The expansion of DeFi is a serious affect over the web3 ecosystem. As a matter of reality, it is among the fashionable instruments for encouraging the adoption of blockchain expertise. On the identical time, it’s also necessary to notice that bear markets are a serious risk to cryptocurrency and DeFi markets. You would possibly seek for solutions to “What’s bear market DeFi?” and its implications for understanding their affect.

Crypto and DeFi bear markets may scale back portfolio worth. Most necessary of all, bear markets even have the tendency to last more than the expectations of customers. Nevertheless, the great factor for traders within the bear market is the chance for re-focusing and spending time on analysis for tasks that would achieve momentum in bullish markets.

The continual growth of the DeFi and crypto market results in the inevitable incidence of bear markets. The bear market definition finance programs put ahead within the 2022-23 market point out the detrimental affect of bear markets. With the formidable value drops in main cryptocurrencies, akin to Ethereum and Bitcoin, bear markets can result in losses for traders.

Then again, it’s also necessary to know that the downward traits would attain the bottom level earlier than the bull market begins. Skilled crypto traders may monitor the necessary metrics and indicators that may information them towards the following Bull Run. Allow us to study extra in regards to the high DeFi metrics that may assist traders in a bear market.

Wish to perceive what’s the scope and goal of DeFi? Enroll now within the Introduction to DeFi Course

What’s the Necessity of DeFi Metrics in Bear Markets?

The significance of DeFi metrics in bear market may assist in understanding their function in driving traders towards higher selections. Metrics may assist traders and analysts establish the start of a strong and efficient cycle. The frequent highlights that decide the effectiveness of DeFi tasks in bear markets embody technical components, on-chain exercise, and provide dynamics. On high of it, the revenue/loss metrics may additionally present an in depth impression of the effectiveness of DeFi tasks.

The technical points of a DeFi challenge level in the direction of its efficiency in response to fashionable technical benchmarking instruments. Then again, on-chain exercise may showcase the optimistic traits in community utilization and on-chain exercise. Moreover, provide dynamics may additionally assist in figuring out the saturation of coin provide within the possession of long-term homeowners. The bear marketplace for DeFi has been characterised by radical drops in costs of native tokens of DeFi tasks. As well as, it’s also necessary to study in regards to the metrics for DeFi market that may assist in figuring out when the following bull market would occur.

Enroll now within the DeFi Improvement Course to study in regards to the functionalities of automated market makers and liquidity swimming pools in DeFi options.

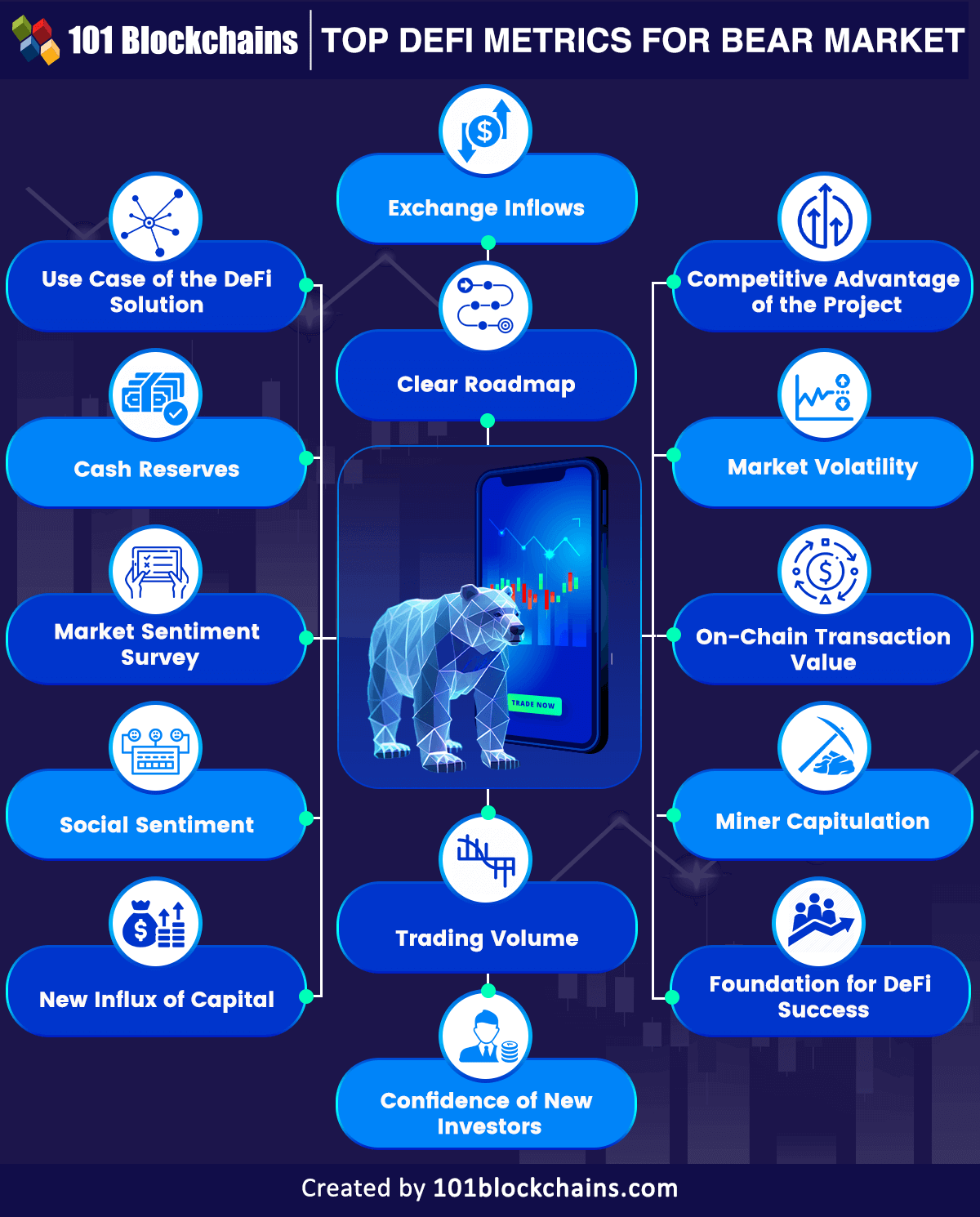

Prime DeFi Metrics for Bear Market

The first purpose for utilizing DeFi metrics in a bear market is the chance to spend money on the suitable tasks that would carry out nicely in bullish market circumstances. What are the very best DeFi metrics in bear market circumstances? Right here is an overview of the highest DeFi metrics that would make it easier to by way of a bear market.

-

Use Case of the DeFi Answer

The DeFi sector has many tasks that promise enormous returns and have protocols with a number of gimmicks. Nevertheless, just a few tasks have efficiently delivered merchandise which have excessive demand and ship efficient utility. One of the vital necessary bear market definition finance sector has put ahead is the impression of failing tasks. Then again, you should utilize a very powerful metric for DeFi tasks to find out their effectiveness in bear markets. No matter the market circumstances, DeFi options can stand up to the downward traits if they’ve a confirmed utility.

You must decide whether or not the DeFi challenge has some type of utility. You will need to search for DeFi tasks that resolve a urgent concern. DeFi tasks with a confirmed utility may stand the check of time in any market situation and will put together for long-term survival.

The following metric required for evaluating DeFi options in a bear market is the alternate inflows. The movement of native DeFi tokens transferred on exchanges can present a transparent impression of investor sentiment. You’ll find solutions to “What’s bear market DeFi?” by checking how the native tokens carry out on completely different exchanges. The rising inflows would imply that traders need to promote their tokens as a result of bearish sentiment. Then again, declining alternate inflows may suggest that asset holders need long-term storage, thereby suggesting that the bear market is declining.

Construct your identification as an authorized blockchain skilled with 101 Blockchains’ Blockchain Certifications designed to offer enhanced profession prospects.

-

Aggressive Benefit of the Challenge

The utility of a DeFi challenge just isn’t the one factor that may assure its survival in a bear market. Nevertheless, the easiest way to know bear marketplace for DeFi would contain a research of the distinctive benefits delivered by the challenge. You will need to learn how the protocol performs compared to different tasks which provide options for a similar downside.

Does the DeFi challenge provide easier or higher options than rivals? For instance, DeFi oracles have develop into one of many frequent entries amongst new protocols within the DeFi market. Nevertheless, customers are probably to decide on the oldest and most prominently built-in Oracle resolution or Chainlink, which is among the strongest rivals.

The record of indicators for checking the efficiency of DeFi tasks in bear market additionally contains money reserves. Each DeFi challenge will need to have a treasury that would assist it survive the downward traits within the bear market. Money reserves are an necessary metric for DeFi tasks, which offer yield on locked belongings that may encourage liquidity.

The DeFi metrics in bear market would additionally level to the function of money reserves for acquiring enough liquidity for surviving an prolonged bear market. You must search for a DeFi challenge that has an enormous treasury that includes various kinds of belongings akin to Bitcoin, Ether, and different stablecoins akin to Tether and USD Coin.

The large, diversified, and well-funded treasury may assist in pulling the DeFi tasks by way of robust instances. DeFi tasks ought to study when they need to take earnings and mustn’t use one token for majority of the protocol’s treasury.

Wish to discover in-depth about DeFi protocol and its use circumstances? Enroll now within the DeFi Intermediate Stage Course

One of the vital distinguished strategies for figuring out the effectiveness of DeFi tasks in a bear market is the roadmap. A DeFi challenge doesn’t have an opportunity at success simply because it has a transparent roadmap. You must know that previous efficiency doesn’t present an indicator of future outcomes.

Nevertheless, a DeFi challenge should persistently comply with its roadmap and meet necessary deadlines. The efficiency of a DeFi challenge in fulfilling its roadmap may make it easier to establish the way it can endure robust instances. You would use instruments for monitoring the frequency of developer exercise on DeFi protocols. If the challenge doesn’t preserve consistency in fulfilling the roadmap deadlines, then it is perhaps a rug-pull challenge.

You’ll find excessive ranges of volatility in a bear marketplace for DeFi and crypto tasks. Costs go on a downward pattern, and volatility reaches peak ranges in the course of the bear market. Stabilization and decline of volatility readings in a bear market would suggest that the bear market is steadily easing. As well as, it additionally offers a trusted indicator that reveals how markets are embracing help mechanisms to facilitate restoration.

Are you aspiring to construct your profession in decentralized finance? Take a look at presentation on Learn how to Kickstart Profession in DeFi now

Essentially the most essential metric within the area of DeFi factors to the sentiment in regards to the challenge in a market. You should utilize large-scale surveys to study extra in regards to the inclination of traders and specialists about DeFi tasks. Sentiments that would point out worry level on the downward traits, and enchancment in optimism may help restoration from bear markets.

-

On-Chain Transaction Worth

The define of finest DeFi metrics in bear market would level on the on-chain transaction worth. With the full USD worth of transactions on a DeFi resolution, you’ll be able to monitor the token velocity and total community utilization. Development of on-chain transaction values following a bear market reveals that the challenge has been performing successfully for natural adoption.

The social sentiment round a DeFi challenge would additionally function an necessary metric for bear markets. Investor psychology additionally performs a serious function in defining the best way a DeFi market works in bear circumstances. You’ll be able to observe social media posts and communities to acquire insights about crowd sentiment for DeFi tasks. You will need to examine whether or not the social sentiment a couple of DeFi challenge can shift from worry and anticipation in the direction of optimistic traits.

Wish to discover an in-depth understanding of safety threats in DeFi tasks? Enroll now in DeFi Safety Fundamentals Course

The buying and selling quantity of DeFi tasks additionally serves as a distinguished DeFi metrics in bear market with an impression of its effectiveness. Greater buying and selling volumes point out that the challenge has been gaining engagement. Then again, it additionally implies that market contributors have been showcasing curiosity within the DeFi challenge. DeFi tasks with stronger buying and selling exercise may suggest extra conviction.

Then again, unstable buying and selling quantity may suggest that the challenge has been falling prey to the bear market. Additionally it is necessary to assessment the bear marketplace for DeFi tasks on the idea of derivatives exercise. A rise in derivatives buying and selling exercise may suggest that the DeFi challenge has ready for the tip of a bear market.

You can even seek advice from miner capitulation as an necessary metric for DeFi tasks throughout a bear market. For instance, Bitcoin miners may cease their operations after they face a decline in profitability. Due to this fact, all-time lows for hash price and rebound in mining exercise counsel that miners look ahead to the state of affairs of restoration.

Crucial metric for a bear market definition finance tasks may present in a time of restoration is the inflow of capital. You must discover that on-chain evaluation offers an estimate of the analysis of realized revenue and loss. It’s a distinction within the worth of cash at disposal, as in comparison with the worth in the course of the time of acquisition.

The ratio of realized revenue to loss can provide oscillator monitoring to show whether or not the combination quantity of realized earnings can surpass the quantity of realized losses. The ratio of realized revenue to loss may assist in figuring out bigger macro shifts within the profitability of DeFi markets. As well as, the volatility of markets may result in false positives. Nevertheless, they are often accounted for within the large-scale shifts within the DeFi market.

-

Basis for DeFi Success

The inspiration for a DeFi challenge additionally serves as an important metric in bear markets. A DeFi challenge may set up a strong basis for a bear market when a bigger quantity of provide ought to be exchanged at decrease costs. The pattern implies the expulsion of sellers alongside an equal inflow of recent accumulation demand. One of many earliest indicators, akin to macro pattern reversal in sturdy foundations, emerges within the type of sharp modifications within the share of the full provide in revenue. Curiously, the pattern is triggered by a comparatively small enhance in pricing.

-

Confidence of New Traders

Crucial addition among the many finest DeFi metrics in bear market factors to confidence of recent traders within the restoration pattern. Remark of the spending patterns of recent traders may assist in showcasing the arrogance of recent traders in DeFi tasks. One of many sensible strategies for evaluating the metric for confidence of recent traders is the comparability between the values of unrealized earnings in newly acquired and HODLed cash and the revenue realized from spent cash. In easy phrases, the metric would consider the distinction between price foundation of short-term holders which might be spending and those which might be holding.

Atone for the most recent traits in DeFi and its connection to crypto with Decentralized Finance Talent Path

Conclusion

The bear market within the DeFi sector has created an atmosphere of uncertainty for traders. Nevertheless, complete analysis and cautious choice of DeFi metrics in bear market may assist in discovering the perfect methods to navigate the DeFi market. You will need to search for the DeFi tasks which have been gaining the eye of recent traders, have a transparent roadmap, and fulfill necessary deadlines.

As well as, you will need to additionally take a look at the metrics akin to buying and selling quantity and on-chain transaction quantity. On high of it, it’s also possible to make the most of metrics akin to social sentiment and market sentiment for DeFi tasks in bear markets. Be taught extra about DeFi and discover out the very best practices for locating your manner by way of a bear market situation.

*Disclaimer: The article shouldn’t be taken as, and isn’t meant to offer any funding recommendation. Claims made on this article don’t represent funding recommendation and shouldn’t be taken as such. 101 Blockchains shall not be answerable for any loss sustained by any one who depends on this text. Do your individual analysis!