The next is a visitor submit from Shane Neagle, Editor In Chief from The Tokenist.

When the Federal Reserve tampered with the cash provide in 2020, by giving it a ~40% increase, everybody has been paying the price of that tampering through inflation. In flip, folks’s life power is siphoned away as their financial savings are eroded. When more cash buys much less, further power must be exerted to maintain the identical tempo.

The answer to this downside is clear. Make cash tamper-proof via decentralization and glued provide. Let nobody lord over it. That’s the preliminary drive behind Bitcoin, however one which wants a important part to work – bodily grounding.

If Bitcoin had been only a digital asset, it will be simpler to change the community’s ledger, often known as blockchain. The elegant treatment for that is proof-of-work mining, which acts as an power barrier tying Bitcoin’s digital code to real-world sources. If a would-be attacker is about on altering the ledger’s report, they might require an exorbitant quantity of power harnessing computational energy.

At 733.41 EH/s (hashrate), such an power barrier is nearly impenetrable. However that signifies that Bitcoin’s power want is the price of having tamper-proof cash. Likewise, power is the price of having knowledge facilities churn out textual content//pictures/movies/codes at any time when folks immediate AI brokers.

In each instances, human productiveness is augmented. However can their power wants be optimized in a symbiotic method?

The Power Dynamics of Bitcoin Mining and AI

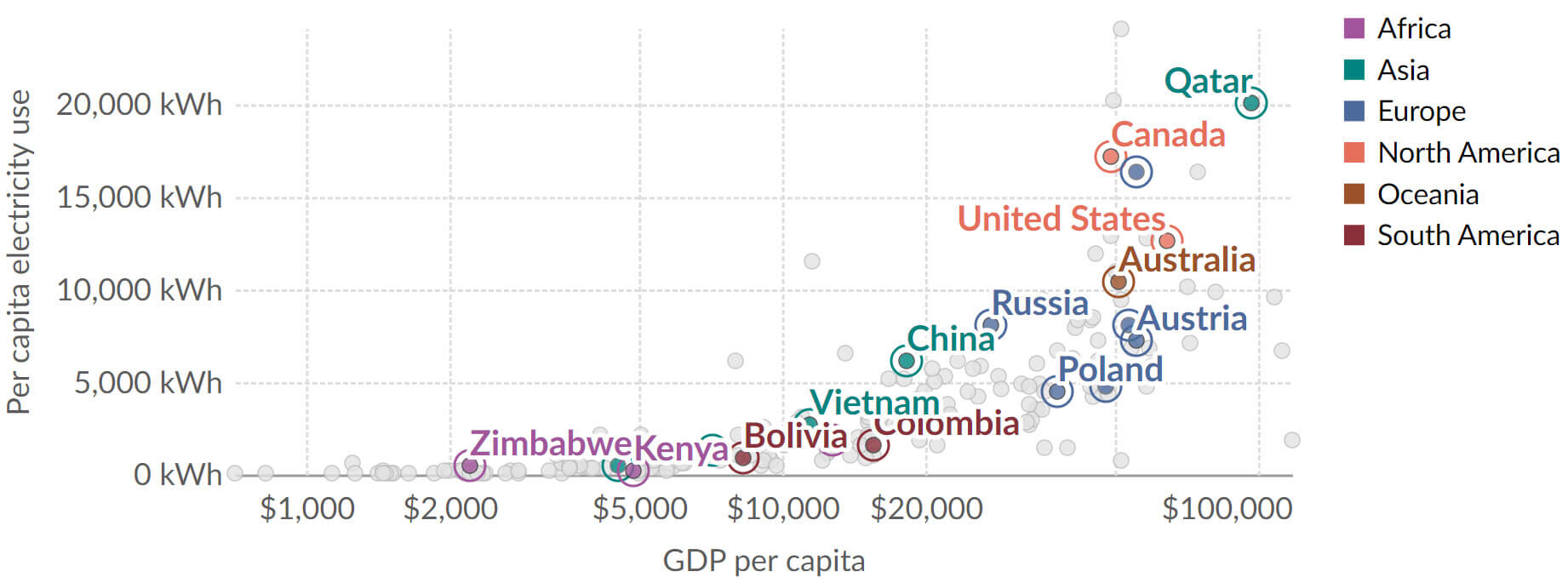

It’s secure to say that being a developed nation is strongly correlated with a excessive power utilization. That is clearly seen if we chart per capita electrical energy era in kilowatt-hours (kWh) towards a nation’s gross home product (GDP).

In different phrases, entry to power extra is a requirement for civilizational development to manifest. In any case, when a number of layers are added to the essential subsistence stage comparable to agriculture, new layers in manufacturing, transportation, public providers, urbanization and computing have to be fed.

Going past mere knowledge facilities for web searching or on-line banking, generative AI and Bitcoin mining symbolize the most recent civilizational layer as high-performance computing (HPC). HPC power wants are exceedingly excessive.

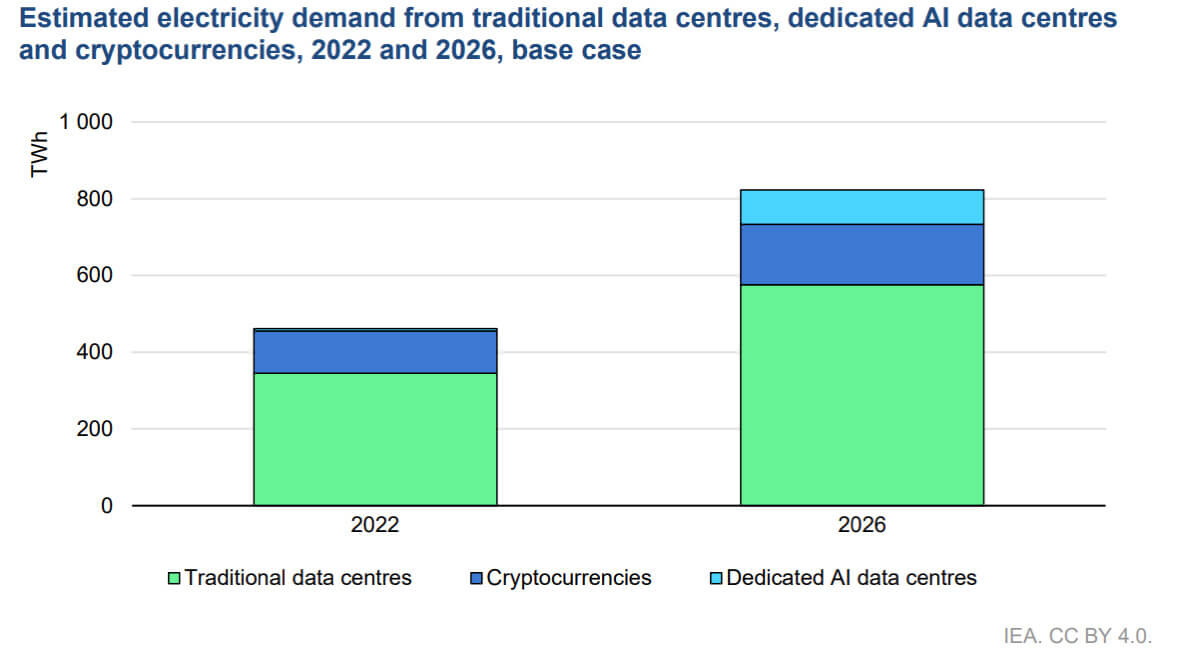

In line with the Division of Power (DoE), knowledge servers already use 10x to 50x extra power (per flooring area) than industrial workplace buildings, whereas accounting for two% of whole US electrical energy utilization. Given rising knowledge heart demand traits, the Worldwide Power Company (IEA) forecasts their whole electrical energy consumption might improve over 1,000 terawatt-hours (TWh) in 2026.

For comparability, such a requirement spike can be the equal to Japan’s current electrical energy consumption. Contrasted to Bitcoin mining, EIA notes that it exerted 130 TWh electrical energy demand.

Goldman Sachs Analysis estimates that AI knowledge heart consumption will exert 200 TWh yearly between 2023 and 2030, given {that a} easy Google search question wants 0.3 watt-hours whereas a single ChatGPT question calls for 2.9 watt-hours of electrical energy.

These traits name for vital optimization efforts. The Bitcoin mining business has repeatedly exerted such efforts by upgrading to extra environment friendly ASIC machines, primarily produced by Bitmain, MicroBT, Canaan, Bitfury, Ebang, and others.

Likewise, superior cooling options considerably scale back power consumption as ASIC rigs can keep decrease working temperatures for longer, decreasing the necessity for cooling energy consumption within the course of. Liquid and immersion cooling is estimated to cut back Bitcoin mining operational bills by as much as 33%.

On the AI power entrance, Nvidia’s GPUs dominate the scene with an estimated 65% market share. Nvidia’s newest Blackwell GPU microarchitecture has purportedly lowered power price by 25x from its predecessor Hopper. As the principle provider to Massive Tech as Mistral, Meta and Apple main the cost with regards to locally-hosted massive language fashions (LLMs), we’re about to see an uptick with regards to GPU server internet hosting and adjoining structure.

Nonetheless, there may be way more to power consumption optimization than updating to raised chips and tweaked cooling. And it’s right here that Bitcoin mining particularly might shine.

The Position of Bitcoin Mining in Power Administration

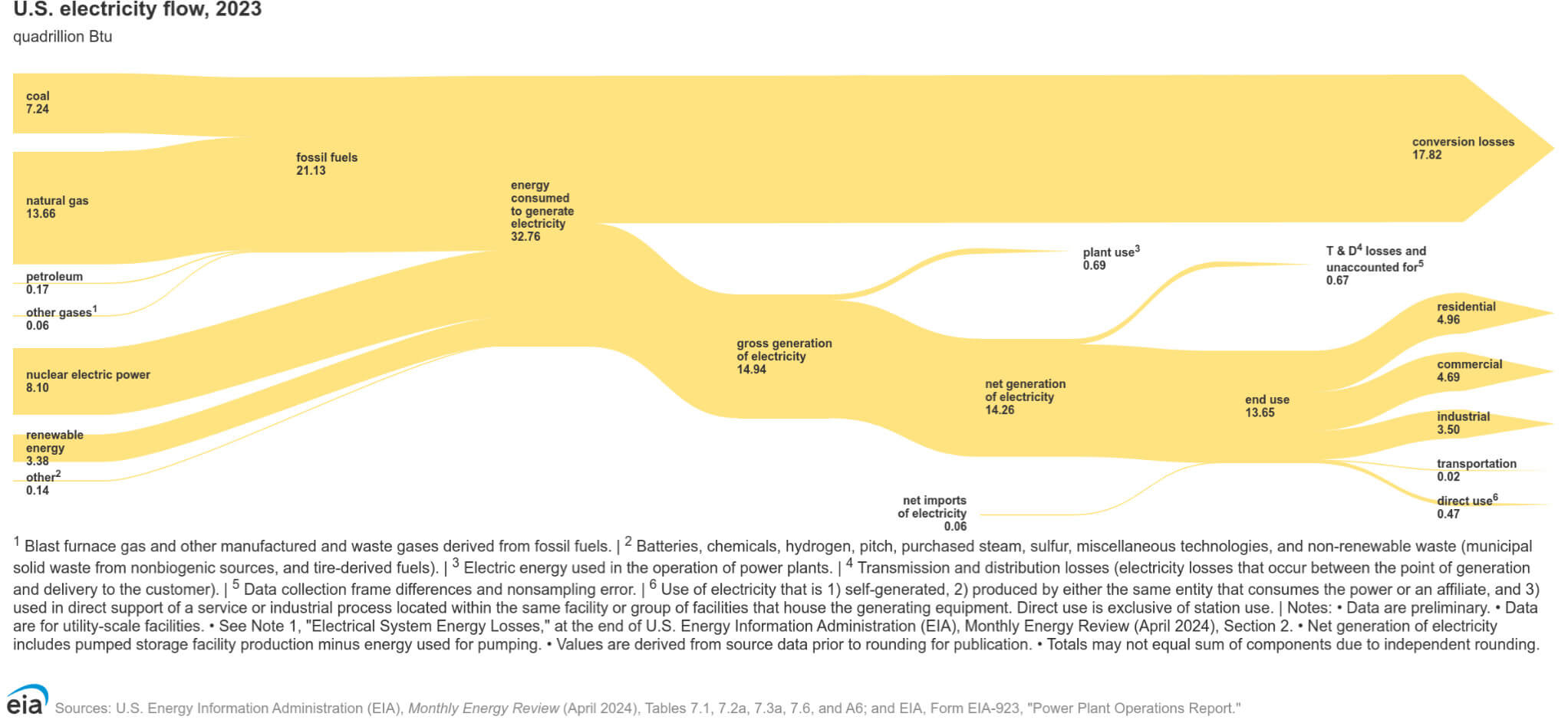

It’s a simplistic concept to suppose {that a} energy plant produces electrical energy, after which that output is acquired by the patron. On that pathway, conversion occurs from high-voltage transmission over lengthy distances to lower-voltage for the end-user.

In different phrases, as the electrical grid must be balanced between excessive outputs and low inputs, it ends in transmission and distribution (T&D) losses, accounting for five% on common, in accordance with EIA.

One option to cope with this balancing act is to depend on power storage, which may match gaps in fast fluctuations between electrical energy demand and provide. Nonetheless, not solely is battery storage excessive in preliminary expenditure price, however the dominant lithium-ion batteries are recognized to have thermal runaway dangers, making them prone to overheating.

The underside line is, no resolution will beat the effectivity of getting nearer to the power supply. Because of this Bitcoin mining agency TeraWulf (Nasdaq: WULF) picked Nautilus Cryptomine as its important facility near the two.5 GW Susquehanna nuclear energy plant in Berwick, Pennsylvania.

Drawing 300 MW straight from the plant, TeraWulf is positioning itself as essentially the most environment friendly Bitcoin mining operation at 2 cents per kWh of zero-carbon power.

Extra importantly, Bitcoin mining can assist the steadiness of electrical grids by performing as a dispatchable load. As a result of HPC lends itself to excessive power consumption, this interprets to real-time changes of masses, leveling out the fluctuations in power provide and demand.

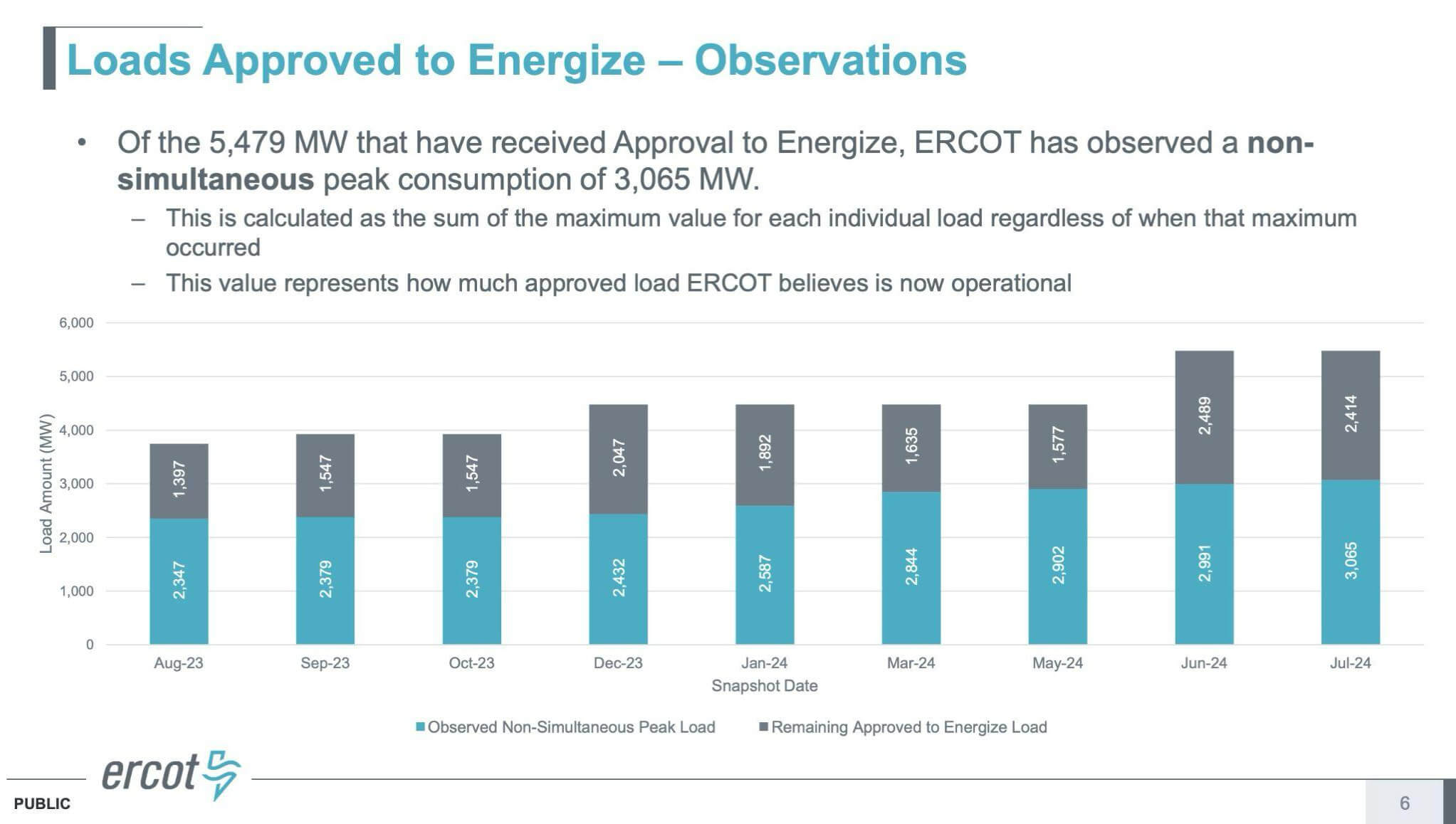

As of July 2024, Electrical Reliability Council of Texas (ERCOT) reported 3 GW price of energy out of 5.5 GW for Bitcoin miners’ load dispatching.

Not solely does load dispatching present an off/on ramp, relying on native deficit or surplus of energy, however Bitcoin mining corporations are incentivized to take action as they begin reporting energy gross sales.

In flip, this injects one other safety ingredient into Bitcoin as tamper-proof cash. As a result of Bitcoin mining corporations can offset their prices throughout BTC selloffs by curbing operations, they will obtain compensation for taking part in their half in balancing the electrical grid. Living proof, Riot Platforms (Nasdaq: RIOT) acquired $2.2 million from ERCOT’s demand response credit in January 2024.

In a extra direct approach, Bitcoin miners also can seize stranded power through the use of up flared gasoline burned in oil and gasoline fields, or funnel/recycle warmth produced by BTC mining to warmth water or greenhouses.

AI and Excessive-Efficiency Computing (HPC) Integration

Thus far, now we have seen that:

- Each AI and Bitcoin mining are energy-intensive.

- Electrical grids have friction as a perform of distribution and cargo balancing.

- Bitcoin mining can decrease that friction.

However can Bitcoin mining additionally combine with AI knowledge facilities?

Though each are underneath the high-performance computing (HPC) umbrella, AI providers demand low interruptibility. The success of current and future AI apps rides on their uptime/response time, making knowledge facilities unsuitable for deploying the identical versatile load-dispatching technique as Bitcoin mining companies.

On the similar time, Bitcoin mining corporations have a confirmed observe report of innovation, harnessing steady hydro/nuclear energy and scaling their operations. And as AI-dedicated knowledge facilities put stress on the electrical grid, miners’ versatile load following can quickly reply to their drain.

Alongside ERCOT, extra states are beginning to see this dynamic. On the finish of Could, Oklahoma Home launched invoice HB1600 that will give tax credit score eligibility to digital asset mining operations, with a particular provision for load balancing.

“The mining should happen in a certified colocation facility with a load discount settlement with its retail electrical provider.”

To that impact, extra Bitcoin mining corporations are transferring to host AI operations in a direct method.

Hybrid Information Middle Methods

Regardless of catering to totally different HPC features, Bitcoin mining services are ideally suited to host AI operations as properly. Not solely have they got veteran personnel, however they emerged from an exceedingly aggressive atmosphere courtesy of Bitcoin’s mining problem and halvings.

It’s then no marvel {that a} transition from pure-play Bitcoin mining into hybrid knowledge heart enterprise is already underneath approach. Australian Iris Power (Nasdaq: IREN) introduced a partnership with WEKA final October to supply each storage and GPU-stacks for generative AI.

Bernstein analysts lately forecasted that Iris will shift 15% of its energy capability to AI knowledge facilities. In June, previously bankrupt Core Scientific (Nasdaq: CORZ) initiated the identical co-hosting mannequin after its chapter restructuring. The corporate signed a 12-year contract with AI startup CoreWeave to harness 200 MW of its energy capability for AI HPC operations.

Throughout that interval, Core Scientific is anticipated to generate $3.5 billion in income, on prime of its Bitcoin mining operations which depend on BTC’s spot worth. As soon as once more, such hybrid methods increase Bitcoin’s backside line.

If extra Bitcoin corporations are much less prone to go bankrupt throughout bear markets, by leveraging AI knowledge heart enterprise, the much less stress is there for BTC selloffs. In flip, sound cash will get sounder by the 12 months. Long run, it’s not troublesome to see the trajectory. A hybrid knowledge heart will be capable to assist corporations handle digital belongings on one hand, whereas being on the coronary heart of sound cash on the opposite.

Conclusion

Buoyed by the promise of cognitive automation, the world’s financial system is receiving one other layer on prime of the digital, the high-performance computing (HPC) layer.

Simply as Bitcoin tamper-proofs cash with its huge energy-harnessing HPC infrastructure, AI knowledge facilities are paving the street for brand spanking new jobs and productiveness spikes. Their convergence is inevitable as well-honed Bitcoin mining operations increase into GPU stacks alongside ASIC stacks.

By doing so, they create a suggestions loop of incentives. Bitcoin miners’ extra power capability funnels into load response credit and energy-hungry AI companies. Mixed with AI brokers able to making autonomous BTC microtransactions, the synergy creates an thrilling starting of hyperbitcoinization.