Australian Bitcoin mining firm Iris Vitality has outlined bold plans to ramp up its hash price to twenty exahashes per second (EH/s) by the latter a part of this yr, as detailed in a Feb. 7 replace.

To attain this vital milestone, Iris agreed with Bitmain to safe 10 EH/s of recent T21 miners at a hard and fast price of $14/TH/s. This settlement encompasses 1 EH/s of quick extra miner acquisitions and grants choices for 9 EH/s of miner purchases exercisable within the latter a part of the yr.

In the meantime, Iris wants to spice up its operational capability by a major 222% to realize its focused hash price, which might place it as a number one BTC mining entity in realized hash price, surpassing opponents like RIot Platforms, Marathon Digital, and Core Scientific, as per information from theminermag.

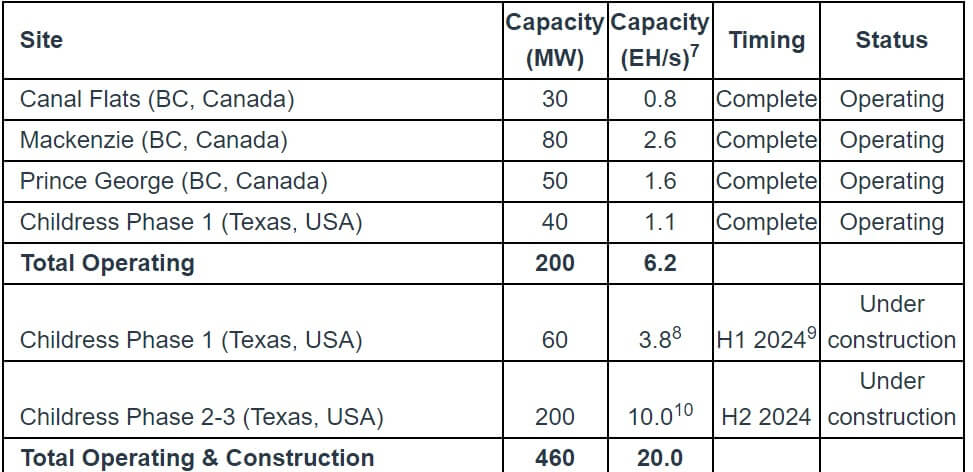

As of Feb. 6, Iris has already enhanced its operational capability to six.2 EH/s from 2.2 EH/s in Nov. 2023, boasting a mining effectivity of 24.8 joules per terahash (J/TH) all through January.

Declined BTC manufacturing

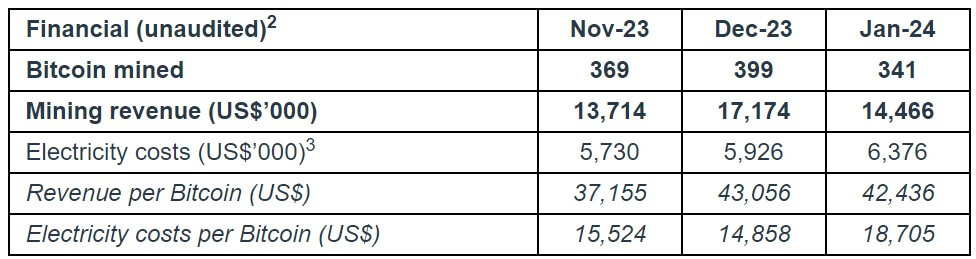

Regardless of Iris’s bold objectives for the yr, the miner Bitcoin manufacturing dropped by 15% to 341 BTC in January. The decline in income was primarily because of decreased transaction charges on the community, increased electrical energy prices, and decreased market volatility at one in every of its mining facilities.

“The rise in electrical energy prices per Bitcoin mined ($18.7k vs. $14.9k in December) was primarily attributable to decrease community transaction charges in addition to increased electrical energy costs and decreased market volatility at Childress,” Iris defined.

This downturn in Bitcoin manufacturing mirrors tendencies noticed amongst different main BTC miners based mostly out of america.

Marathon Digital reported a considerable 42% month-over-month lower in Bitcoin manufacturing, citing short-term disruptions akin to weather-related points and tools failures resulting in website outages. Consequently, it solely mined 1,084 BTC in January, down from 1,853 BTC in December.

Riot Platforms additionally skilled a decline in month-to-month Bitcoin manufacturing, from 619 BTC in December 2023 to 520 BTC in January. CEO Jason Les attributed this lower to the agency’s efforts to stabilize the grid by curbing vitality utilization amidst heightened electrical energy demand following excessive chilly climate in Texas.

Core Scientific, lately relisted on Nasdaq, recorded a drop in Bitcoin manufacturing in January. Regardless of a rise in its energized hash price, the agency’s month-to-month manufacturing decreased from 1,177 BTC in December to 1,027 BTC in January, marking a notable decline regardless of its sturdy efficiency all through 2023.