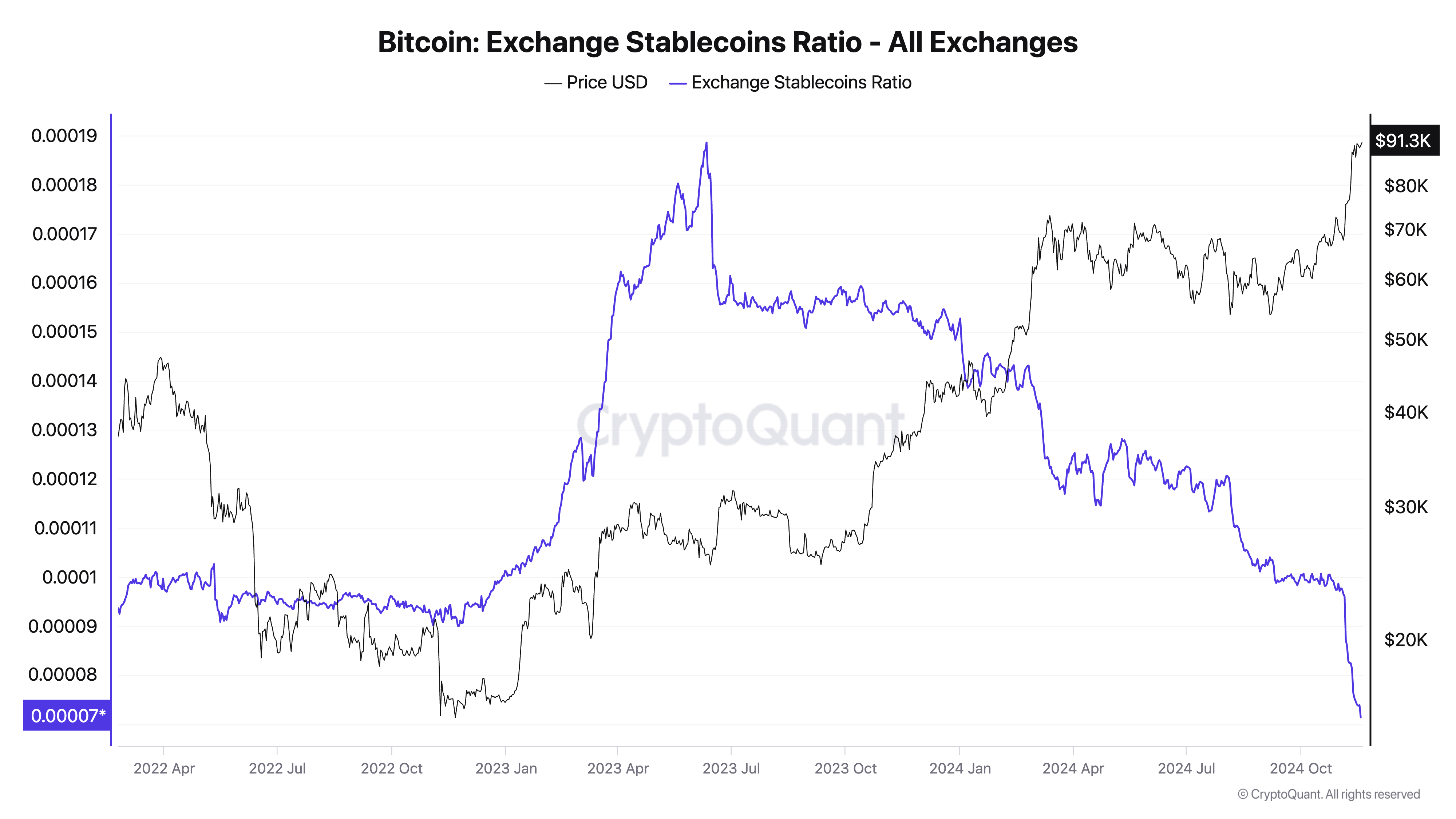

The change stablecoin ratio (ESR) is an on-chain metric that signifies the stability of liquidity between Bitcoin and stablecoins held on exchanges.

The metric is calculated because the ratio of the entire Bitcoin reserves to the entire stablecoin reserves, basically exhibiting the market’s shopping for energy and promoting stress.

A low ESR signifies that stablecoin reserves considerably outweigh Bitcoin reserves, suggesting an abundance of liquidity able to move into BTC. This disparity has traditionally correlated with bull markets and rallies, as stablecoins have at all times been most well-liked for buying BTC on exchanges.

Conversely, a excessive ESR means that BTC dominates reserves relative to stablecoins, which often means restricted shopping for energy on exchanges and a possible for important promote stress.

Whereas there are various completely different indicators of bull markets, ESR is especially useful because it captures the readiness of capital to maneuver into Bitcoin. In contrast to remoted value metrics, the ratio displays underlying liquidity traits and mirrors investor sentiment.

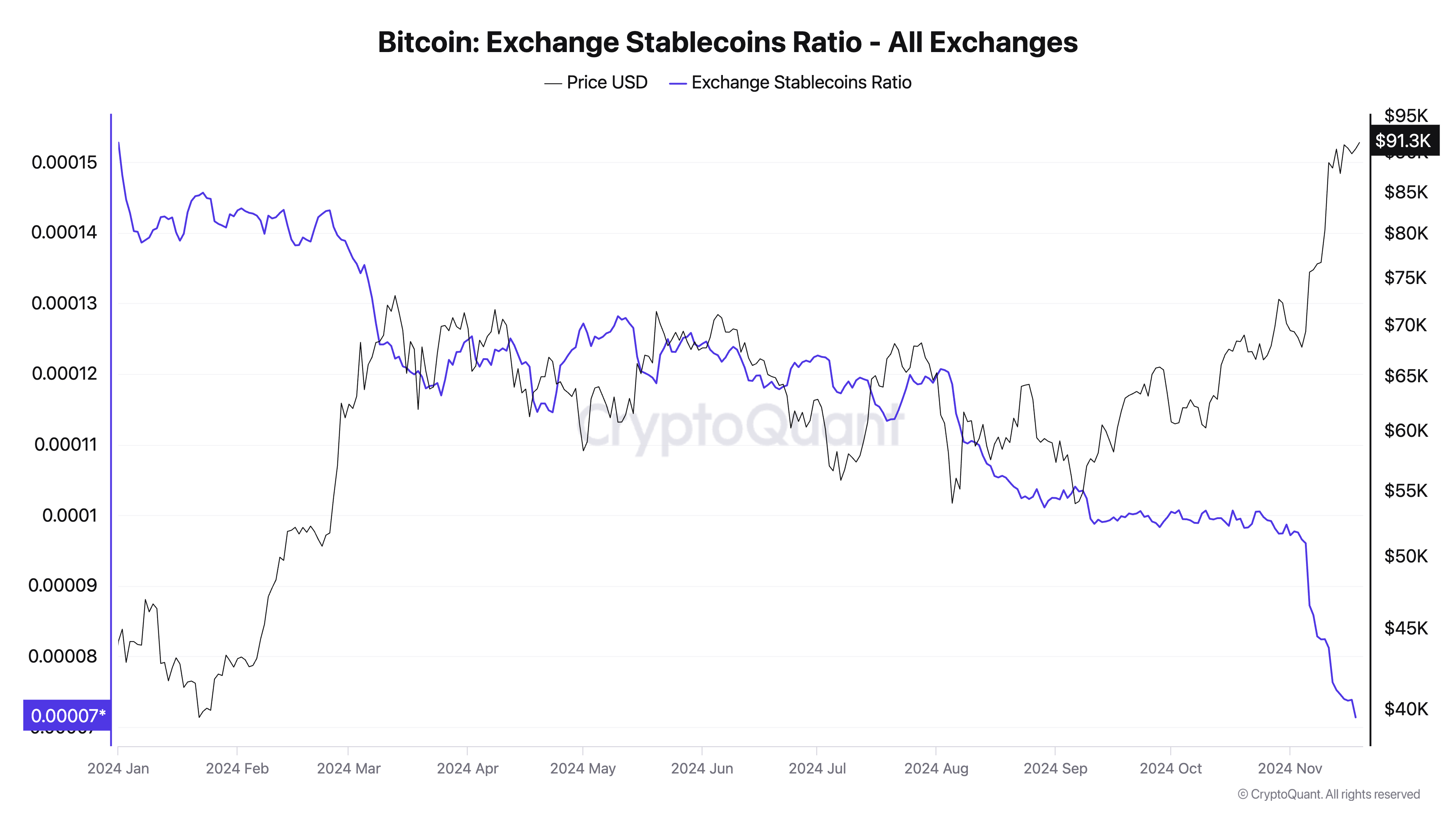

On Nov. 18, the ESR dropped to an all-time low following a declining development that intensified in 2024. For the reason that starting of the 12 months, the ESR decreased by simply over 95%, dropping from 0.0015276 on Jan.1 to an all-time low of 0.00007317 by Nov.18. Throughout the identical interval, Bitcoin’s value skyrocketed from $44,200 to $90,500, exhibiting a transparent inverse relationship between the ratio and value.

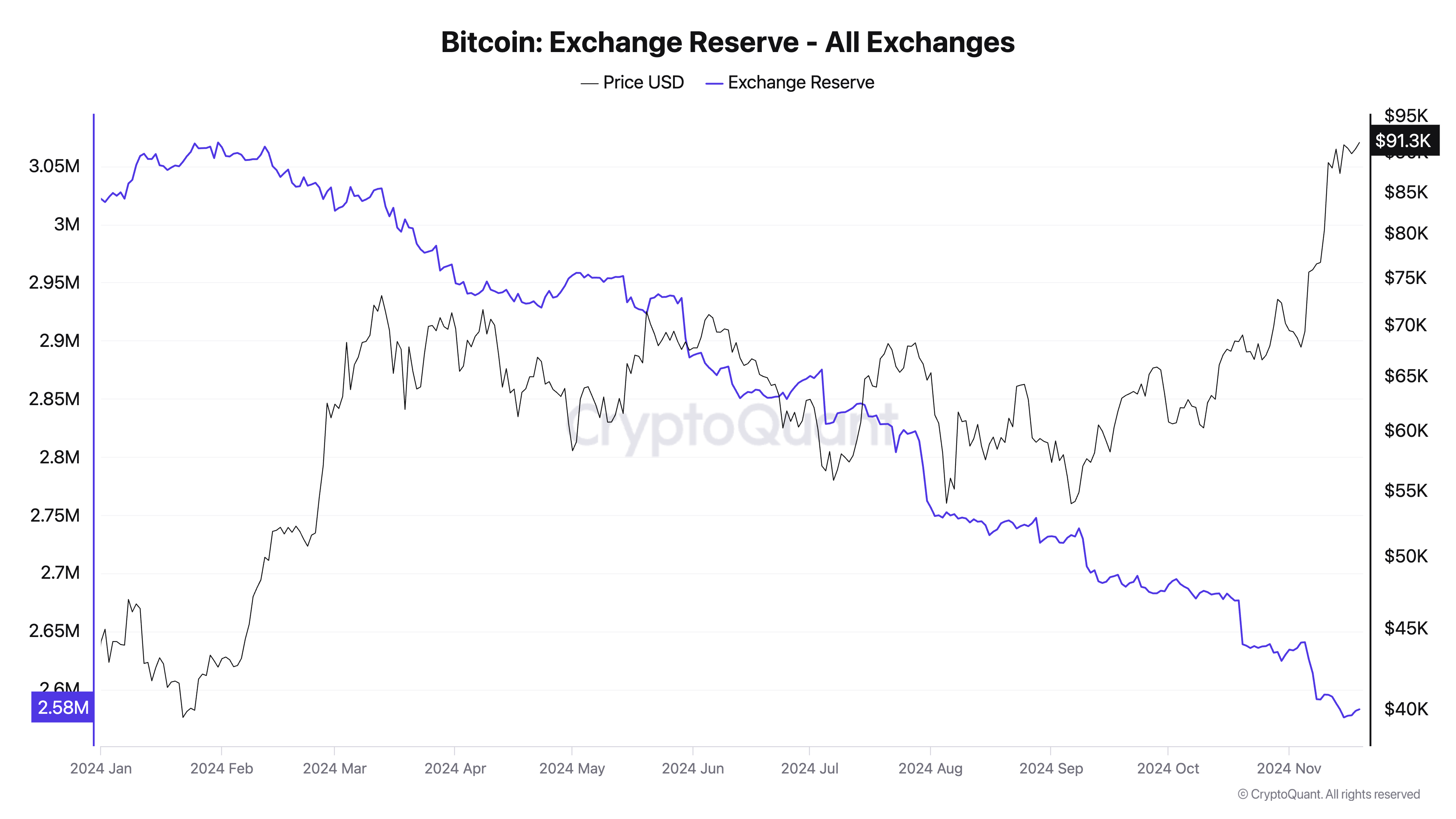

The US presidential election on Nov. 5 had a profound influence in the marketplace, performing as a catalyst for Bitcoin’s surge to its all-time excessive of $93,000. It triggered document buying and selling volumes in each spot and derivatives markets as establishments and retail traders rushed to capitalize on Bitcoin’s rising narrative as a hedge and retailer of worth. These heightened buying and selling actions drove Bitcoin’s value larger whereas stablecoin reserves gathered, additional compressing the ESR.

The all-time low in ESR paired with Bitcoin buying and selling between $90,000 and $92,000 reveals a market in a singular place. A low ESR throughout a interval of value progress reveals a strong demand fueled by substantial capital reserves in stablecoins.

Such an surroundings limits the draw back danger for Bitcoin, because the abundance of stablecoins creates a form of liquidity cushion prepared to soak up any promoting stress. On the similar time, the restricted BTC provide on exchanges exacerbates shortage, pushing costs larger.

Wanting on the modifications over the 12 months, the sharpest drop within the ESR occurred proper after the US elections as Bitcoin entered its most aggressive rally this 12 months. This means that the market was accumulating stablecoins during times of value consolidation earlier within the 12 months and deployed them to buy BTC as quickly as sentiment turned bullish.

The interplay we’ve seen between stablecoin accumulation and rising costs reveals that these reserves have a strategic nature — serving each as a buffer and a progress catalyst.

The implications of this drop in ESR within the coming weeks and months are important.

If ranges proceed to stay low or drop even additional whereas Bitcoin’s value climbs larger, it’ll imply that the market is closely capitalized with dry powder. Below such a state of affairs, we will count on additional steady upward motion.

Nevertheless, we might additionally see a way more aggressive deployment of stablecoins into BTC. Whereas this may profit the market within the brief time period by driving the value larger, it might additionally depart exchanges with diminished stablecoin reserves — resulting in larger volatility sooner or later.

The put up Alternate stablecoin ratio hits document low, fueling Bitcoin surge appeared first on CryptoSlate.