Indicators are actually strongly hinting that Bitcoin’s (BTC) latest rallies have much more gasoline left within the tank and that a lot larger positive aspects are about to be witnessed, a intently adopted crypto analyst says.

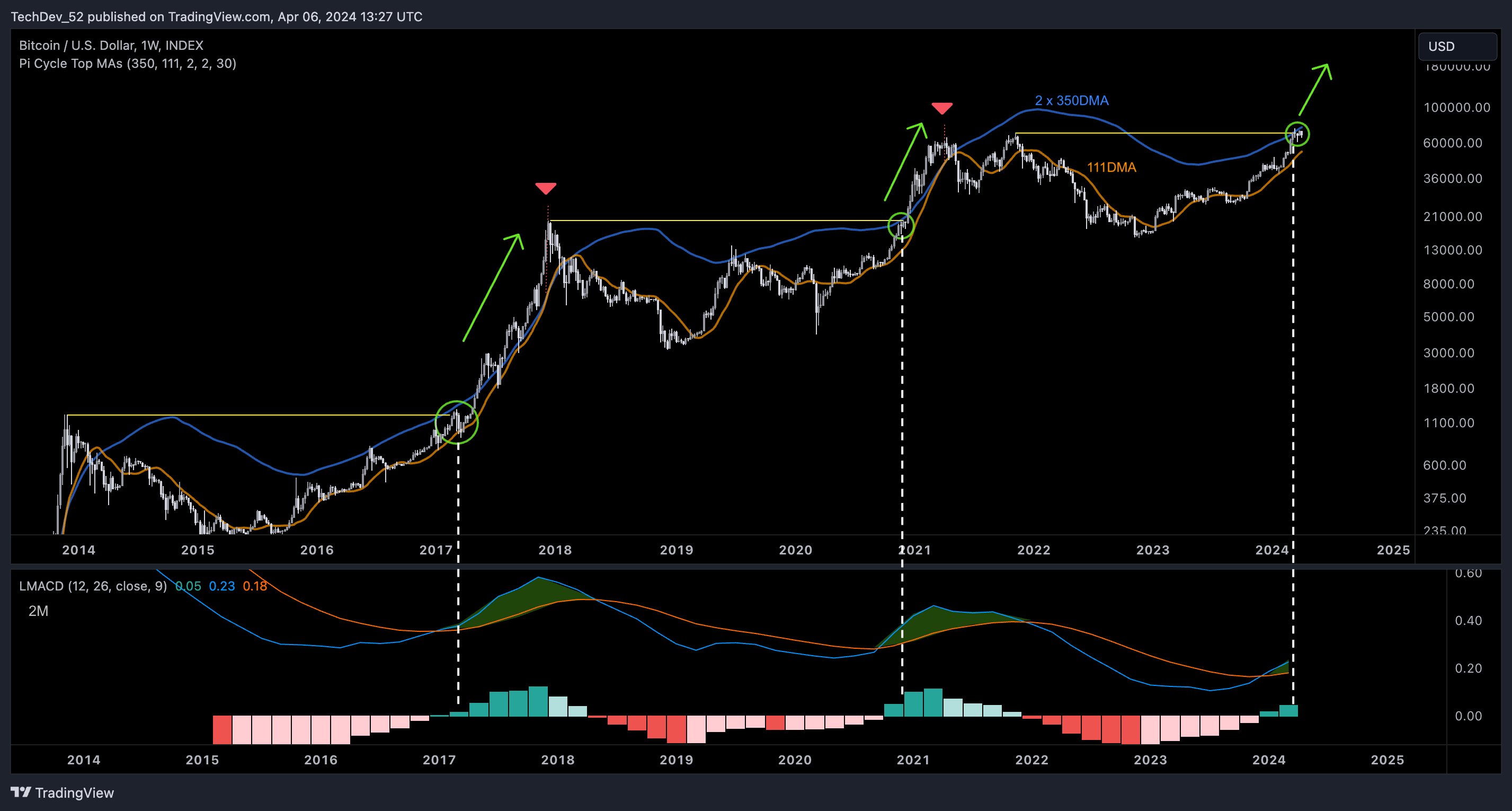

The pseudonymous analyst generally known as TechDev tells his 444,000 followers on the social media platform X that Bitcoin is presently pushing up on the 2x a number of of its 350 day by day shifting common (DMA) whereas it consolidates close to all-time highs.

TechDev additionally notes that BTC’s shifting common convergence divergence (MACD) indicator on the two-month chart has concurrently flipped inexperienced.

The analyst says that collectively, the three traits of Bitcoin’s present worth motion have traditionally coincided with a parabolic rally, which he notes will probably finish when the 111 DMA touches the two×350 DMA.

“BTC consolidation on the intersection of prior all-time excessive and a couple of x 350 DMA quickly after a two-month MACD flip is nothing new.

Quite the opposite, it’s been the precursor to a parabolic surge as much as a cross with the 111 DMA.”

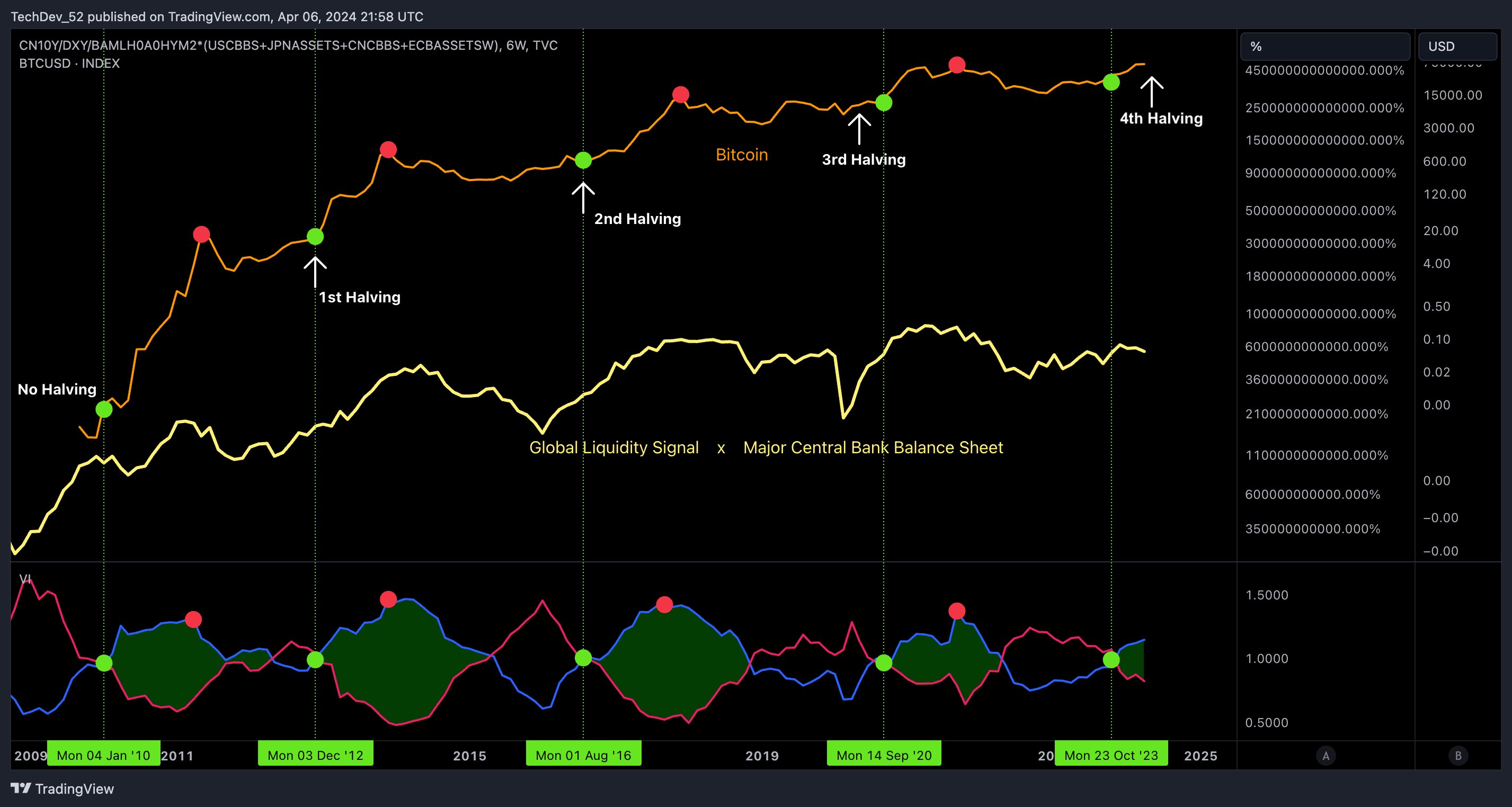

TechDev is of the point of view that Bitcoin’s market cycles could have little to do with the halving, which occurs roughly each 4 years and slashes miners’ BTC rewards in half.

As a substitute, the analyst says that Bitcoin is extra probably correlated with international liquidity cycles. He shares a long-term chart suggesting a correlation between BTC, international liquidity and the steadiness sheets of main central banks.

“That is the primary time a brand new Bitcoin all-time excessive has come earlier than a halving…

As a result of this has been the primary liquidity cycle to begin earlier than a halving.

Reveals which has been driving these runs, and which has occurred to align (besides this time).”

At time of writing, Bitcoin is buying and selling at $69,780.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you might incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in affiliate marketing online.

Generated Picture: DALLE-3