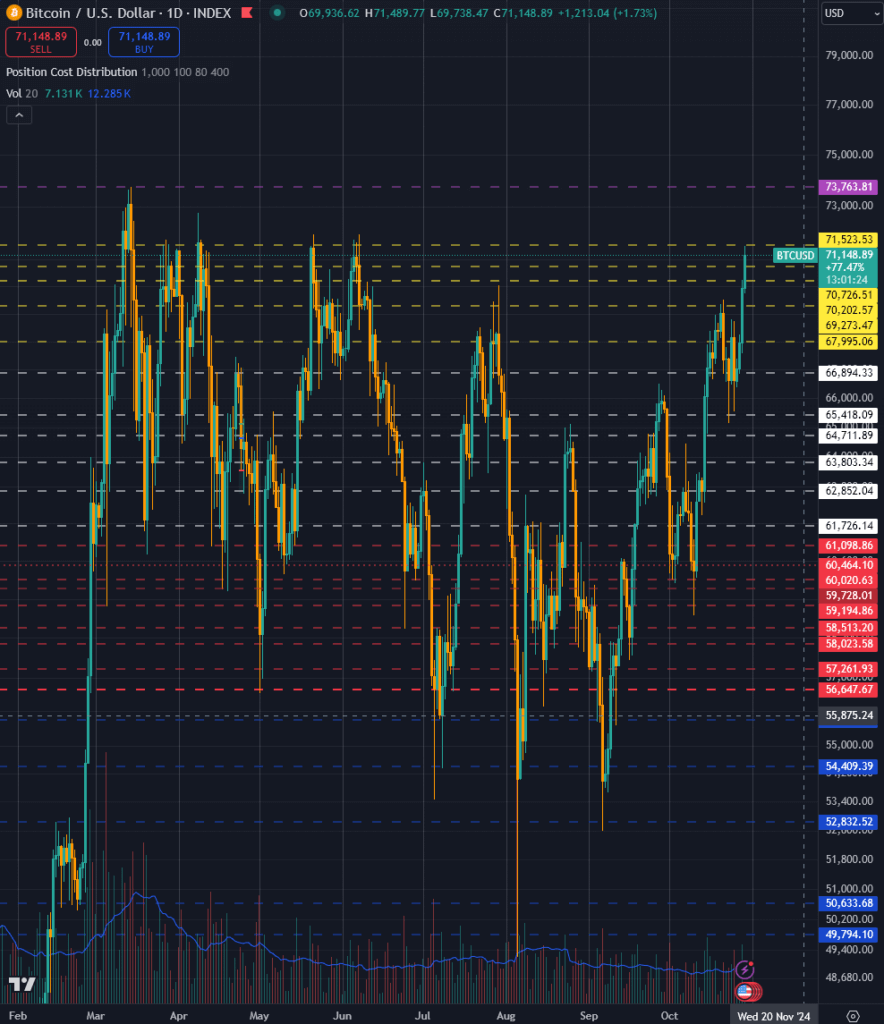

After 9 months of buying and selling inside constant worth channels, Bitcoin is threatening to interrupt out above a brand new all-time excessive and enter true worth discovery. My worth channels have been famous for his or her correlation with key Bitcoin actions via 2024.

Nevertheless, we’ve now hit the highest of my channels for under the sixth time this yr. All however as soon as, Bitcoin retraced from the present worth, and that was after we hit a brand new all-time excessive, indicating we’re both at an area high or a brand new period of worth discovery is earlier than us.

At the moment traded on the high of a core worth channel between $67.9k and $71.5k, Bitcoin will probably be round a worth level it has solely spent a number of days in all through its historical past if it surpasses this key resistance. Between $71.5k and $73.7k, there may be little worth motion to permit analysts to determine affordable assist or resistance.

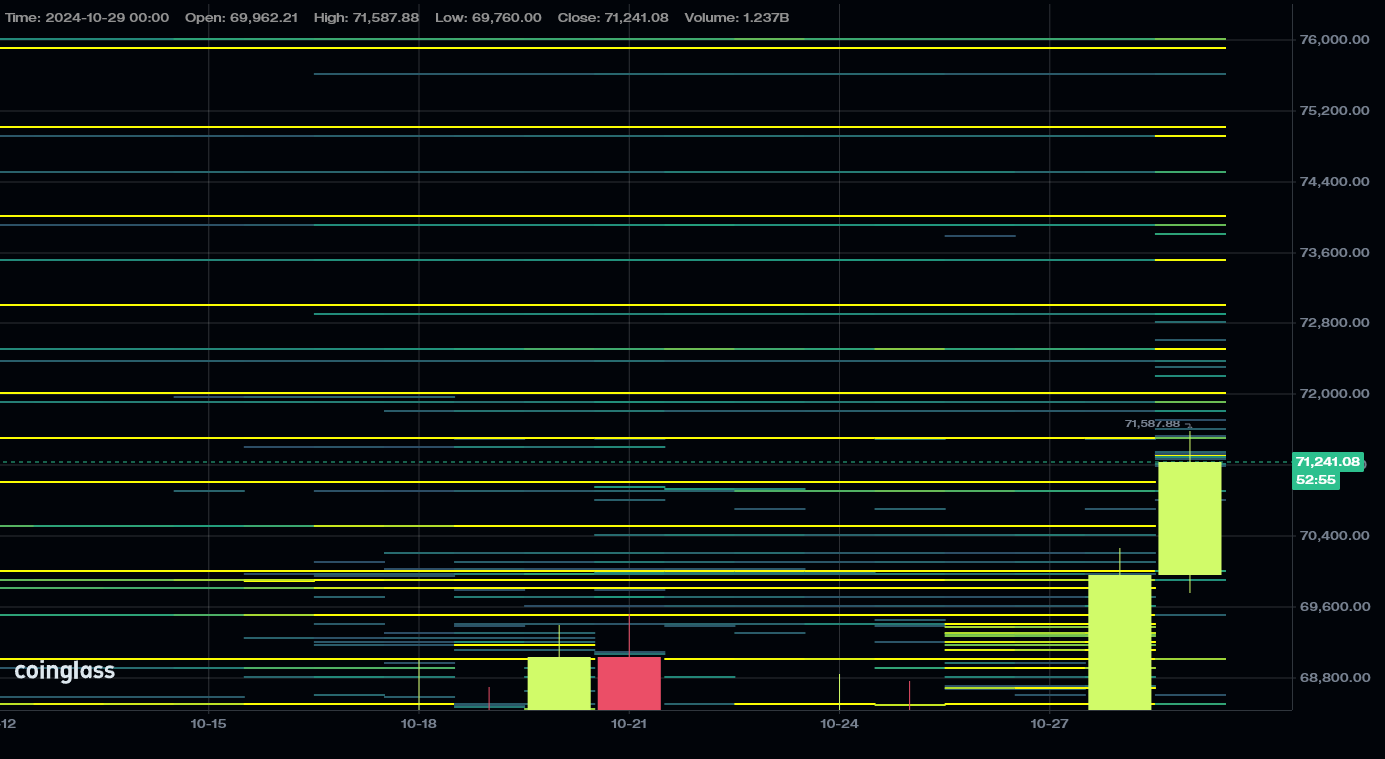

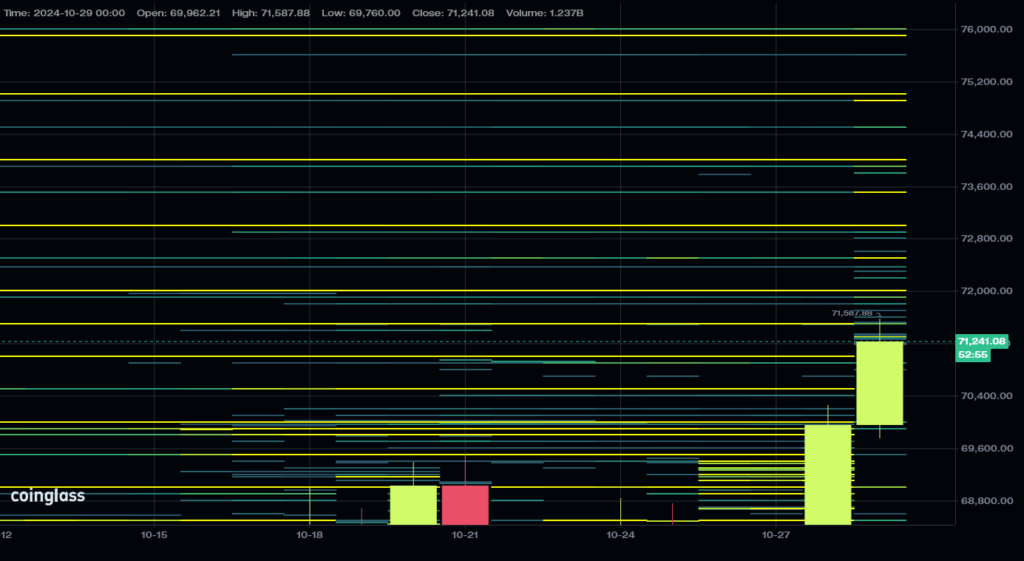

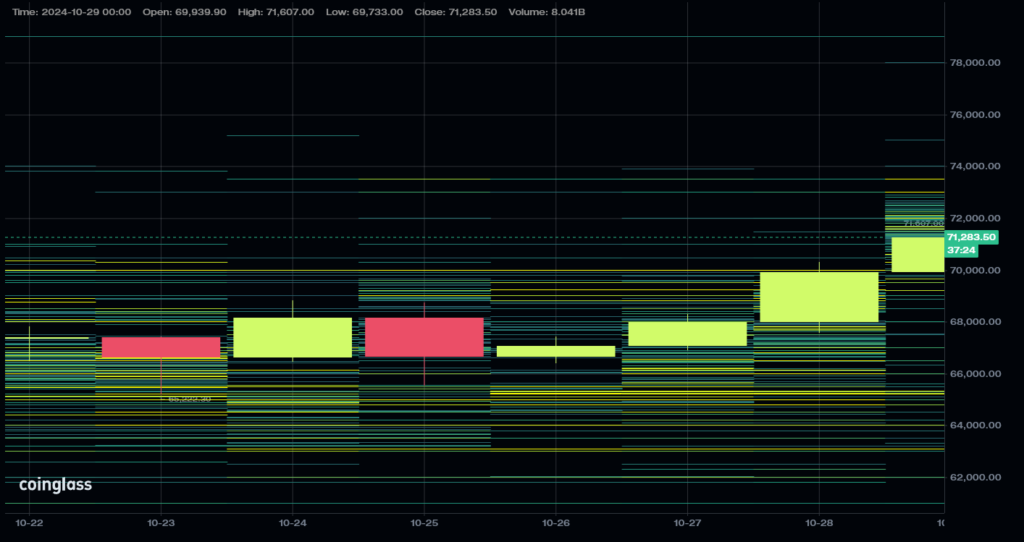

Nevertheless, reviewing the spot order books and spinoff positions does supply some primary insights. Coinglass knowledge reveals a number of notable promote order blocks throughout the order e book throughout main exchanges above the all-time excessive of round $76k. Yellow bars denote cumulative orders on Binance over 200 BTC. These areas may present resistance ought to Bitcoin method these costs.

Apparently, there’s a extreme lack of liquidity for promote orders on perpetual futures markets on Binance above the all-time excessive. This might scale back resistance in futures markets if profit-taking doesn’t instantly happen ought to Bitcoin enter worth discovery. Once more, yellow denotes order values above 200 BTC, with none above $73.7k

Primarily based on present market liquidity and the restricted worth motion above the present worth. The under ranges could also be value contemplating for potential assist and resistance areas ought to Bitcoin proceed its bullish journey.

Word: Historic exercise just isn’t essentially consultant of future market exercise, and market liquidity adjustments from second to second. The value channels introduced on this perception are for instructional and informational functions solely. They don’t predict future costs however merely point out areas the place market liquidity may doubtlessly influence the speed of Bitcoin’s worth.