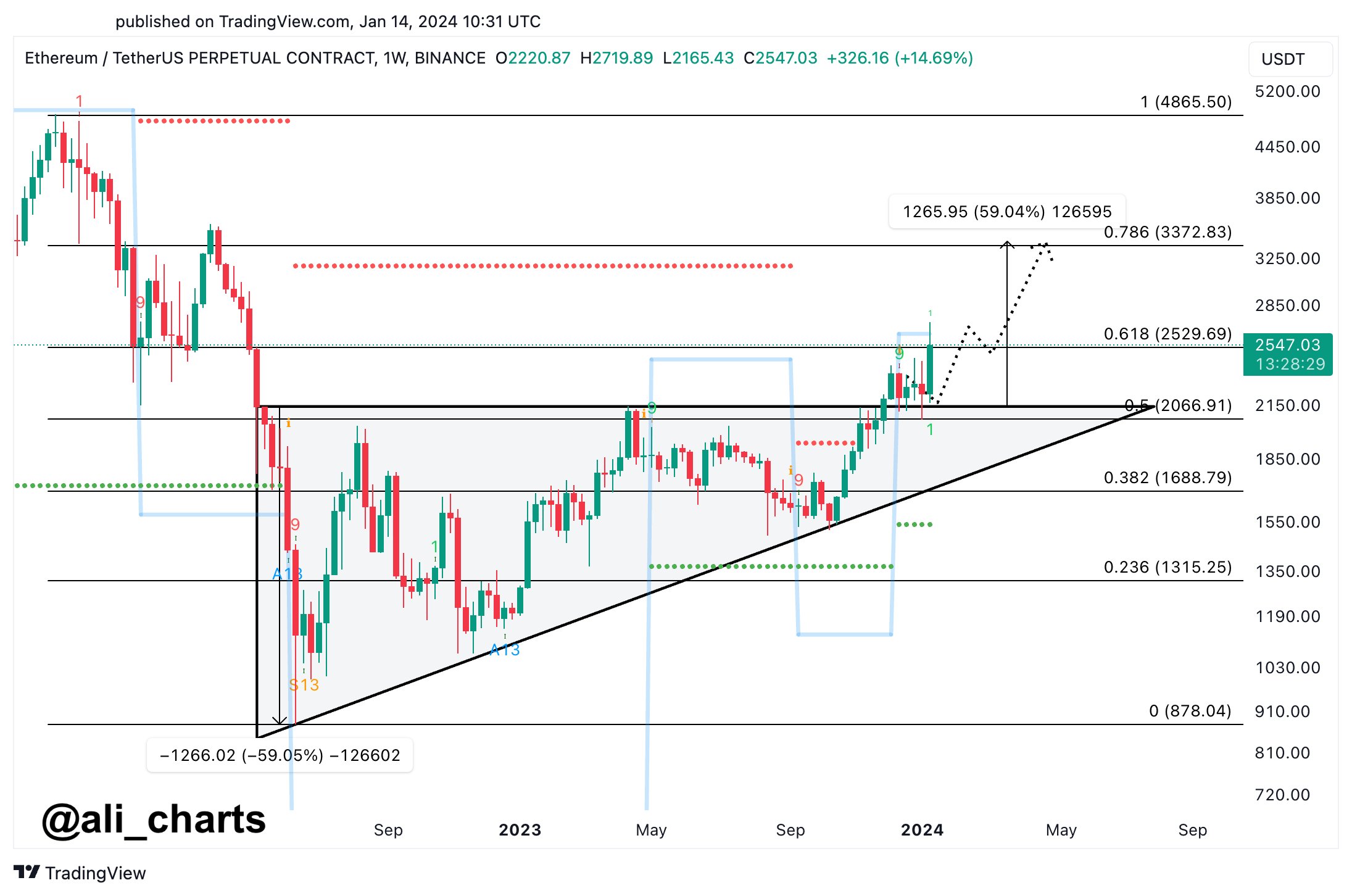

A intently adopted analyst thinks Ethereum (ETH) is on the verge of a rally after the second-largest crypto asset flashed a bullish sign on the excessive time-frame chart.

Ali Martinez tells his 40,700 followers on the social media platform X that ETH broke out from an ascending triangle on its weekly chart and continues to focus on $3,400 regardless of its short-term volatility.

An ascending triangle is a technical evaluation sample that sometimes entails two or extra equal highs and a collection of upper lows. It’s often interpreted as a bullish sample.

Ethereum is buying and selling at $2,517 at time of writing.

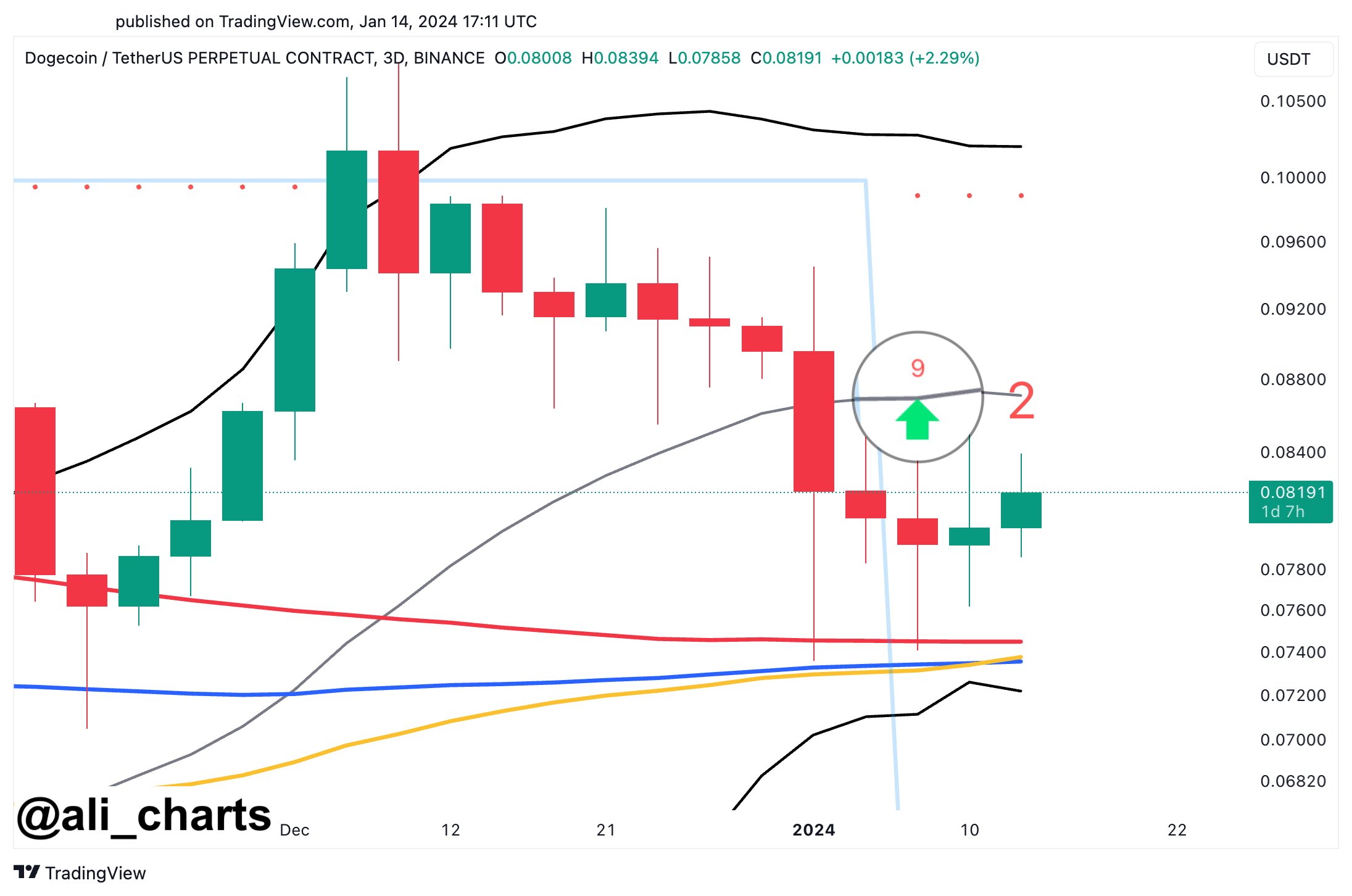

Martinez additionally notes that the Tom DeMark (TD) Sequential indicator just lately introduced a purchase sign for prime meme asset Dogecoin (DOGE). The TD Sequential indicator is utilized by merchants to foretell potential pattern reversals based mostly on the closing costs of the 13 earlier bars or candles.

Says Martinez,

“So long as the $0.074 assist cluster continues to carry, DOGE has an important likelihood of rebounding to $0.100 or increased!”

DOGE is buying and selling at $0.080 at time of writing.

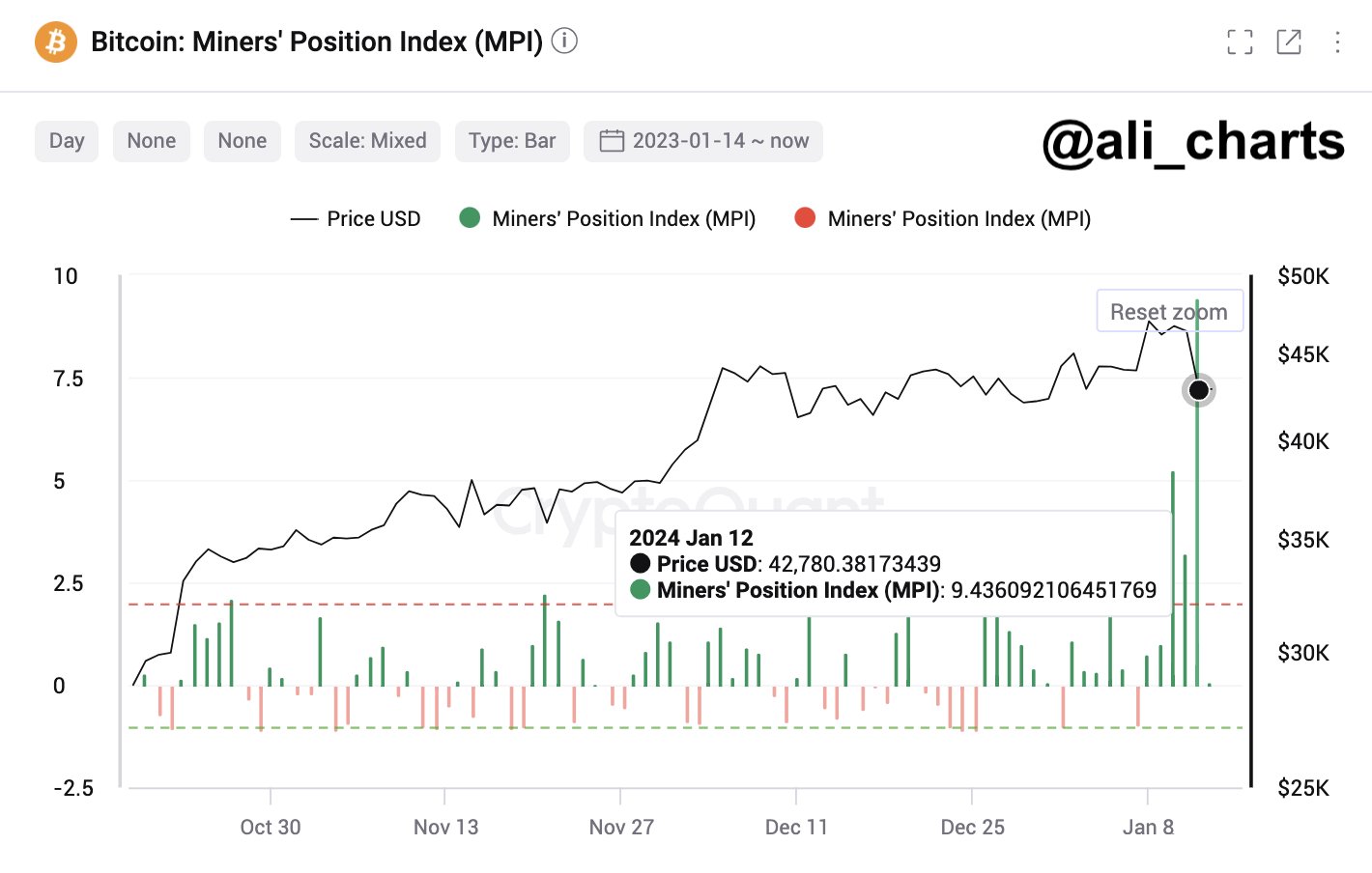

When it comes to Bitcoin (BTC), Martinez notes that the BTC Miners’ Place Index (MPI) hit a excessive of 9.43 on January twelfth.

“This means miners moved extra BTC than typical, hinting at potential gross sales. Regardless of a latest BTC value correction, keep vigilant – additional miner promoting might drive costs additional down!”

The MPI is a metric that gives perception into whether or not BTC miners are promoting or holding onto their cash. It’s calculated by figuring out the ratio of the variety of all miners’ outflows in US {dollars} divided by the 365-day transferring common, in keeping with the digital asset analytics agency CryptoQuant.

BTC is buying and selling at $42,821 at time of writing.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on Twitter, Fb and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses chances are you’ll incur are your accountability. The Each day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Each day Hodl an funding advisor. Please observe that The Each day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney