Aave group members are pushing for a payment swap proposal after the DeFi protocol’s annualized income reached new highs this week.

On June 2, Matthew Graham, a member of the Aave liquidity committee, reported that the protocol was “averaging simply over $80 million in annual income from seven Aave v3 & v2 deployments” throughout numerous blockchain networks, together with Ethereum.

Stani Kulechov, the founding father of Aave, corroborated this milestone, stating:

“Aave DAO is now incomes $115 million annualized. Let that sink in.”

This excessive income will not be sudden, contemplating CryptoSlate just lately reported that Aave was one of many few decentralized purposes most well-liked by crypto customers over conventional blockchain networks.

Consequently, the spectacular earnings have reignited group calls for a payment swap proposal. A payment swap permits a platform to toggle particular person charges on or off, doubtlessly redistributing transaction-generated charges to platform members. Notably, a number of DeFi protocols, together with Uniswap, are considering initiating an initiative for his or her customers.

In the meantime, these calls come greater than a month after Marc Zeller, founding father of the Aave Chain Initiative, steered {that a} payment swap proposal was in growth. Zeller highlighted that the Aave DAO has a considerable revenue margin, offering a monetary cushion for the following 5 years.

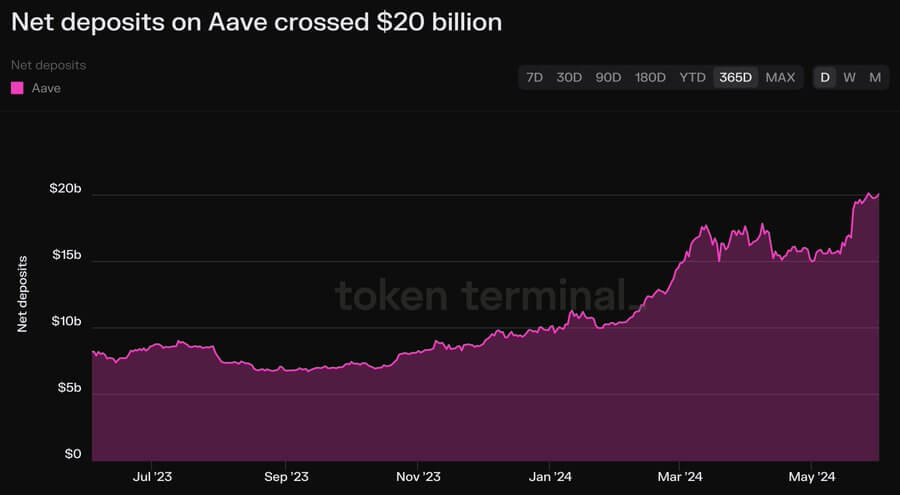

Deposits cross $20 billion.

In keeping with Token Terminal knowledge, the quantity of crypto deposited in Aave has exceeded $20 billion, a degree not seen for the reason that crash of Terra’s UST algorithmic stablecoin in 2022.

Market specialists stated the protocol’s development reveals that the DeFi sector was quickly recovering from the lows of the 2022 bear market that led to the collapse of a number of centralized lenders like Celsius, Genesis, and others. Moreover, they stated the elevated liquidity displays the rising investor curiosity in Ethereum, pushed by the optimism surrounding the ETH exchange-traded fund (ETF) approvals.

In keeping with DeFillama knowledge, Aave is the most important crypto-lending platform within the trade, based totally on the Ethereum community. The platform just lately disclosed plans to introduce a number of key initiatives, together with launching Aave V4, a brand new visible id, and expanded DeFi functionalities for its customers.