Bitcoin (BTC) skilled a major drop, reaching as little as $56,700 on Thursday. This value stage has not been seen since Could 1st, as Bitcoin faces a number of challenges, together with US political uncertainties and the continuing sell-off of BTC seized by the German authorities. These components have contributed to an almost 20% value correction for Bitcoin, inflicting concern amongst buyers.

Unraveling The Bitcoin Value Drop

In line with a latest Bloomberg report, buyers are considering potential eventualities if President Joe Biden decides to withdraw his US reelection bid. One chance is the emergence of a stronger Democratic contender who could pose challenges to Republican Donald Trump, whose agenda favors the crypto trade.

Richard Galvin, co-founder of hedge fund Digital Asset Capital Administration, highlights the chance of a “stronger Democratic candidate” who won’t assist cryptocurrencies as an element influencing Bitcoin’s weak spot within the quick time period.

Associated Studying

As well as, the overhang from the collapsed Mt. Gox Bitcoin alternate case, which plans to start refunding, affected prospects of the alleged hack suffered practically 10 years in the past, and the US and German authorities sell-off are contributing to the present weak spot within the Bitcoin market.

Merchants are intently monitoring the chance of Bitcoin disposals by each the US and German governments, who possess seized BTC. Current information from Arkham Intelligence reveals {that a} pockets related to the German state transferred roughly $75 million value of BTC to exchanges on Thursday, including to a collection of comparable transfers.

In the meantime, directors of the failed Mt. Gox alternate are step by step returning a considerable quantity of Bitcoin to collectors, leaving speculators unsure in regards to the potential affect of the $8 billion haul available on the market.

Miners’ Response And Market Influence

Then again, Bitcoin miners answerable for the computational energy that helps the Bitcoin blockchain proceed to face the monetary penalties of the Halving occasion, which reduces the variety of new tokens they obtain as a reward.

As a response, some miners are promoting a portion of their token stock, including to the promoting strain on Bitcoin. This ongoing battle with promoting strain from miners is affecting Bitcoin’s value efficiency, as highlighted by Noelle Acheson, writer of the Crypto Is Macro Now e-newsletter.

Nonetheless, Acheson notes that the sentiment within the crypto market can rapidly change, particularly if weaker US financial information instigates expectations of looser financial insurance policies from the Federal Reserve.

Moreover, the potential approval of US exchange-traded funds (ETFs) to put money into Ethereum might uplift the general market temper. Moreover, the interpretation of US political developments could shift over time.

Matt Hougan, Chief Funding Officer at Bitwise, means that potential adjustments on the prime of the Democratic ticket will doubtless settle in an improved place for cryptocurrencies. He emphasizes that Washington’s perspective in direction of digital property has modified positively up to now 12 months.

Glassnode Predicts Retest Of Earlier All-Time Highs

Regardless of the unfavorable value efficiency and uncertainty surrounding BTC’s value, Jan Happel and Yan Allemann, founders of blockchain analytics platform Glassnode, preserve their goal for Bitcoin, stating that BTC is anticipated to achieve the $110,000 space earlier than the market peak.

Notably, Allemann and Happel see the present consolidation as a retest of the earlier all-time excessive space. Nonetheless, for this to occur, Bitcoin might want to cross key ranges at $64,000 and later $70,000, which would require additional market improvement and value motion.

Associated Studying

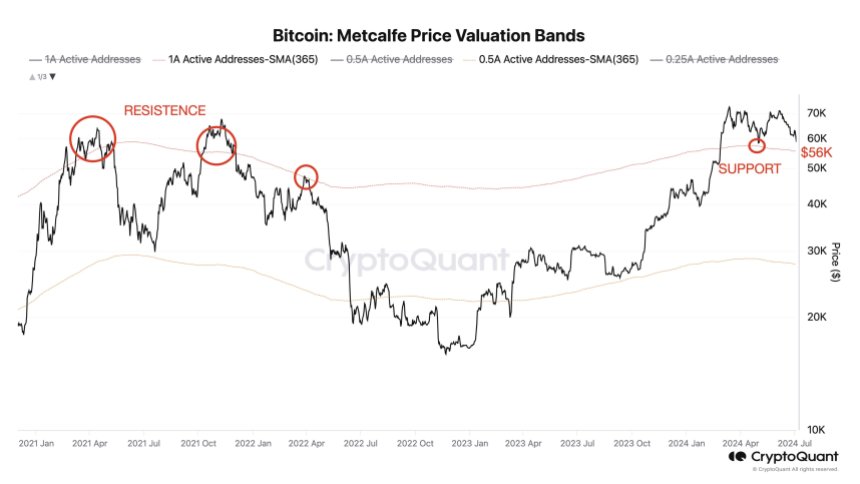

In accordance to Julio Moreno, the Metcalfe Value Valuation presents insights into the potential assist stage for Bitcoin’s value. Moreno means that $56,000 needs to be an important assist stage for Bitcoin based mostly on this valuation.

Moreno concluded that if the Bitcoin value fails to carry this key $56,000 stage, the correction might probably deepen, resulting in extra extreme penalties for the market.

BTC has regained the $57,300 stage; nevertheless, the cryptocurrency has been down 5% up to now 24 hours, with no indicators of near-term bullish catalysts to climb above $60,000.

Featured picture from DALL-E, chart from TradingView.com