Digital property related to the decentralized finance (DeFi) challenge Abracadabra Finance, together with its Magic Web Cash (MIM) stablecoin, values fell after its crew confirmed an exploit of the platform.

In a Jan. 30 submit on social media platform X (previously Twitter), the challenge’s crew acknowledged an ongoing exploit involving sure Ethereum cauldrons. “Our engineering crew is triaging and investigating the state of affairs,” they added.

Information from CoinMarketCap reveals that the safety incident resulted within the ecosystem’s MIM stablecoin deviating from its $1 peg. The asset’s worth fell to as little as $0.77 earlier than recovering to $0.92 as of press time.

The crew assured that its decentralized autonomous group (DAO) would attempt to assist the stablecoin regain its peg.

“To the most effective of its Potential, the DAO treasury will probably be shopping for again MIM from the market to then burn.” the crew acknowledged.

Equally, the protocol’s SPELL reward token declined 2.43% to $0.00051 as of press time, in line with CryptoSlate information.

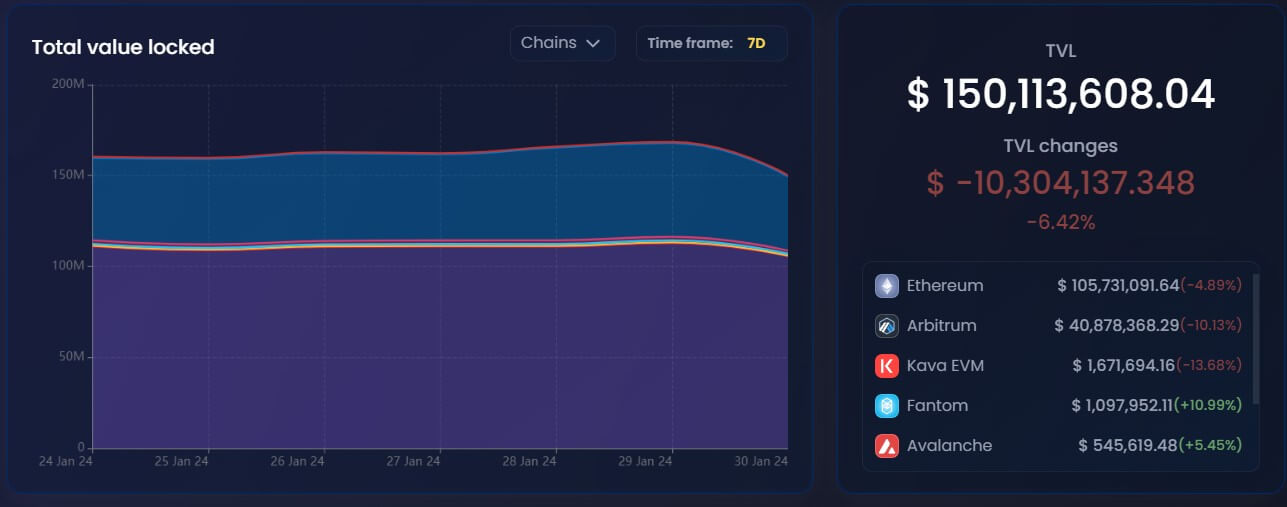

Moreover, the safety incident has quickly dropped the entire worth of property locked on the platform. Information from DeFillama reveals that the protocol’s property below administration quickly fell by round $23 million to $139 million.

Nonetheless, information from Abracadabra’s web site pegs the entire outflow to $10.3 million and its TVL at $150 million as of press time.

Abracadabra Finance is a DeFi lending protocol permitting customers to borrow its Magic Web Cash (MIM) stablecoin utilizing completely different cryptocurrencies as collateral.

$6.5M hack

Blockchain safety agency CertiK advised CryptoSlate that the protocol was exploited for $6.5 million.

In accordance with CertiK, the attacker was funded by way of the crypto-mixing software Twister Money and created an assault contract that exploited a rounding error subject on the platform.

“The exploiter repeatedly known as userBorrowPart() and repay() from the challenge’s V4 Cauldrons with early indications pointing to a rounding subject,” CertiK furthered.

Consequently, the attacker was in a position to siphon $6.5 million in MIM and instantly transformed the stolen property into Ethereum that have been despatched to 2 externally owned addresses,