Bitcoin is agency, not too long ago trending above $71,200 and easing previous native resistance ranges, a lot to the delight of holders. Nonetheless, the present leg up is only the start for Willy Woo, an on-chain analyst.

Bitcoin Rally Getting Began: Analyst

Taking to X, Woo, who has been sustaining a bullish outlook for the world’s most precious coin, boldly asserts that the present Bitcoin rally is simply midway by means of its welcomed bullish journey.

Sharing a chart, the on-chain analyst notes that the Bitcoin VWAP oscillator simply bottomed up from oversold territory and is now on the zero mark, which is halfway. Although Woo is upbeat and anticipating much more good points, the analyst didn’t specify when or at what degree costs will peak.

Associated Studying

Even so, the analyst defined {that a} interval of consolidation under the all-time excessive is important. Woo says this consolidation may permit customers to build up earlier than a “second leg” propels the Bitcoin to new heights.

Trying on the Bitcoin day by day chart, this “second leg” is predicted to be a breakout second that may raise the coin above March highs.

At press time, Bitcoin continues to be in a bullish formation. The uptick above $68,000 and final week’s excessive have been essential for pattern definition. Furthermore, for the reason that Could 20 breakout bar is wide-ranging and has a excessive buying and selling quantity, the chances of pattern continuation are excessive. If bulls observe by means of, confirming Could 20 good points, BTC will seemingly break $73,800, aligning with Woo’s forecast.

BTC Bull Run To Final 300 Days If There Is No Black Swan Occasion

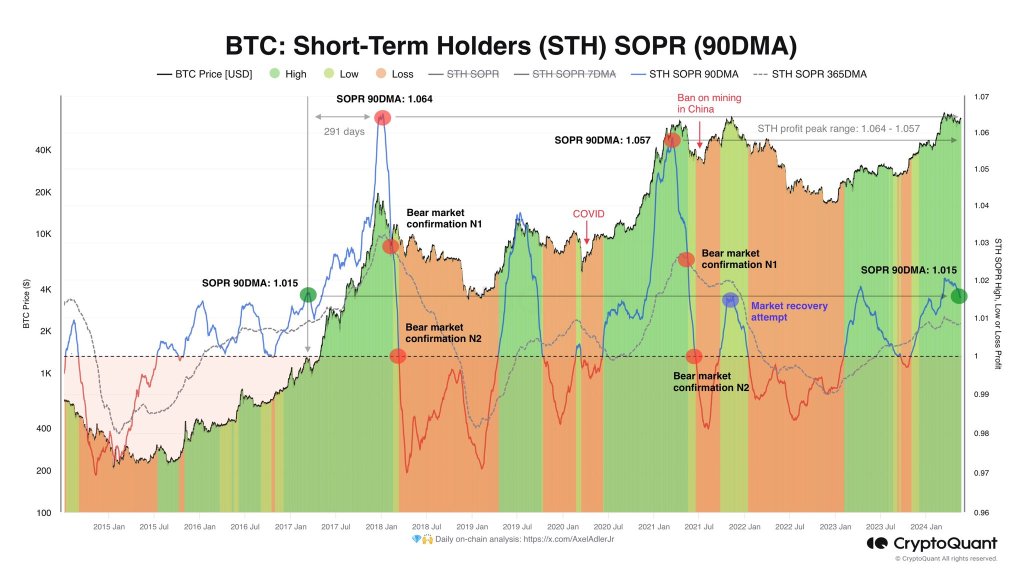

Apart from Woo, one other analyst says the Bitcoin uptrend is in full swing. Sharing a chart, the dealer mentioned that barring any unexpected disruptions, such because the impression of a main alternate going bankrupt, it’s extremely seemingly that the present bull run will lengthen for one more 300 days.

This prediction relies on revenue and loss evaluation of short-term holders (STHs) with a 90-day transferring common. At present, the STH is transferring decrease however is comparatively larger. Analysts use the STH to find out market sentiment from short-term value actions and dealer speculations.

Associated Studying

As sentiment improves and costs get better, the tempo at which the coin edges larger will rely upon exterior components. Apart from the impression of america Federal Reserve and their financial coverage declaration, influx to identify Bitcoin exchange-traded funds (ETFs) can be essential. After a lull, demand is selecting up, serving to to propel bulls.

Function picture from DALLE, chart from TradingView