The previous week has been a triumphant one for Lido DAO, with its LDO token surging a powerful 22%, leaving a sluggish broader crypto market in its mud. This notable feat mirrors the 18% ascent of Ethereum, its underlying blockchain, showcasing a deep synergy between the main liquid staking platform and its technological basis.

However the excellent news doesn’t cease there. A staggering 87% of Lido DAO token holders are reaping the rewards of their funding, in line with information from IntoTheBlock. This strong determine underscores the sturdy efficiency of LDO, attributed largely to its stellar weekly efficiency, because the crypto buying and selling analytics platform famous.

Lido Holders Get Good Returns From Their Funding

Following a powerful value transfer by $LDO this week, ~87% of LDO addresses are actually in revenue. pic.twitter.com/3rLodKvK21

— IntoTheBlock (@intotheblock) January 10, 2024

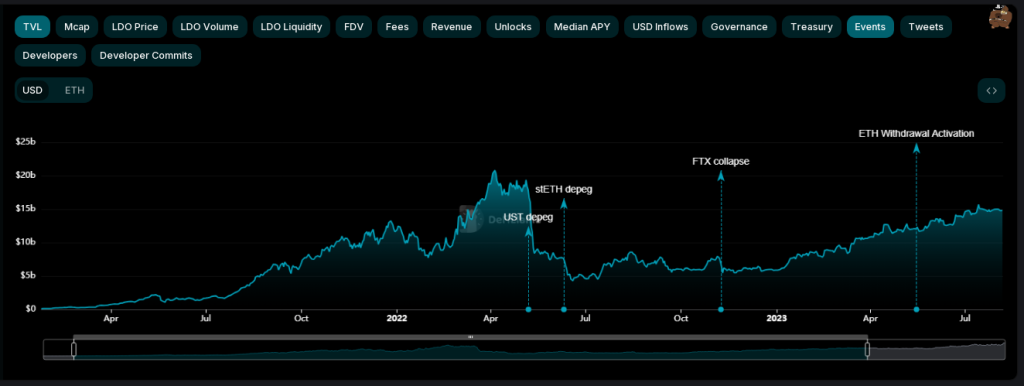

Moreover, Lido’s Complete Worth Locked (TVL), an important metric reflecting the quantity of cryptocurrency deposited in its protocol, has additionally ballooned a outstanding 19% in tandem with the value hike.

Analysts attribute LDO’s ascent to a potent cocktail of things. Firstly, its symbiotic relationship with Ethereum. Because the main good contract platform enjoys renewed momentum, initiatives constructed on its infrastructure – like Lido – relish the rising tide that lifts all boats.

Moreover, Lido’s latest bounce again from a important help degree at $2.80 seems to have ignited a bullish fervor. Technical indicators whisper of a possible retest of the $3.60 resistance barrier, suggesting additional upward potential.

Lido TVL. Supply: Defillama

Including gas to the fireplace is the skyrocketing demand for Ethereum staking. Lido’s user-friendly mannequin permits buyers to earn rewards on their ETH with out locking them up for prolonged intervals, a flexibility that resonates deeply with yield-hungry crypto lovers. This, coupled with Lido’s sturdy platform and confirmed observe file, is attracting new customers at a gentle tempo.

Robust TVL Numbers Put Lido In Rivalry

The surging TVL is a testomony to this burgeoning belief. As extra customers deposit their ETH on Lido, the overall worth locked within the protocol will increase, additional validating its platform and doubtlessly attracting much more individuals. This constructive suggestions loop might propel Lido in direction of solidifying its place because the premier Ethereum staking answer.

LDO market cap at the moment at $3.3 billion. Chart: TradingView.com

Nonetheless, a word of prudent warning stays. Lido’s latest upswing hasn’t been solely natural. The absence of main platform-specific developments raises questions in regards to the rally’s long-term sustainability. Moreover, a big token sale earlier triggered a brief dip, highlighting the potential for volatility.

Technical evaluation additionally means that breaking the $3.60 resistance is essential for continued upward momentum. Failure to take action might result in a pullback, and buyers ought to be ready for such a situation.

In the end, whereas Lido DAO is using a wave of momentum, fueled by its affiliation with Ethereum, its sturdy platform, and the ever-growing demand for liquid staking options, buyers ought to strategy with cautious optimism.

Featured picture from Freepik

Disclaimer: The article is offered for instructional functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site solely at your personal threat.