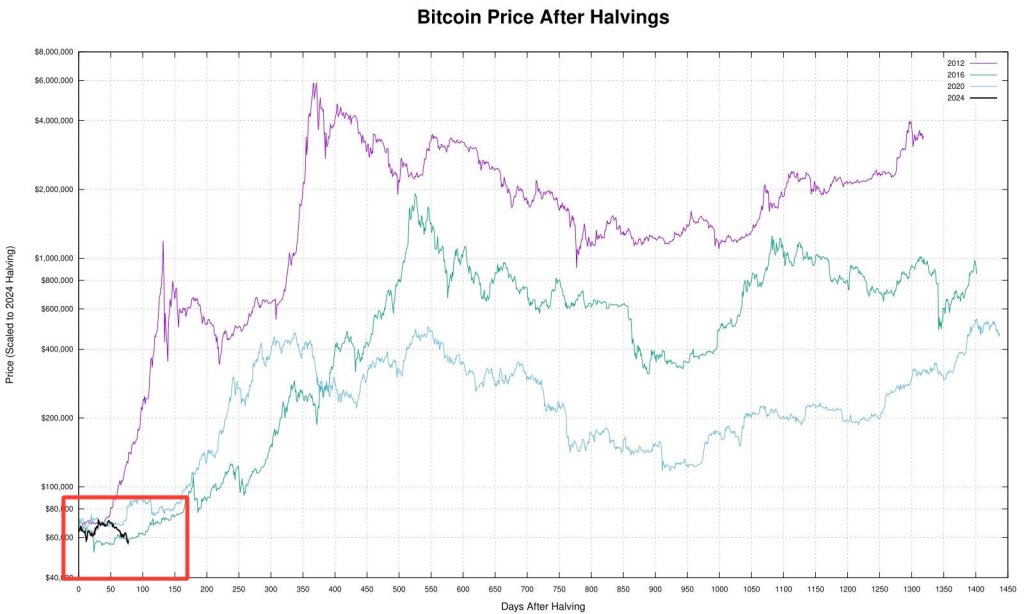

The arrogance that BTC will bounce again after the present sell-off, sparked most by Mt. Gox liquidation fears and the fixed dump by the German authorities, is predicated on historical past. After the Halving, Bitcoin costs are likely to get well steadily.

If something, one analyst mentioned holders shouldn’t panic promote throughout the first 79 days after the Halving occasion. Marking the start of the fifth epoch, the community lowered its miner rewards on April 20, roughly three months in the past.

Characteristic picture from DALLE, chart from TradingView