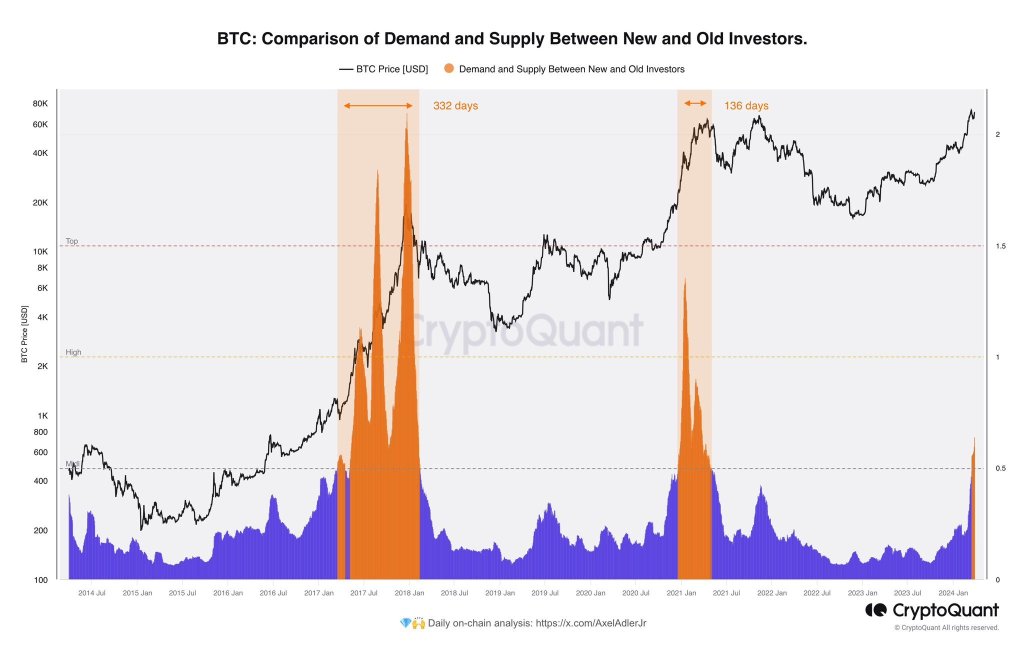

Ki Younger Ju, the founding father of CryptoQuant, a blockchain analytics agency, has seen a curious pattern. In a publish on X, the founder shared a snapshot suggesting that Bitcoin “outdated whales” may be shifting their holdings to “new whales,” primarily conventional finance heavyweights like Constancy and BlackRock.

America Securities and Alternate Fee (SEC) just lately accepted these new whales to checklist spot Bitcoin exchange-traded funds (ETFs) for all traders.

“Outdated Whales” Transferring Cash: Promoting Or Danger Mitigation?

Whereas a definitive sell-off isn’t confirmed, commentators replying to the founder’s publish consider these “outdated whales” might be mitigating threat. Of their evaluation, transferring their Bitcoin stash from self-custody to a regulated funding car like spot Bitcoin ETFs is a greater measure of protecting surprising eventualities.

If that is the strategy, then it may show strategic. Bitcoin holders can transact with out relying on a 3rd social gathering. Notably, this improvement coincides with a major drop in BTC stock on main exchanges like Coinbase and Binance, in addition to at GBTC.

The decline has accelerated because the introduction of spot Bitcoin ETFs, hinting at a possible departure from exchanges. In the meantime, the operators of GBTC are unwinding the product and changing it to a spot Bitcoin ETF following a courtroom determination.

Will Spot BTC ETFs Acquire Traction?

Even so, that “outdated whales” are transferring their cash to centralized merchandise like ETFs contradicts the core philosophy of BTC as a software for monetary self-sovereignty. Whether or not extra customers, primarily retailers, will select to personal spot Bitcoin ETF shares relatively than the underlying cash immediately stays to be seen.

Establishments may be obliged by legislation to make use of a regulated product in the event that they must be uncovered to BTC. Nevertheless, retailers can select to purchase immediately from exchanges or mine. This freedom would possibly result in extra retailers opting to purchase BTC.

This pattern emerges forward of the extremely anticipated Bitcoin halving. This occasion is ready for mid-April 2024 and can additional cut back BTC’s circulating provide, doubtlessly driving increased costs. Earlier than then, BTC costs are agency, regular above $70,000 on the time of writing.

Characteristic picture from DALLE, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal threat.