A Binance consultant confirmed in a Jan. 30 electronic mail assertion despatched to CryptoSlate that the platform is now permitting institutional buyers to safe their buying and selling collateral by way of a third-party banking associate.

Binance’s resolution, described as a “banking triparty” association, has been beneath improvement for the previous two years and immediately addresses the first concern of counterparty threat, a big consideration for institutional buyers. This mannequin allows buyers to handle threat successfully whereas optimizing capital effectivity by pledging collateral in conventional property.

Whereas particulars concerning the particular banking companions stay undisclosed, Binance emphasised energetic engagement with numerous banking entities and institutional buyers expressing curiosity within the association.

The platform launched the pilot scheme for this resolution final November, permitting collateral held with the banking associate to be in fiat equivalents, similar to Treasury Payments.

Earlier than this improvement, Binance purchasers have been restricted to holding their property on the trade itself or by way of its custodial service supplier, Ceffu. Nevertheless, issues arose following the U.S. Securities and Trade Fee’s lawsuit in opposition to Binance, questioning the trade’s crypto pockets custody practices and its relationship with Ceffu.

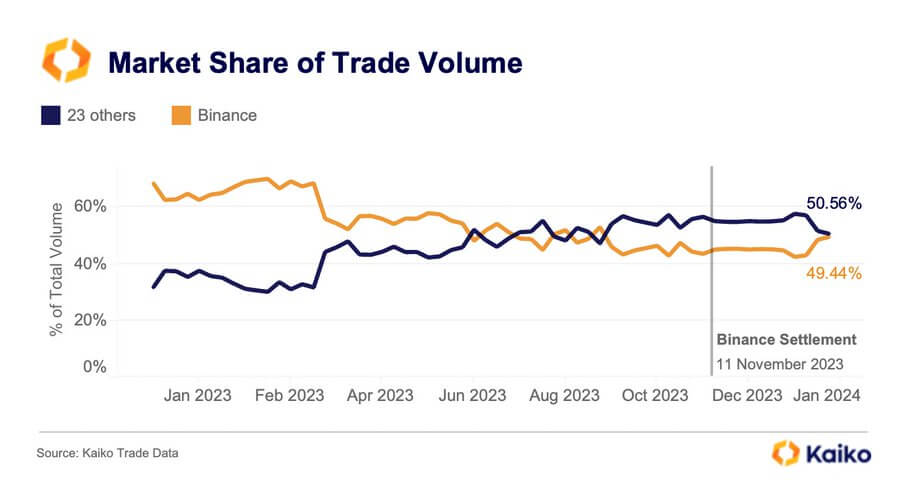

Binance market share recovers.

Binance market share is steadily rising to earlier heights after its run-in with a number of monetary regulators throughout totally different jurisdictions impacted its operations final yr.

In response to this important turnaround, Binance CEO Richard Teng expressed his optimism with a succinct “Maintain Constructing” submit on social media platform X.

The submit Binance permits clients to custody buying and selling collateral off trade as market share recovers appeared first on CryptoSlate.