Cosmos is presently held between a rock and a tough place available in the market, based on crypto analyst Alan Santana. To him, it is a very opportunistic time for long-term traders, most particularly these with a bullish outlook.

Associated Studying

He feels that ATOM is at present buying and selling at fairly a exceptional low cost from the highs posted, therefore positioning itself for a really compelling risk-reward entry. Based on Santana, Cosmos has “an excellent chart” as a result of the coin is buying and selling very low in comparison with historic costs.

✴️ Cosmos (ATOM) Pre-2025 Bull-Market Accumulation Zone & Technique

Cosmos has an excellent chart…

How are you doing my pricey buddy?

Prepared for a brand new yesterday, tomorrow-today?

Are you able to discover this chart with me on this fantastic day?Cosmos has an excellent chart as a result of it’s… pic.twitter.com/SH4yrF76yd

— Alan Santana (@lamatrades1111) August 14, 2024

Cosmos: Accumulation Section and Dangers

Santana emphasised that Cosmos was in its vital section of accumulation. However, ATOM has traditionally shaped increased long-term lows, which might be a technical indicator setting a stage for future good points.

Nevertheless, accumulation comes with dangers. The important thing stage to observe can be $1.923, a low from March 2020. Ought to the value of ATOM go beneath this threshold, it could considerably undermine the bullish narrative Santana presents.

Such a decline might be interpreted as a shift in market sentiment and would end in weaker efficiency in contrast with different cryptocurrencies.

One other stress on ATOM comes from insider promoting. As quickly because the builders, miners, or exchanges start to promote their holdings en masse, that often turns into a crimson flag indicator of issues inside the challenge or, on the very least, a scarcity of perception in its additional perspective.

This could be why, particularly, Cosmos can’t maintain up that nicely in comparison with different altcoins, which have been in a position to keep above their June 2022 lows.

Bearish Forecast And Market Sentiment

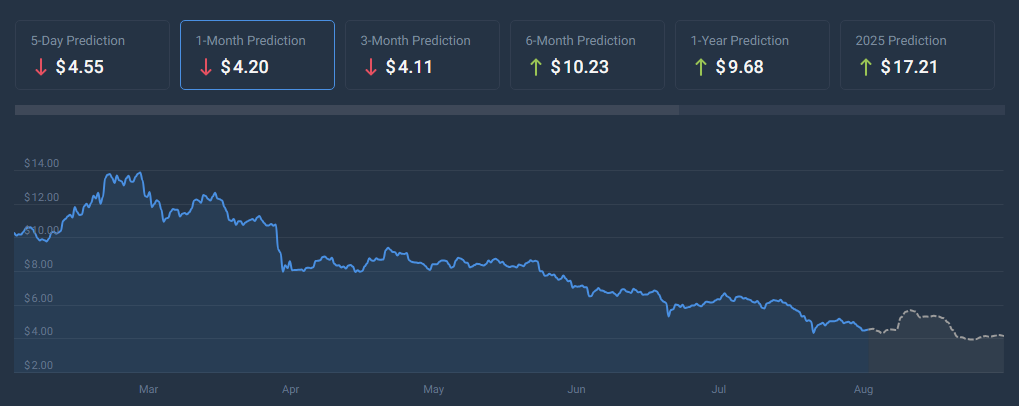

Though Santana’s sentiment is barely overly hopeful, the market sentiment is overwhelmingly bearish. Based on CoinCodex’s most up-to-date prediction, Cosmos will lose 8.56% and its value will fall even additional to $4.13 by September 15, 2024.

All technical indicators on this forecast are bearish. The Concern & Greed Index has lastly reached 27, displaying a lot concern available in the market. For Cosmos, there have been 9 inexperienced days over the last 30 days—out of a doable whole of 30.

This interprets right into a optimistic return fee of 30%. Its present value volatility is at 11.64%, indicating a extremely unsure and dangerous timeframe.

Properly, contemplating the present state of the market, it is probably not a really perfect time to spend money on Cosmos. Primarily based on the elements talked about above, specifically the value drop forecast and the present sense of concern available in the market, it could appear that warning is due.

Associated Studying

Weighing The Dangers and Rewards

Though Santana’s evaluation reveals that this might really be useful for future achieve, the outlook instantly shouldn’t be so promising. The elements subsequently should be considered by the investor prior to purchasing.

Cosmos is a high-risk, high-reward state of affairs. The present low value and former increased lows might yield big rewards for long-term traders who can deal with the storm. Nevertheless, adversarial temper, insider promoting, and value lower expectations are dangers.

Featured picture from Zipmex, chart from TradingView