A extensively adopted on-chain analyst thinks that Bitcoin (BTC) bears are about to get worn out following final week’s crypto correction.

Analyst Willy Woo tells his 1.1 million followers on the social media platform X that the newest Bitcoin retracement to $60,000 flushed out leveraged longs.

Woo says he doesn’t see Bitcoin taking place in a straight line as he believes that BTC bulls will defend the “formidable” short-term holder (STH) at $59,000. In line with the analyst, the percentages are greater that BTC will bounce and liquidate merchants who shorted at round $70,000.

“We flushed out lengthy leverage all the way down to $60,000.

To liquidate decrease, value would have damaged the formidable $59,000 STH help, and a powerful signal of a bear market.

Extra doubtless quick liquidations to $71,000-$75,000 is subsequent.

Quick-term value is a stroll of liquidations.”

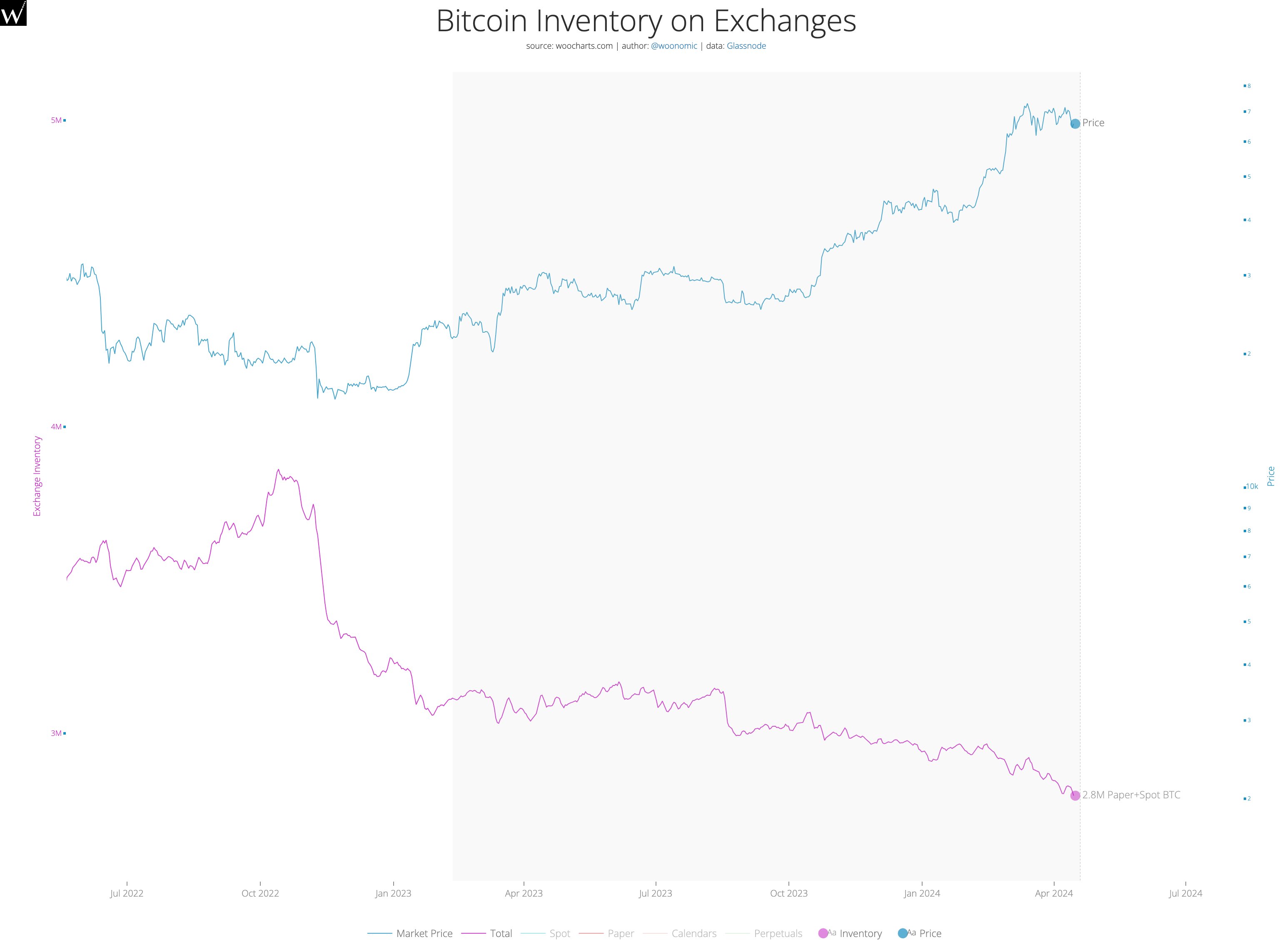

Woo can be conserving a detailed eye on the quantity of Bitcoin provide obtainable on crypto exchanges. In line with the analyst, BTC’s stock on exchanges has been on a downtrend since October 2022, suggesting that it’s solely a matter of time earlier than demand overwhelms provide and pushes Bitcoin to new all-time highs (ATH).

“ views of demand and provide, this chart being solely certainly one of them, it’s only a matter of time earlier than the buildup taking place all through this consolidation squeezes us previous ATH. Endurance is vital, don’t be degenerate.”

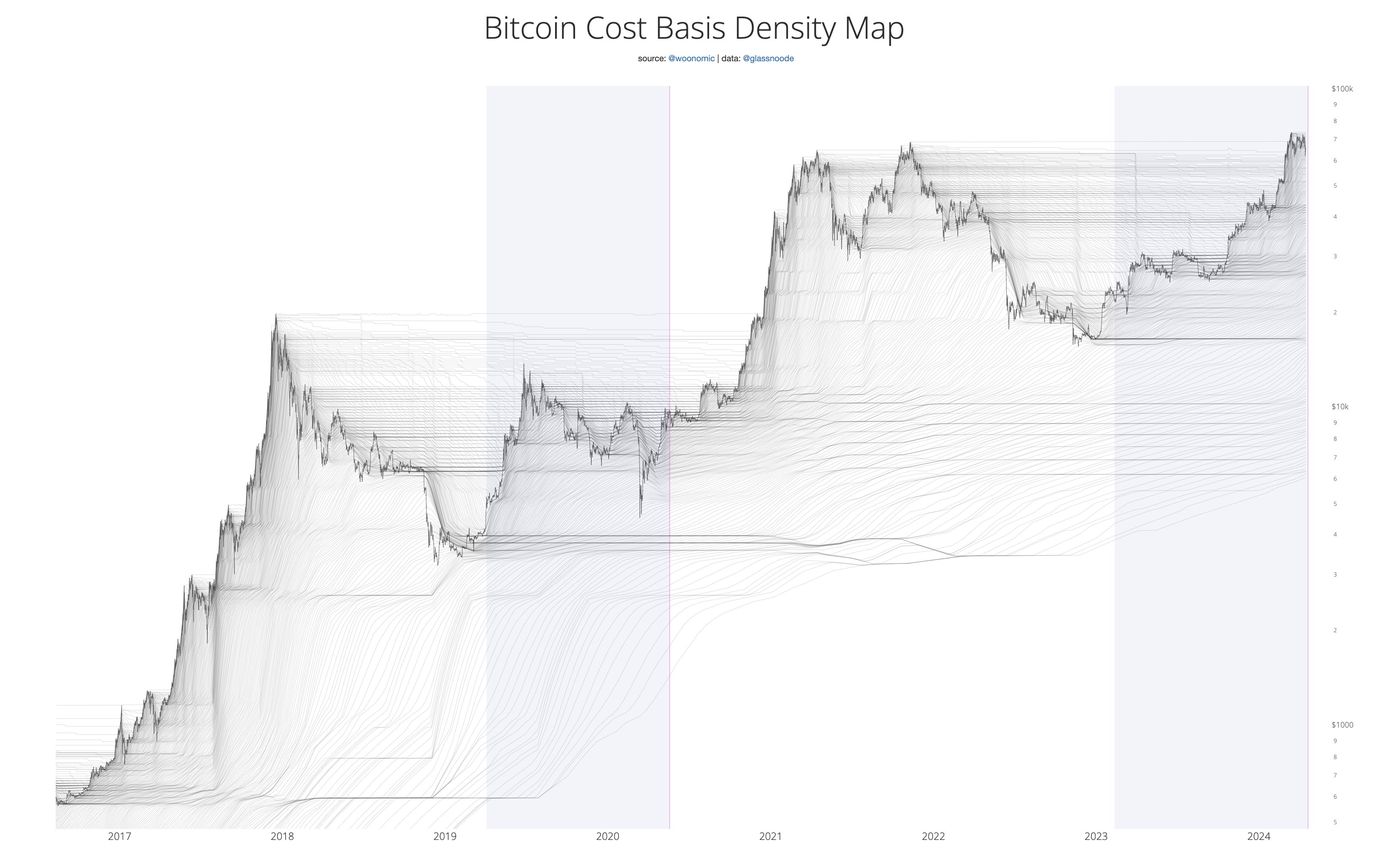

Woo additionally highlights that the present consolidation across the all-time highs is making a strong help degree for BTC. In line with Woo, the continued accumulation between $60,000 and $70,000 is establishing a base of patrons that can safe BTC’s place as a trillion-dollar asset.

“Bear in mind: the longer BTC consolidates round ATH, the extra cash that change fingers between traders cementing its value discovery.

This creates formidable long-term help as soon as we break it.

Bitcoin as a trillion-dollar asset class is right here to remain.

This can be a good factor.”

At time of writing, Bitcoin is buying and selling for $63,272, down practically 4% previously day.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Comply with us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any loses you could incur are your duty. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please be aware that The Each day Hodl participates in online marketing.

Generated Picture: DALLE3