Fast Take

MicroStrategy (MSTR), the enterprise intelligence agency famend for its substantial Bitcoin holdings, skilled a major share worth decline of over 11% on March 28. The corporate’s shares are presently buying and selling at $1,704, starkly contrasting the just lately anticipated $2,000 mark reported by CryptoSlate simply days earlier. Regardless of the latest setback, MSTR’s year-to-date efficiency stays spectacular, with a exceptional 150% acquire.

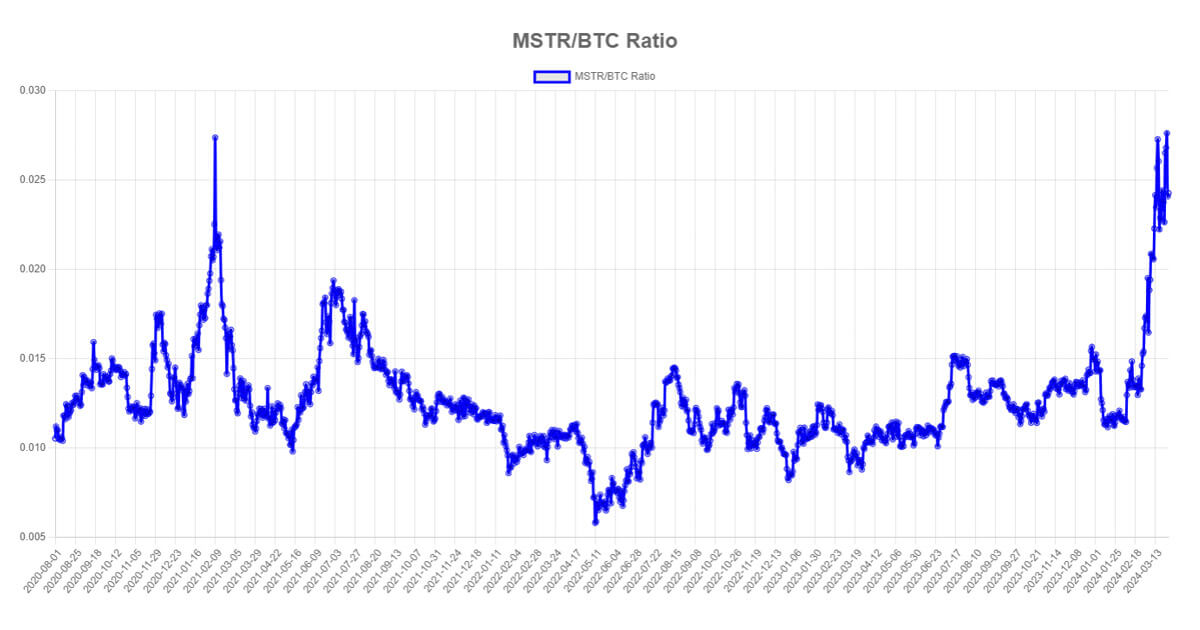

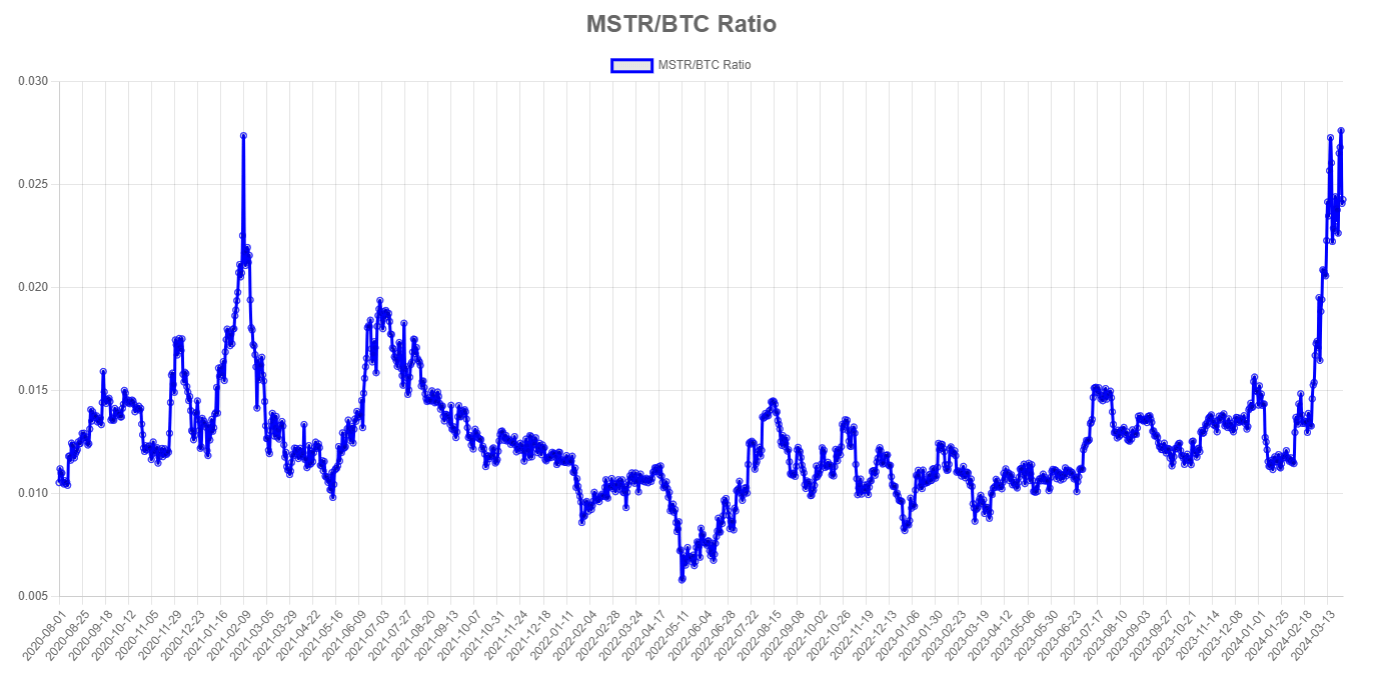

Analysts intently monitor the “MSTR/BTC Ratio,” a comparative worth ratio between MicroStrategy’s inventory worth and the value of Bitcoin. This ratio illustrates how the corporate’s inventory worth traits in relation to Bitcoin’s market actions. Presently buying and selling at 0.024, the ratio hit a latest excessive of 0.028, mirroring the degrees noticed in June 2021 at roughly 0.027, in keeping with mstr-tracker.

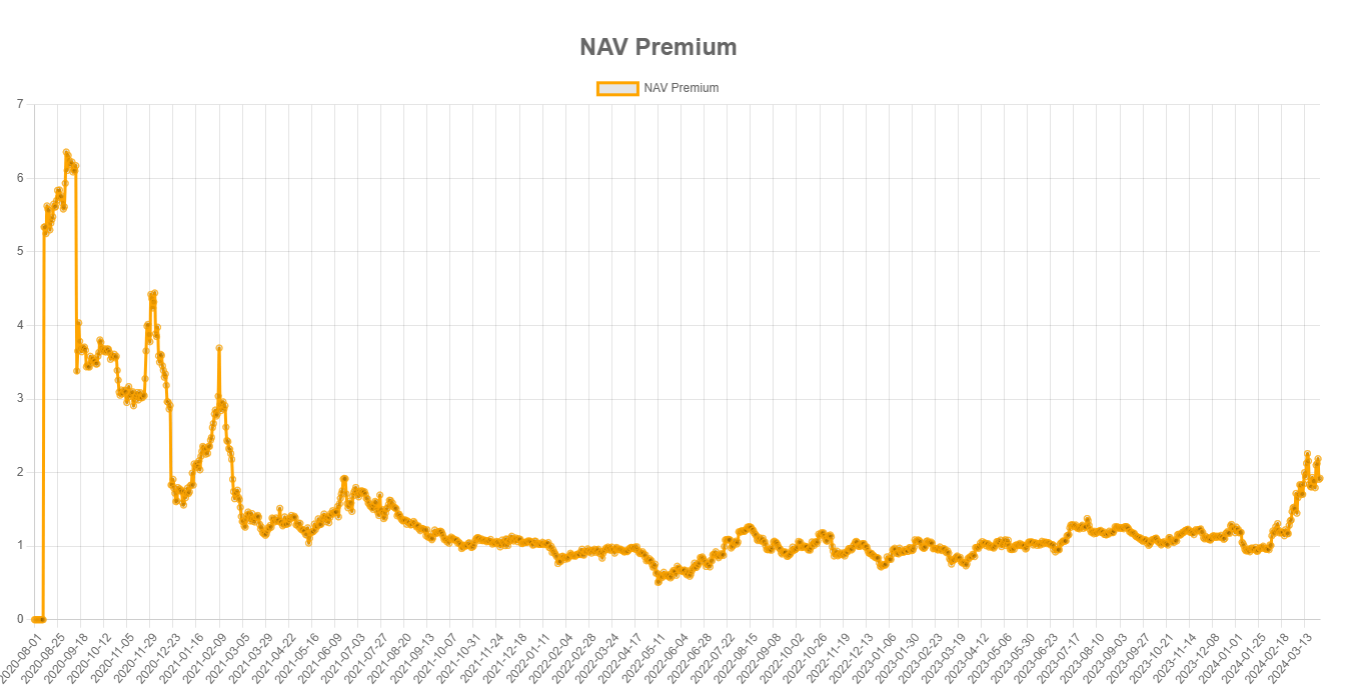

The “NAV Premium” chart, supplied by mstr-tracker, which shows the premium of MicroStrategy’s inventory over its proxy-NAV in Bitcoin, signifies that the market values the corporate’s inventory at 1.92 instances its Bitcoin holdings. The location has a novel methodology for outlining an equal NAV for MicroStrategy, which considers its Bitcoin holdings, excellent shares, share worth, and market cap. Intriguingly, the present NAV determine matches the excessive noticed in June 2021, when MSTR’s share worth hovered round $500-$600, and Bitcoin traded at roughly $35,000.

The publish Analysts eye MicroStrategy share worth to Bitcoin holdings ratio intently as MSTR falls 11% appeared first on CryptoSlate.