In what has been an “uncommon” September, Bitcoin (BTC) has now recorded one other constructive weekly efficiency. Based on information from CoinMarketCap, the maiden cryptocurrency surged by 5.07% within the final seven days, shifting its cumulative achieve on this month to 11.30%. Curiously, with Bitcoin halving since gone, analysts stay extremely expectant of the normal market bull run by the biggest digital asset.

BTC In Consolidation As It Gathers Momentum For Breakout

In an X put up on Friday, fashionable analyst Crypto Rover predicted BTC will hit a $290,000 worth mark within the upcoming bull run.

Curiously, this worth projection tallies with earlier statements from analysts who put a six-figure worth goal for BTC following the introduction of the Bitcoin spot ETFs which represents an elevated institutional demand for the crypto market chief.

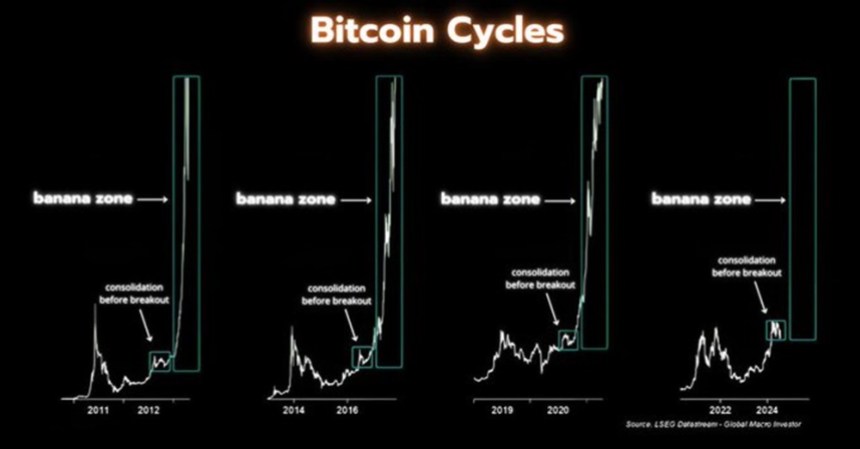

Notably, BTC has been shifting between $55,000 – $70,000 over the past seven months which represents a state of consolidation. Based on Crypto Rover, following a breakout from this present sideways motion, Bitcoin is prone to enter the “banana zone” i.e. the section of outrageous worth progress, as seen in earlier bull cycles.

The crypto analyst predicts that in this era which historically lasts for 12-18 months, BTC may commerce as excessive as $290,000 representing a 339.39% achieve on the asset’s present worth.

For a lot of crypto fanatics, it’s seemingly that the much-anticipated breakout will happen within the fast-approaching weeks as Bitcoin has now fashioned an inverse head and shoulders sample as highlighted by Crypto Rover in one other put up. To clarify, the inverse head and shoulders sample is a standard bullish indicator of potential reversals of a downtrend. If the value breaks above the neckline with vital quantity, it signifies a shift to bullish management.

These sentiments on a worth breakout are additional strengthened by the upcoming This autumn which has confirmed to be probably the most bullish interval for Bitcoin with a mean achieve of 88% over the past 11 years.

Bitcoin Alternate Stablecoins Ratio Exhibits Bullish Sign

In additional constructive information for the Bitcoin group, the Bitcoin Alternate Stablecoin Ratio is presently indicating a purchase sign. Based on CryptoQuant analyst with username EgyHash, this metric which measures BTC reserves (in USD) to the mixed stablecoin reserves on change is presently on the low ranges seen in the beginning of 2024.

EgyHash explains {that a} low ratio signifies merchants have an elevated shopping for energy on account of excessive stablecoin holdings which may translate into investments in Bitcoin, thus leading to a worth achieve. Due to this fact, the present low Bitcoin Alternate Ratio provides to the record of bullish alerts for Bitcoin buyers.

On the time of writing, the premier cryptocurrency continues to commerce at $66,064 with a 1.14% achieve within the final day. In the meantime, Bitcoin’s each day buying and selling quantity is down by 12.92% and valued at $32.01 billion.

Featured picture from Cwallet, chart from Tradingview