Bitcoin bulls could quickly be again in enterprise. In line with Willy Woo, an on-chain analyst, market knowledge reveals that pressing “market sells” accountable for forcing the coin from all-time highs at the moment are falling. This improvement could prop up costs, stopping additional sell-offs.

Bitcoin Promoting Stress Easing

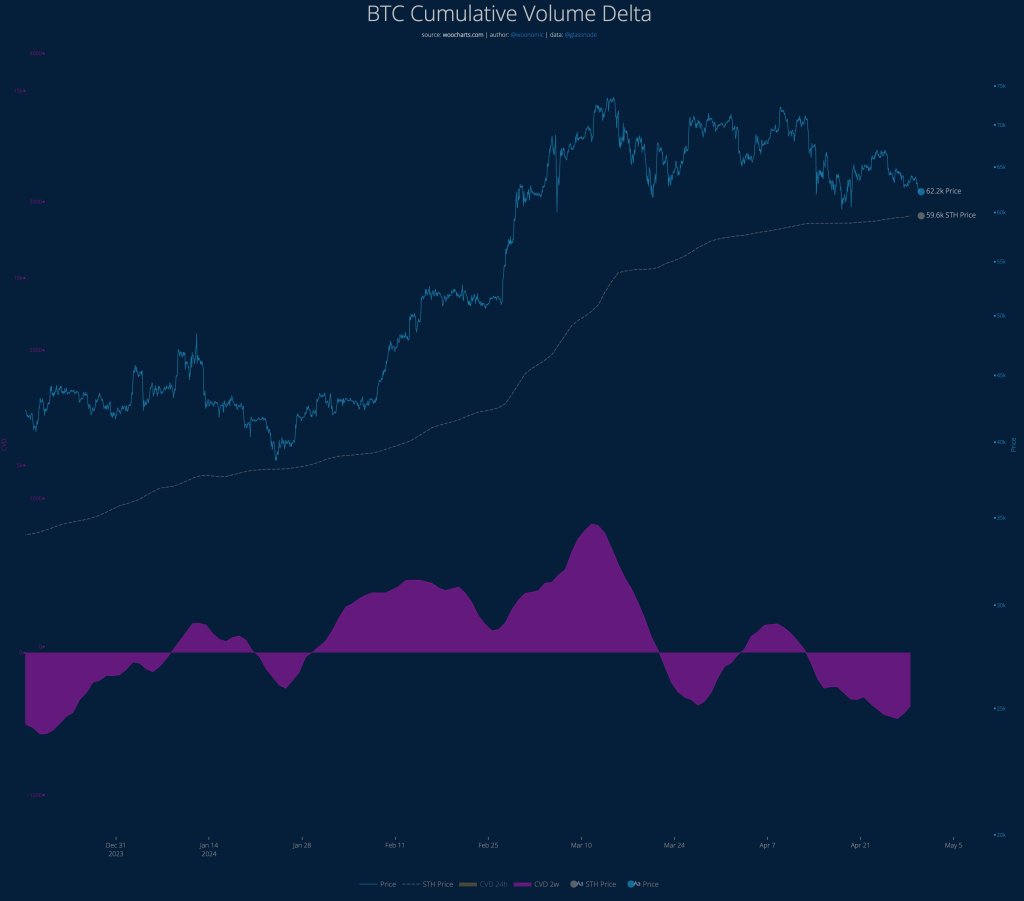

This preview is because of falling Cumulative Quantity Delta (CVD) knowledge, an on-chain indicator that may additionally monitor market sentiment. Particularly, it tracks shopping for and promoting aggression from market contributors. Now that CVD is dropping, Woo says extra BTC holders are possible prepared to climate the storm. Their determination could straight help costs.

Woo provides that BTC should reject promoting strain and finish the present short-term weak spot as issues stand. As on-chain knowledge reveals, BTC ought to keep above $59,600. The CVD lie has traditionally separated bullish and bearish zones.

Based mostly on this, BTC ought to stay above the $60,000 spherical quantity for the uptrend to be sustained. If not, and bears take over, urgent costs decrease under the CVD degree might sign the start of a brand new bear regime.

To date, BTC is below immense promoting strain, shaving roughly 15% from all-time highs. The coin has help at across the $60,000 and $61,000 zone, transferring inside a spread. Resistance is at an all-time excessive of round $74,000 on the higher finish.

Based mostly on this preview, any losses under $60,000, as Woo notes, would possible see BTC dump. The coin would possibly drop to $53,000 within the brief time period, torching cease losses and fueling the sell-off.

Will Hong Kong Spot ETF Launch Elevate Costs?

Whether or not BTC bulls will stream again relies upon totally on institutional involvement within the days to come back. Following the approval of spot Bitcoin exchange-traded funds (ETFs) in January, costs spiked greater, breaking earlier all-time highs.

Institutional involvement has been important. Nonetheless, inflows have slowed down, particularly within the final two weeks of April. Analysts at the moment are trying on the launch of spot Bitcoin ETFs in Hong Kong on April 30.

In a current interview, Zhu Haokang, the Head of Digital Asset Administration in Hong Kong, is bullish. Haokang expects buying and selling quantity to eclipse these seen in the US. The manager says the product is exclusive, permitting for a bodily subscription that’s extra engaging for BTC miners. Furthermore, it’s international, drawing curiosity from Singapore and the Center East traders.

Function picture from DALLE, chart from TradingView

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use data offered on this web site completely at your personal threat.