Lately, crypto analysts have been interested in Bitcoin Money (BCH); Alan Santana offered an especially intricate evaluation regarding the coin’s future. He advises buyers although to carry off on accumulating BCH till the market reveals clearer indicators of stability.

Associated Studying

The cautious outlook for Santana was based mostly on the notion that, from his perception, the correction available in the market wasn’t over but. He indicated that BCH nonetheless is perhaps due for slightly room right down to the underside, more likely to precede the bull market anticipated in 2025.

Strategic Accumulation And Market Timing

The analyst focuses on a meticulous accumulation technique. Santana advises buyers to attend for indicators of the bottoming of the market earlier than shopping for BCH. He says such persistence can repay handsomely. He additionally encourages one to take a look at each linear and logarithmic graphs, for every presents a special perspective into value motion. This provides a better overview of the place BCH is perhaps headed when each of them are mixed.

✴️ Bitcoin Money Pre-2025 Bull-Market Accumulation Zone & Technique

One other superb cryptocurrency venture. You understand our motto, we love all cryptocurrencies; the extra the higher.

Good night women and gents… Are you able to be entertained?

Bitcoin Money peaked earlier than… pic.twitter.com/DMLJ077ufN

— Alan Santana (@lamatrades1111) August 13, 2024

After all, these potential returns can be for these keen to comply with the recommendation. Nonetheless, he additionally cautioned that such beneficial properties would most definitely should journey by additional declines in the marketplace. Timing and persistence in driving out wildly swinging markets are thus what appear to be emphasised greater than anything along with his technique.

BCH is impartial of the broad market development. In 2021, BCH led in Might, slightly forward of different altcoins. Within the yr 2023, BCH began off in June to peak in April 2024. This time distinction proper right here can provide BCH an added strategic benefit for buyers who perceive that market conduct.

World Of Charts, one other analyst, not too long ago supplied an upbeat prediction for Bitcoin Money’s (BCH) value trajectory. WOC believes that BCH is sort of prepared for an enormous bounce within the upcoming weeks.

BCH was making an attempt numerous resistance ranges on the time of his analysis. These milestones functioned as obstacles that BCH needed to clear in an effort to pursue new annual highs. Based on the analyst, a big value acquire could happen if BCH is ready to overcome these resistance ranges.

Associated Studying

Brief-Time period Outlook: Resistance And Development

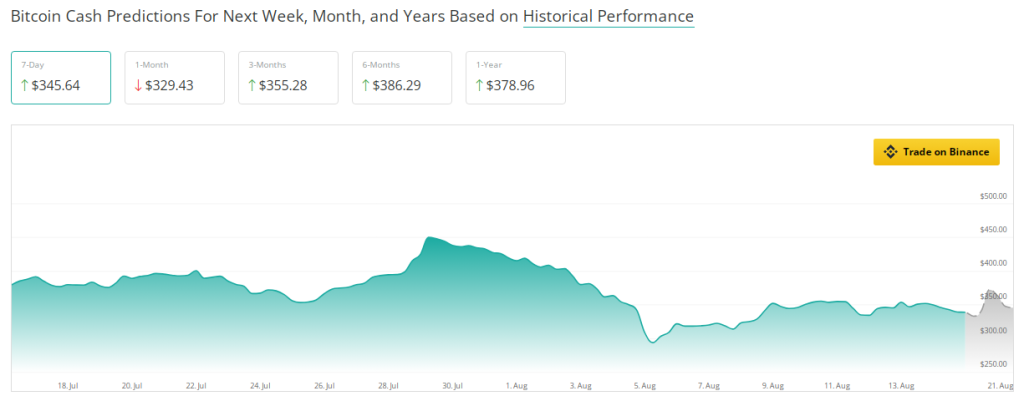

Whereas Santana’s view for the long run may be very conservative, the short-term BCH forecasts are fairly optimistic. CoinCheckup information interprets this to imply a doable 4.80% enhance BCH over the subsequent three months. This development may very well be pushed by regular accumulation and delicate bullish momentum. Although modest, this might place BCH to check the $230-$240 resistance zone.

Additional out, the six-month outlook for BCH is a projected 14% rise. Assuming BCH can escape of its present resistance ranges, the goal would be the $270-$280 zone. However extra so vital might be how the market reacts at these ranges, and that shall be the determinant as as to whether BCH will preserve the momentum or there might be heavy pullbacks.

Featured picture from Pintu, chart from TradingView