Stablecoin issuer Tether, a outstanding participant within the cryptocurrency market behind the extensively used USDT stablecoin, has launched its audit assertion for the primary quarter of 2024, accompanied by a report carried out by impartial accounting agency BDO.

The report, which supplies extra monetary info past the reserves backing Tether’s fiat-denominated stablecoins, exhibits the corporate’s revenue for the primary quarter of the 12 months, which noticed an elevated inflow of capital into the market.

Tether Q1 2024 Financials Soar

Digging into the numbers, the primary quarter of 2024 proved extremely worthwhile for Tether, with a web revenue of $4.52 billion.

The primary contributors, the entities chargeable for issuing stablecoins and managing reserves, reportedly generated roughly $1 billion of this revenue from web working good points, primarily from US Treasury holdings. The remaining income have been attributable to mark-to-market good points on Bitcoin (BTC) and gold positions.

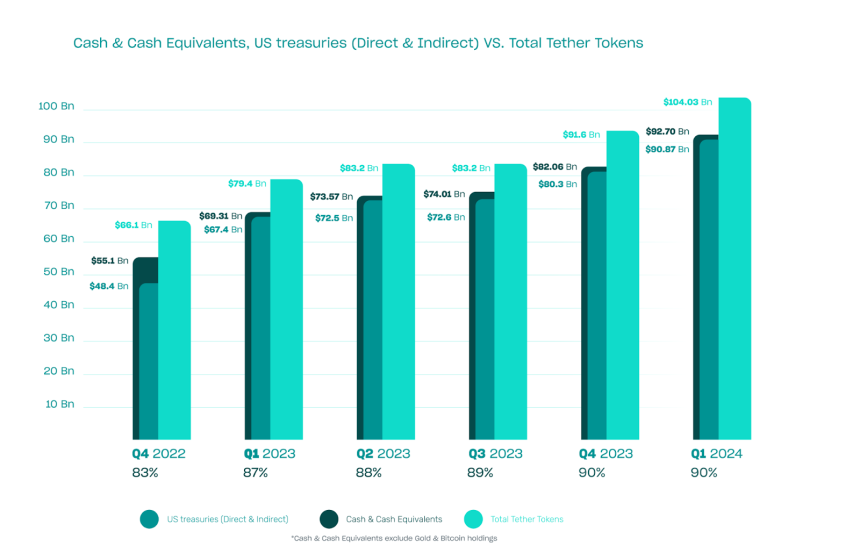

The report additionally highlighted Tether’s success in rising its direct and oblique holdings of US Treasuries to over $90 billion. This consists of oblique publicity by in a single day reverse repurchase agreements collateralized by US Treasuries and investments in US Treasuries by cash market funds.

In an indication of great development, Tether additionally disclosed its web fairness for the primary time, revealing a determine of $11.37 billion as of March 31, 2024. This is a rise from the $7.01 billion fairness reported as of December 31, 2023.

The report additionally highlighted a $1 billion enhance in extra reserves, which help the corporate’s stablecoin choices, bringing the overall to almost $6.3 billion.

CEO Emphasizes Transparency And Stability

The BDO affirmation reiterated that Tether-issued tokens are 90% backed by money and money equivalents, underscoring the corporate’s stance on sustaining liquidity throughout the stablecoin ecosystem. Moreover, the report revealed that over $12.5 billion price of USDT was issued within the first quarter alone.

Tether Group’s strategic investments, which exceed $5 billion as of the report date, span numerous sectors, together with synthetic intelligence (AI) and information, renewable vitality, person-to-person (P2P) communication, and Bitcoin Mining.

In response to the newest report, Paolo Ardoino, CEO of Tether, expressed the corporate’s dedication to transparency, stability, liquidity, and accountable danger administration.

Ardoino highlighted Tether’s record-breaking revenue benchmark of $4.52 billion and the corporate’s efforts to extend transparency and belief throughout the cryptocurrency trade. Ardoino additional claimed:

In reporting not simply the composition of our reserves, however now the Group’s web fairness of $11.37 billion, Tether is once more elevating the bar within the cryptocurrency trade within the realms of transparency and belief.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info offered on this web site solely at your personal danger.