Ark Make investments’s continued accumulation of the Ark 21Shares Spot Bitcoin ETF (ARKB) has elevated the asset to a top-five place inside the agency’s Ark Subsequent Technology Web ETF (ARKW) portfolio.

The agency’s newest buying and selling file seen by CryptoSlate confirmed that it acquired 267,804 shares of ARKB, value $12.3 million, primarily based on the Jan. 24 closing value of $46.27.

Conversely, it liquidated 282,975 ProShares Bitcoin Technique (BITO) shares, valued at an estimated $5.4 million primarily based on the closing value of $19.11.

This buying and selling exercise follows Ark Make investments’s current development of divesting from BITO and actively accumulating its BTC-based spot ETF. Latest experiences by CryptoSlate revealed how the funding agency has made vital purchases of its ARKB shares for the reason that fund went stay this month.

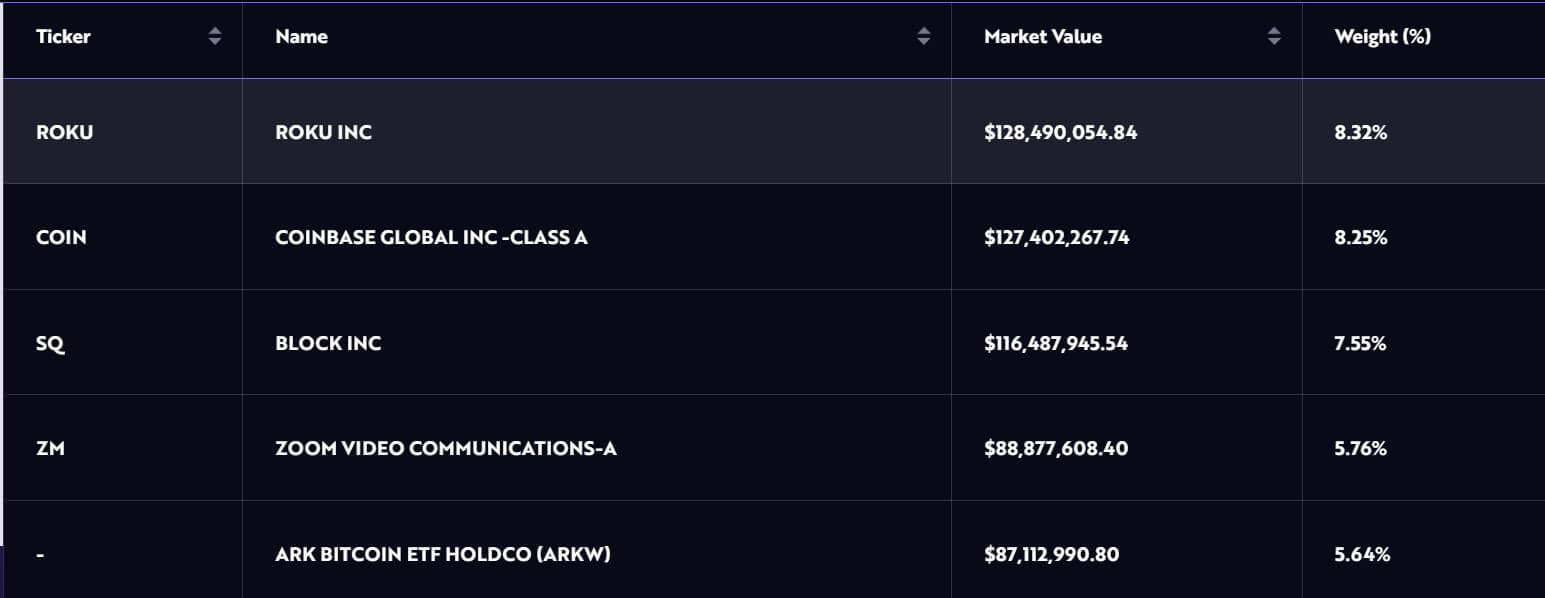

On account of these strategic strikes, ARKB has now secured the fifth place among the many belongings in ARKW’s portfolio.

The ARKW fund at the moment holds 2.1 million ARKB shares, valued at over $87 million, comprising 5.64% of the full portfolio. Notably, ARKB surpasses holdings in well-known entities akin to Tesla, Robinhood, and DraftKings, although it trails behind crypto-focused companies Block and Coinbase inside the ARKW portfolio.

In distinction, Ark Make investments’s holding in BITO has decreased to 566,285 shares, valued at $10.8 million. BITO is the primary BTC futures ETF within the US, launched in October 2021.

In the meantime, the Cathie Wooden-led agency’s strategic reallocation of funds aligns with market expectations, as observers anticipated the agency would shift away from BITO and redirect the capital into ARKB to reinforce the fund’s asset base.

These maneuvers have propelled the Ark 21Shares Bitcoin ETF to 3rd place among the many “New child 9” spot Bitcoin ETFs, trailing BlackRock’s IBIT and Constancy’s FBTC. Based on Bloomberg Intelligence information, the fund’s belongings below administration now exceed $500 million.