The crypto market took an sudden hit on April 12 as a spontaneous decline within the worth of Bitcoin and distinguished altcoins resulted in large liquidations. The origin of this widespread worth dip stays largely unknown, amongst a plethora of believable causes, together with a latest worth correction within the US inventory markets.

Virtually $500 Million Liquidated In An Hour Amidst Crypto Flash Crash

In response to knowledge from CoinMarketCap, Bitcoin slipped by 4.49% within the final day, falling as little as $66,052. As anticipated, BTC’s decline reverberated by the market, with distinguished altcoins Ethereum and Solana recording every day losses to the tune of 8.12% and 12.16%, respectively

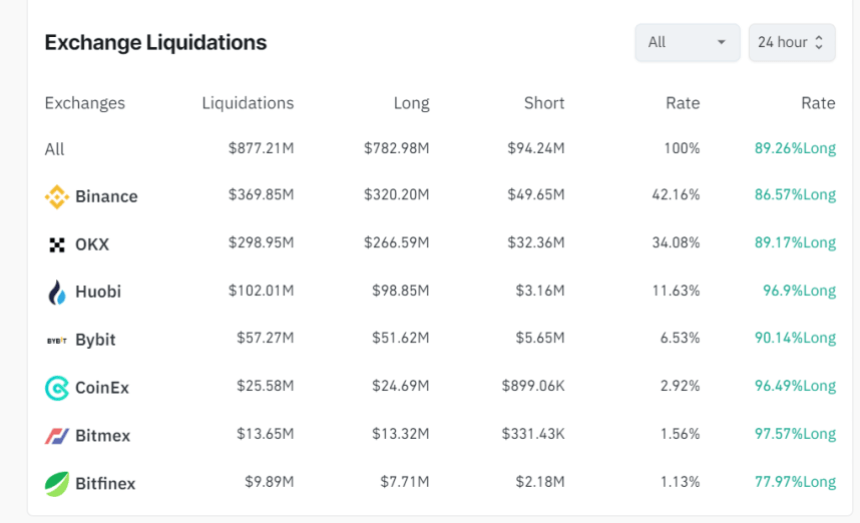

As earlier acknowledged, these losses translated into 277,843 merchants dropping their leverage positions as complete crypto liquidations reached $877.21 million within the final 24 hours primarily based on knowledge from Coinglass. Of those figures, lengthy positions accounted for $782.98 million, with quick merchants dropping solely $94.24 million.

Notably, $467 million in leverage positions had been closed inside an hour because of a normal worth decline. The very best quantity of liquidations at $369.85 million was recorded on Binance, whereas the only largest liquidation order valued at $7.19 million occurred within the ETH-USD market on the OKX trade.

Supply: Coinglass

Supply: Coinglass

Curiously, Bitcoin’s worth decline correlated with a dip within the US inventory market because the S&P 500 index declined by 1.6% to commerce as little as $5,108. This market crash was preceded by latest CPI knowledge, which confirmed that the inflation charge rose to three.5% yr over yr in March.

Such reviews solely point out that the US Federal Reserve (Fed) couldn’t be implementing any charge cuts quickly because it goals to drive inflation right down to its annual goal of two%. This prediction is sort of bearish for the crypto market usually as Fed charge cuts permit traders to comfortably search dangerous belongings similar to BTC with a possible of excessive yields.

Bitcoin Experiences Community Progress As Halving Approaches

On a extra optimistic observe, Bitcoin has recorded an increase in non-empty wallets on its community forward of the Halving occasion on April 19. Blockchain analytics platform Santiment reported a rise of 370,000 BTC wallets holding energetic cash over the past six days. Curiously, the analytic crew is backing traders to keep up this accumulative development all by the Bitcoin halving occasion.

On the time of writing, Bitcoin was buying and selling at $66,882, with a 44.80% improve in its every day buying and selling quantity, which is at present valued at $43.80 billion. Nevertheless, Bitcoin’s worth has usually been unimpressive in latest instances, with a decline of 1.33% and 6.20% within the final seven and 30 days, respectively.

Bitcoin buying and selling at $66,499.00 on the every day chart | Supply: BTCUSDT chart on Tradingview.com

Bitcoin buying and selling at $66,499.00 on the every day chart | Supply: BTCUSDT chart on Tradingview.com

Featured picture from The Impartial, chart from Tradingview

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site totally at your personal threat.