Bitcoin has been having a foul time just lately, however this analyst isn’t too frightened about it, primarily based on the latest pattern in an on-chain indicator.

Bitcoin Unrealized Loss Has Been At Low Ranges Not too long ago

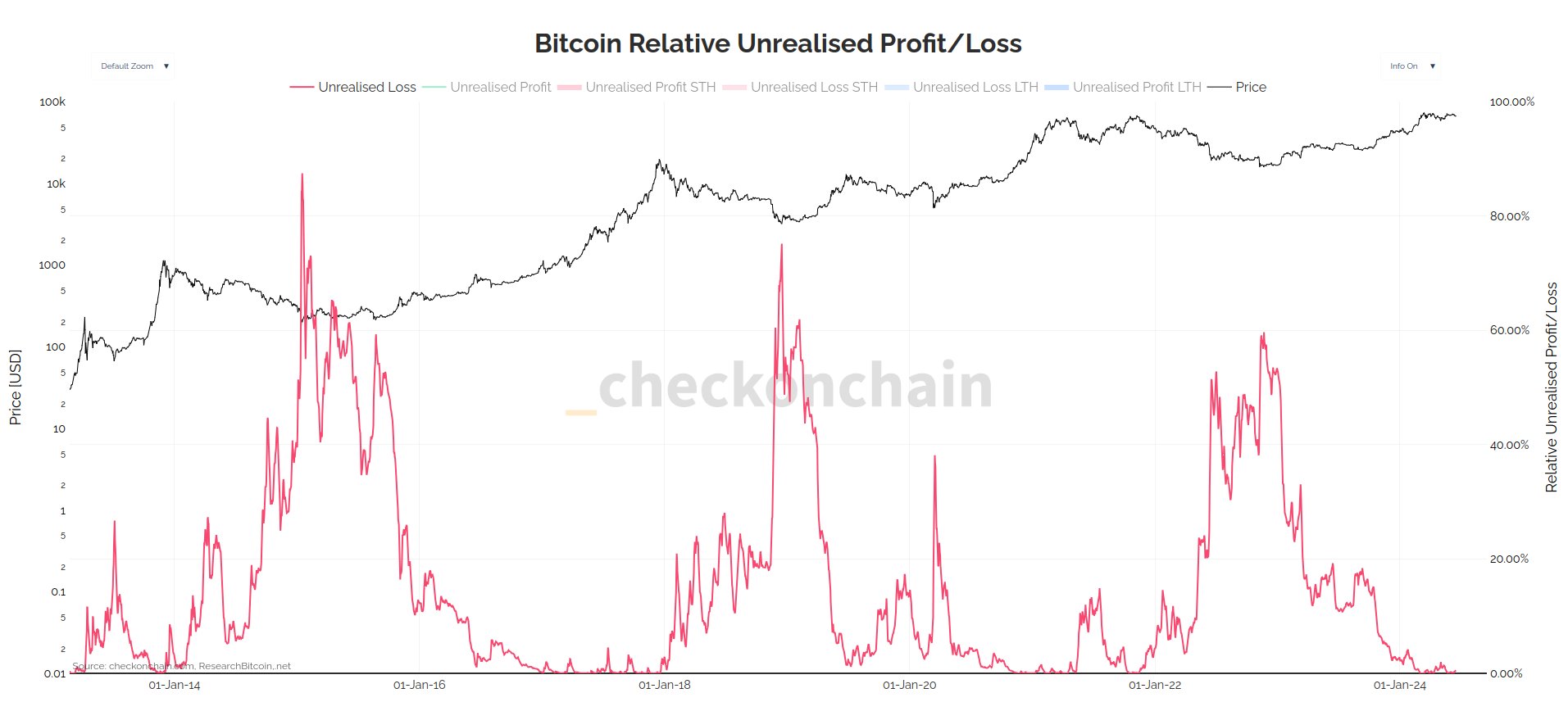

In a brand new put up on X, on-chain analyst Checkmate talked about how the most recent value motion of the cryptocurrency isn’t too scary when contemplating the pattern within the Unrealized Loss.

The “Unrealized Loss” right here refers to an on-chain indicator that retains monitor of the overall loss that addresses throughout the Bitcoin community are holding proper now.

This metric works by going via the transaction historical past of every coin in circulation to see what value it was final moved at. Assuming that this newest transaction was the final level at which the coin modified palms, the value at its time would mirror its present value foundation.

If this value foundation is increased than the present spot value of the cryptocurrency for any coin, then that exact coin may be thought-about to carry a internet unrealized loss at present.

The Unrealized Loss subtracts the 2 values to calculate the magnitude of loss for each coin after which sums them up. Naturally, cash of the other kind contribute in the direction of the “Unrealized Revenue” metric as a substitute.

Within the context of the present dialogue, the Unrealized Loss itself isn’t of curiosity, however fairly a normalized type known as the Relative Unrealized Loss. This metric divides the Unrealized Loss by the asset’s market cap.

Under is a chart exhibiting this Bitcoin indicator’s pattern over the previous decade or so.

As is seen within the graph, the Bitcoin Relative Unrealized Loss peaked throughout the November 2022 bear market lows and has since been heading down. Not too long ago, the metric’s worth has been near zero, implying the losses available in the market have solely been equal to a negligible share of the market cap.

The rationale behind these lows is the latest value surge in the direction of the new all-time excessive (ATH). The complete provide turns into worthwhile throughout ATH breaks, so the Unrealized Loss shrinks to zero.

The indicator naturally additionally fell to zero earlier within the yr when the ATH occurred, however the bearish value motion since then has meant that a few of the traders have gone again into losses.

Curiously, although, the indicator’s worth has nonetheless been extraordinarily low, implying that whereas some shopping for has occurred on the increased costs, it hasn’t been extreme.

From the chart, it’s seen that spikes adopted bull market tops previously within the indicator, as solely a small drop was sufficient to place all of the latecomers chasing hype right into a loss. That hasn’t been the case within the present cycle to date.

“It’s onerous for me to be too petrified of Bitcoin value motion when unrealized losses seem like this,” notes Checkmate. The analyst additionally cautions that it may deteriorate from right here, however it hasn’t occurred but.

BTC Worth

Bitcoin has continued its latest bearish momentum throughout the previous day as its value has now slipped to $64,500.