Because the market rebound slows, Bitcoin SV captured some momentum and gaining some floor in opposition to the bears right this moment, August 8. The coin has been up extra than 10% since final month, an enormous benefit available in the market’s hostile surroundings.

Associated Studying

Bitcoin SV is a tough fork of Bitcoin Money which can be a fork of Bitcoin itself. BSV, nonetheless, has traits distinctive to itself, not like its shut cousins that make it extra engaging to companies.

Fixing Actual World Issues With On-Chain Options

President of the Blockchain Affiliation Uganda Reginald Tumusiime mentioned his group’s challenge, the KitePesa, a stablecoin backed by the Ugandan shilling. In accordance with him, a lot of the nations in Subsaharan Africa have been exploring central financial institution digital forex (CBDC) initiatives as a type of forex. This institutional curiosity in blockchain tech and stablecoins are the elements that KitePesa will leverage for additional growth.

The challenge has its deserves. The Ugandan individuals have been switching to digital banking which provides the identical options as conventional banks however with comfort as cell phones turn into increasingly more prevalent. In 2023, prospects of cellular cash suppliers reached 42.9 million with the determine anticipated to rise within the coming many years.

KitePesa will leverage institutional curiosity to construct a dependable blockchain infrastructure that operates and capabilities a lot better than conventional cellular cash networks. With Uganda’s strong regulatory framework concerning funds and the applied sciences concerned, KitePesa has regulatory backing to function in a authorized surroundings.

The challenge will probably be launched on the BSV Blockchain, integrating the considerably native challenge into the worldwide market which can make investments as they see potential in KitePesa.

Continuation Rally May Occur At These Ranges

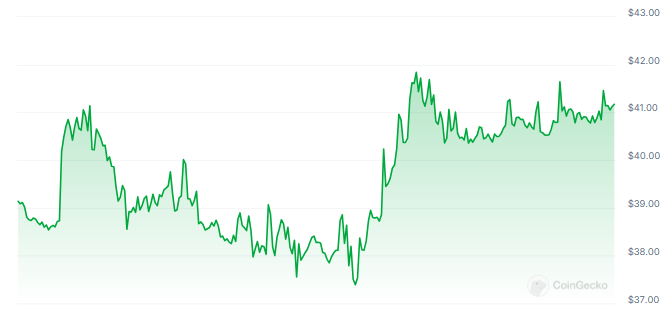

BSV might be confronted with a breakthrough and is trying to settle between $40.29 and $45.30. If the bulls are profitable in taking this place, we’d see additional upward motion within the coming days or perhaps weeks.

Nevertheless, the market nonetheless has its doubts with the whole market cap of the crypto market seeing a measly 0.2% acquire previously 24 hours as Bitcoin and Ethereum get well at a snail’s tempo. In personal fairness, indices, futures, and commodities are experiencing hiccups because the market expects extra volatility forward and after the discharge of a number of macro indicators.

Associated Studying

This can hamper BSV’s brief time period to long-term acquire because the coin strikes with the broader market. The present motion is a part of the outlying group of cryptocurrencies that outpaced the entire crypto market.

If BSV can stabilize on the $40.29-$45.30 worth vary, we’d see a continuation rally in the long run. However this transfer continues to be extremely depending on the broader market’s motion that’s presently grinding to a halt.

Traders and merchants ought to nonetheless deal with BSV with warning as it may be vulnerable to any market swing each upward and downward.

Featured picture from Pexels, chart from TradingView