Blockchain platform Algorand achieved notable features in key metrics in the course of the 12 months’s first quarter (Q1), aligning with the general upward development noticed within the crypto market ecosystem.

Nonetheless, regardless of this development, its native token ALGO skilled a 22% value lower for the reason that starting of Q2, placing a essential assist line to the check and elevating questions in regards to the cryptocurrency’s prospects.

Algorand Income Skyrockets

In keeping with a report by Messari, Algorand’s income witnessed a considerable 1,747% quarter-on-quarter (QoQ) surge, primarily pushed by a 288% improve in transactions and a 50% rise within the common value all through the quarter. The Orange memecoin mission additionally contributed to this development.

In Q1 2024, ALGO’s dedication to governance on the Algorand platform declined by 60% year-on-year (YoY) and three% Quarter-on-Quarter, reaching its lowest stage in a 12 months at 1.7 billion ALGO staked.

Per the report, this downturn may be attributed, at the least partially, to the diminishing governance rewards allotted per governance interval. For instance, governance individuals acquired 68.2 million ALGO in Q1 2023, however this determine dropped considerably to solely 21.9 million ALGO in Q1 2024.

The market cap for stablecoins on the Algorand platform declined 6% QoQ to $73 million. Circle’s USDC market cap on Algorand decreased by roughly 9% QoQ to $50 million.

In distinction, Tether’s USDT stablecoin market cap remained steady throughout the identical interval with no QoQ change, though it recovered 2% of the stablecoin market share.

Consequently, USDC’s market share decreased by 3% to 68% QoQ, whereas USDT’s market share elevated by 2% to embody 30% of Algorand’s complete stablecoin market cap.

Algorand’s DeFi TVL And Market Cap Lead The Pack

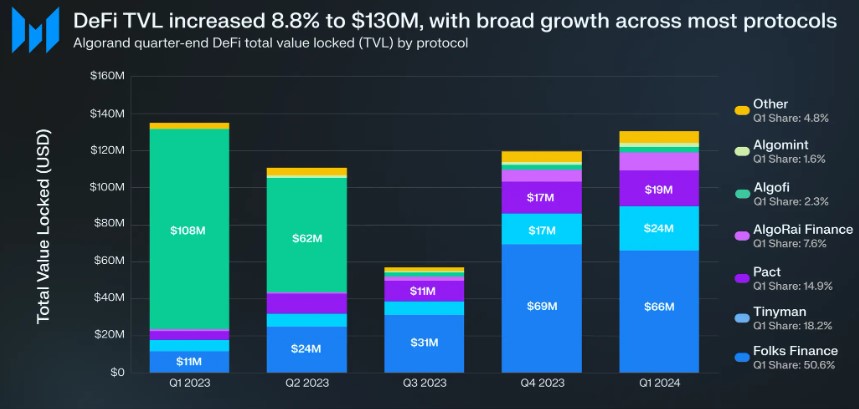

Algorand’s complete decentralized finance (DeFi) complete worth locked (TVL) witnessed development for the second consecutive quarter, rising by 9% QoQ to $130 million.

Though TVL skilled a decline in Q3’23 as a consequence of Algofi’s deprecation, your entire DeFi market on Algorand rebounded and surpassed Q2’23 ranges, practically reaching the degrees seen in Q1’23.

People Finance retained its place as the highest DeFi protocol by TVL on Algorand. Regardless that its TVL fell by 5% QoQ in Q1, it maintained simply over 50% market share.

Pact and Tinyman additionally demonstrated noteworthy features, capturing roughly 15% and 18% of the DeFi TVL market share in Q1. AlgoRai Finance skilled essentially the most substantial development, with a exceptional 53% improve in its TVL QoQ.

Lastly, throughout Q1, Algorand’s market cap expanded by 18% QoQ, reaching $2.1 billion. The worldwide crypto market cap additionally witnessed vital development throughout the identical interval, nearing all-time highs of round $3 trillion, denoting a 50% improve from the earlier quarter.

Though Algorand capitalized on this upward development with an 18% improve in its market cap, it skilled a extra substantial surge of 123% within the previous quarter.

Testing Key Help Ranges

ALGO’s efficiency within the early phases of the second quarter has been predominantly bearish. Presently, the token is buying and selling at $0.1935, with a chance of additional testing the assist line at $0.1904. A breach of this stage might result in a continuation of the decline in direction of the following assist at $0.1789.

On the upside, the $0.1988 zone presents a big resistance stage for ALGO. Notably, the token has tried to surpass this threshold 3 times up to now 10 days with out success.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site completely at your personal danger.