Welcome to this week’s publication of the Market’s Compass Developed Markets Nation (DMC) ETF Examine #475. As all the time it highlights the technical modifications of the 22 DM Nation ETFs that I observe on a weekly foundation and publish each third week, There are three ETF Research that embrace the Market’s Compass US Index and Sector (USIS) ETF Examine, the Developed Markets Nation (DMC) ETF Examine and the Rising Markets Nation (EMC) ETF Examine. The three Research are usually printed each three weeks and despatched to paid subscriber’s electronic mail. There’s now a Weekly publication that’s despatched to paid subscribers each Sunday titled The Market’s Compass Crypto Candy Sixteen Examine that tracks the technical situation of sixteen of the bigger cap Cryptocurrencies that additionally makes use of (just like the ETF Research) an goal technical rating mannequin amongst different measures together with relative energy and my most popular technical evaluation instruments.

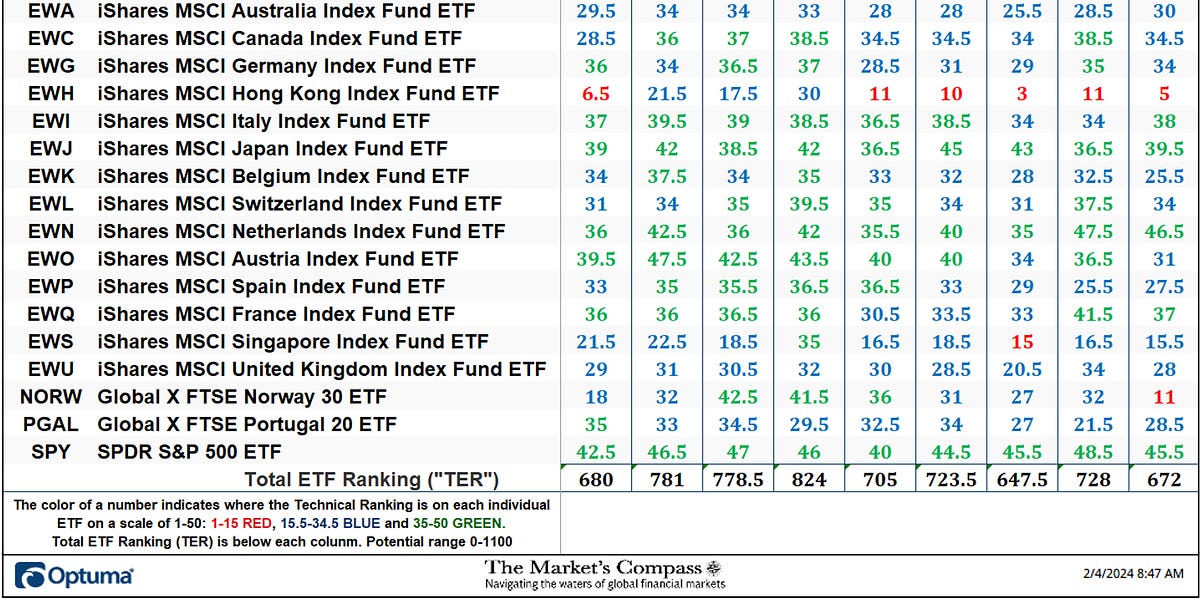

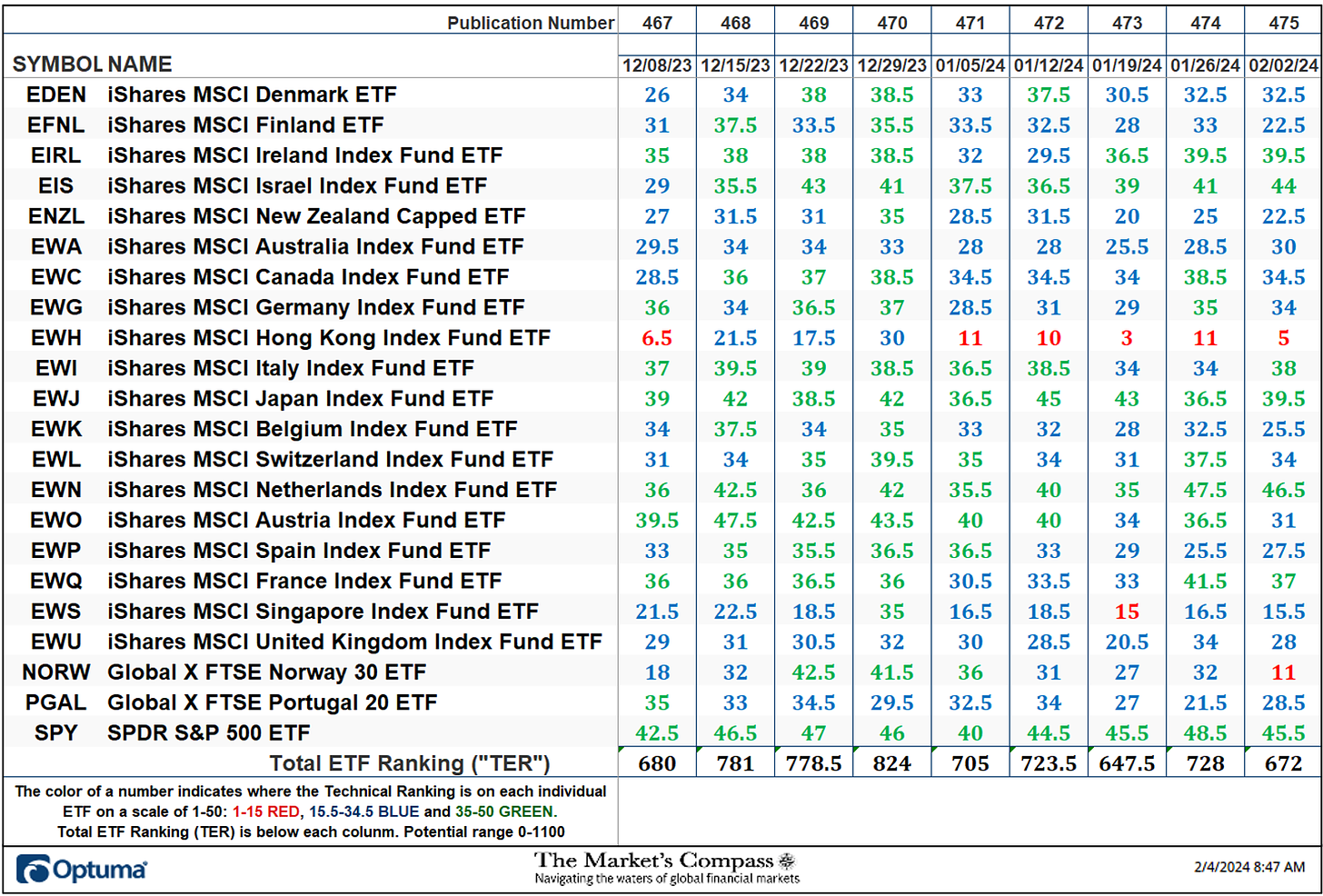

The Excel spreadsheet beneath signifies the weekly change within the goal Technical Rating (“TR”) of every particular person ETF. The technical rating or scoring system is a wholly quantitative strategy that makes use of a number of technical issues that embrace however aren’t restricted to development, momentum, measurements of accumulation/distribution and relative energy. If a person ETFs technical situation improves the Technical Rating (“TR”) rises and conversely if the technical situation continues to deteriorate the “TR” falls. The “TR” of every particular person ETF ranges from 0 to 50. The first take-away from this unfold sheet ought to be the development of the person “TRs” both the continued enchancment or deterioration, in addition to a change in course. Secondarily a really low rating can sign an oversold situation and conversely a continued very excessive quantity might be considered as an overbought situation however with due warning, over offered circumstances can proceed at apace and overbought securities which have exhibited extraordinary momentum can simply turn into extra overbought. A sustained development change must unfold within the particular person TR for it to be actionable.

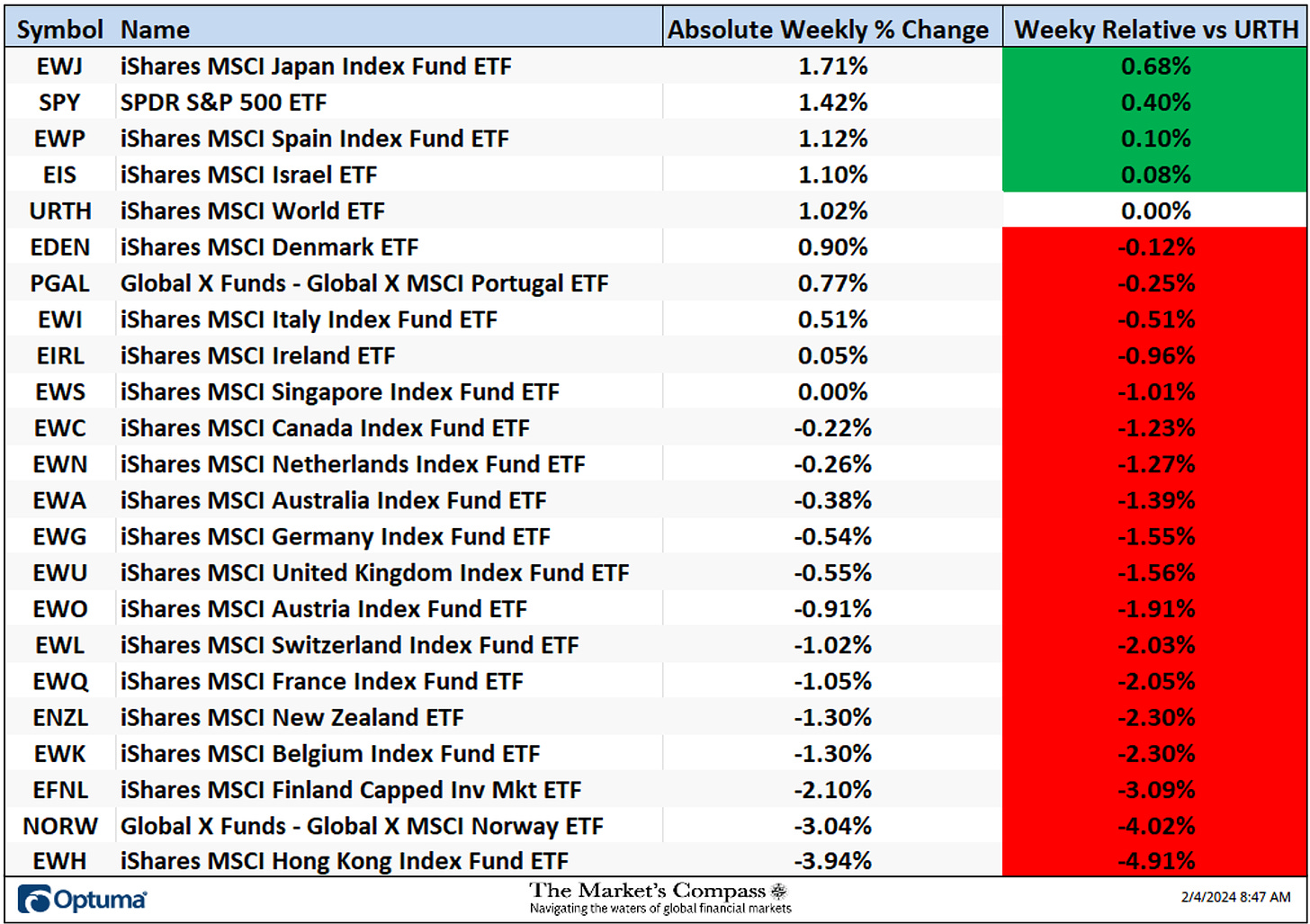

On a WoW foundation the Whole Developed Markets ETF Rating (“TER”) fell -7.69% to 672 from 728 the earlier week. Six weeks in the past, the TER had risen to 824 for the week ending December twenty ninth which was the best TER studying since January of final 12 months.

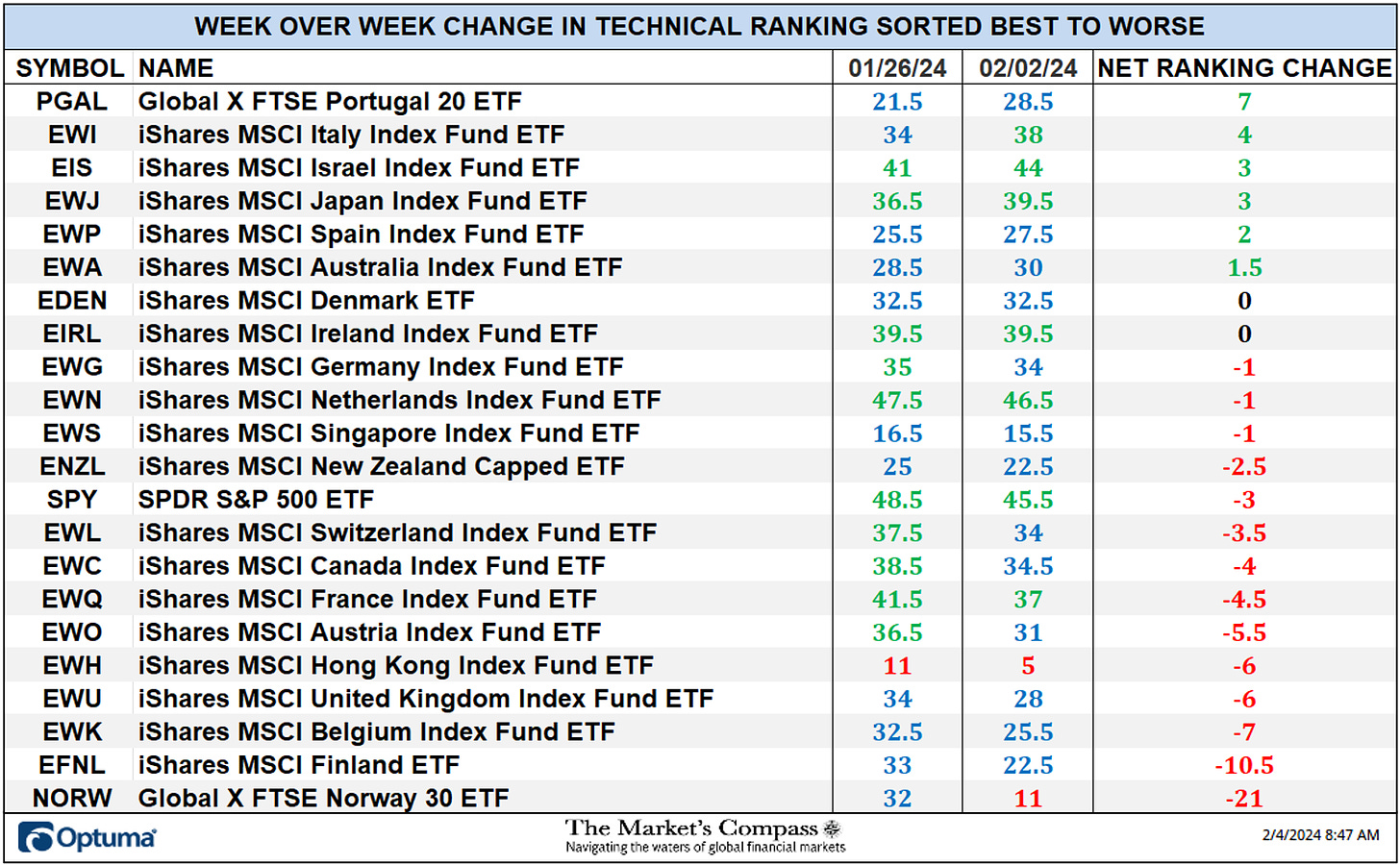

Six of the Developed Nation Market TRs we observe in these pages registered a acquire of their TRs on a WoW foundation, two had been unchanged and fourteen fell. As might be seen above on the finish of final week there have been seven ETFs within the “inexperienced zone” (35 to 50), 13 had been within the “blue zone” (15.5 to 34.5) and two had been within the “pink zone” (0-15). This was versus the week earlier than when there have been ten TRs within the “inexperienced zone”, eleven TRs within the “blue zone” and one was within the “pink zone” (0 to fifteen) which was the iShares MSCI Hong Kong Index Fund ETF (EWH). That was the fifth week in a row that the EWH was within the “pink zone” (see chart beneath with technical feedback). The Common TR lack of the 22 Developed Markets Nation ETFs final week was -2.54 vs. a median acquire of +3.75 the week earlier than. The International X FTSE Norway 30 ETF entered the “pink zone” final week with the biggest TR lack of the 22 with a pointy drop in TR to 11 from 32.

The iShares MSCI Hong Kong Index Fund ETF (EWH) has been in a gentle downtrend since January of final 12 months with all three shifting averages monitoring decrease. Other than a short restoration late final 12 months MACD displays the draw back worth momentum because it istracking decrease once more beneath it sign line. Though there was a big measure of volatility the Technical Rating has been falling steadily, notice the longer-term shifting common (blue line) in decrease panel. These technical options counsel it could folly to backside fish at the moment.

There are eight Technical Situation Components (“TCFs”) that decide particular person TR scores (0-50). Every of those 8, ask goal technical questions (see the spreadsheet posted above). If a technical query is optimistic an extra level is added to the person TR. Conversely if the technical query is unfavorable, it receives a “0”. A number of TCFs carry extra weight than the others such because the Weekly Development Issue and the Weekly Momentum Think about compiling every particular person TR of every of the 22 ETFs. Due to that, the excel sheet above calculates every issue’s weekly studying as a proportion of the doable complete. For instance, there are 7 issues (or questions) within the Each day Momentum Technical Situation Issue (“DMTCF”) of the 22 ETFs (or 7 X 22) for a doable vary of 0-154 if all 22 ETFs had fulfilled the DMTCF standards the studying could be 154 or 100%.

A 44.16% studying within the DMTCF was registered for the week ending February 2nd, or 68 out of 154 factors. In doing so, rising from an almost oversold studying of 16.23% or 25 two weeks earlier than.

As a affirmation software, if all eight TCFs enhance on per week over week foundation, extra of the 22 ETFs are enhancing internally on a technical foundation, confirming a broader market transfer larger (consider an advance/decline calculation). Conversely, if extra of the 22 TCFs fall on per week over week foundation, extra of the ETFs are deteriorating on a technical foundation confirming the broader market transfer decrease. Final week all eight TCFs misplaced floor producing a non-confirmation of final week’s +1.02% acquire within the iShares MSCI World ETF (URTH).

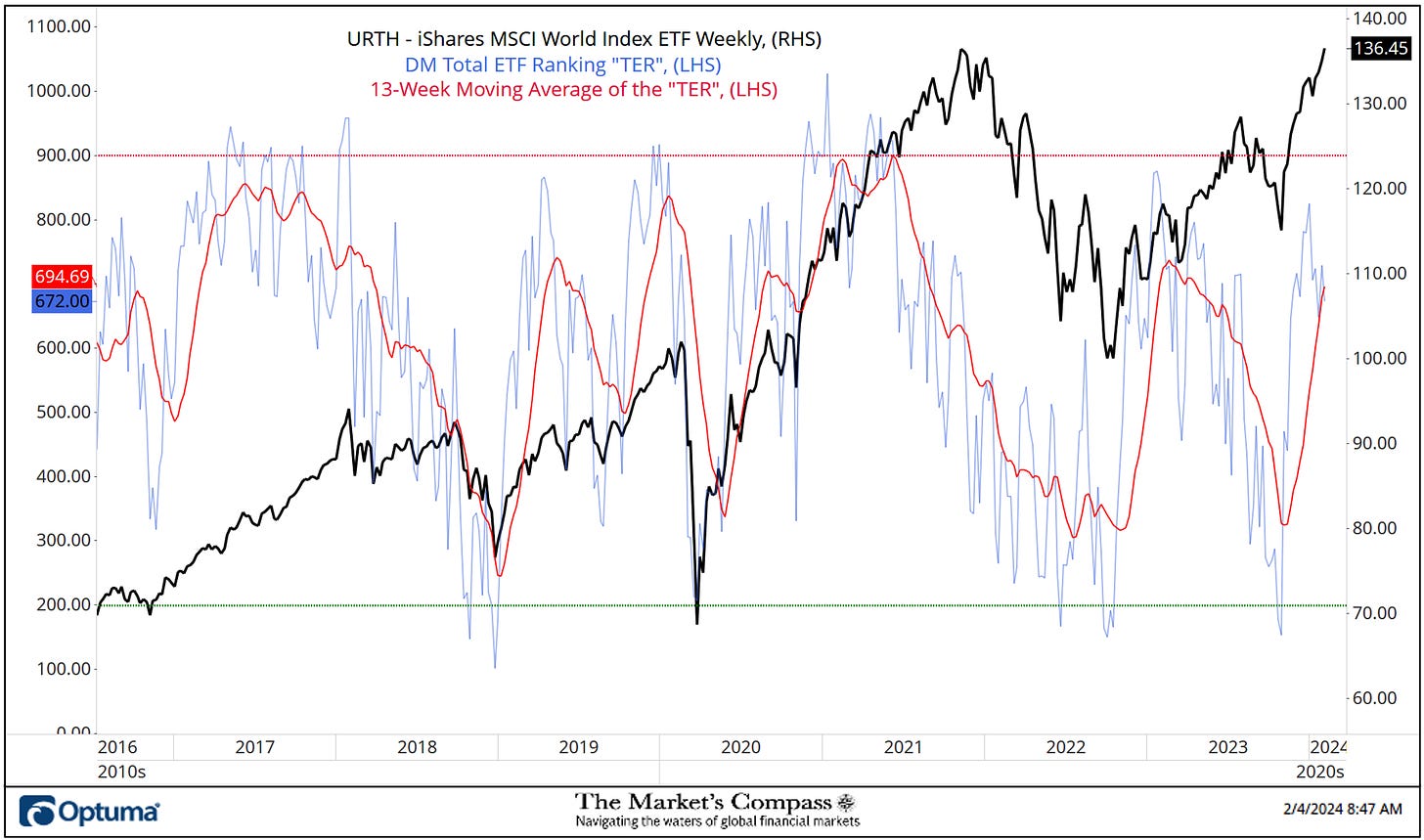

The Whole Technical ETF Rating (“TER”) Indicator is a complete of all 22 ETF rankings and might be checked out as a affirmation/divergence indicator in addition to an overbought oversold indicator. As a affirmation/divergence software: If the broader market as measured by the iShares MSCI World Index ETF (URTH) continues to rally with no commensurate transfer or larger transfer within the TER the continued rally within the URTH turns into more and more in jeopardy. Conversely, if the URTH continues to print decrease lows and there’s little change or a constructing enchancment within the TER a optimistic divergence is registered. That is, in a vogue, is sort of a conventional A/D Line. As an overbought/oversold indicator: The nearer the TER will get to the 1100 degree (all 22 ETFs having a TR of fifty) “issues can’t get significantly better technically” and a rising quantity particular person ETFs have turn into “stretched” the extra of an opportunity of a pullback within the URTH. On the flip aspect the nearer to an excessive low “issues can’t get a lot worse technically” and a rising variety of ETFs are “washed out technically” an oversold rally or measurable low is near be in place. The 13-week exponential shifting common in Purple smooths the unstable TER readings and analytically is a greater indicator of development.

Final week was the fourth week in a row that the URTH gained floor and seemed to be set to problem potential resistance on the November 2021 excessive however there continues to be a budding non-confirmation of the restoration excessive by the DM Whole ETF Rating or “TER”. That stated it ought to be famous that the 13-week shifting common (pink line) has continued to trace larger. What might be seen later within the Weblog, lower than half of the twenty-two ETF we observe gained floor on an absolute foundation final week.

The Common Technical Rating of the 22 Developed Markets Nation ETFs

The Weekly Common DM Technical Rating (“ATR”) is the common of the person Technical Rankings of the 22 Developed Markets Nation ETFs we observe. Just like the TER, it’s a affirmation/divergence or overbought/oversold indicator.

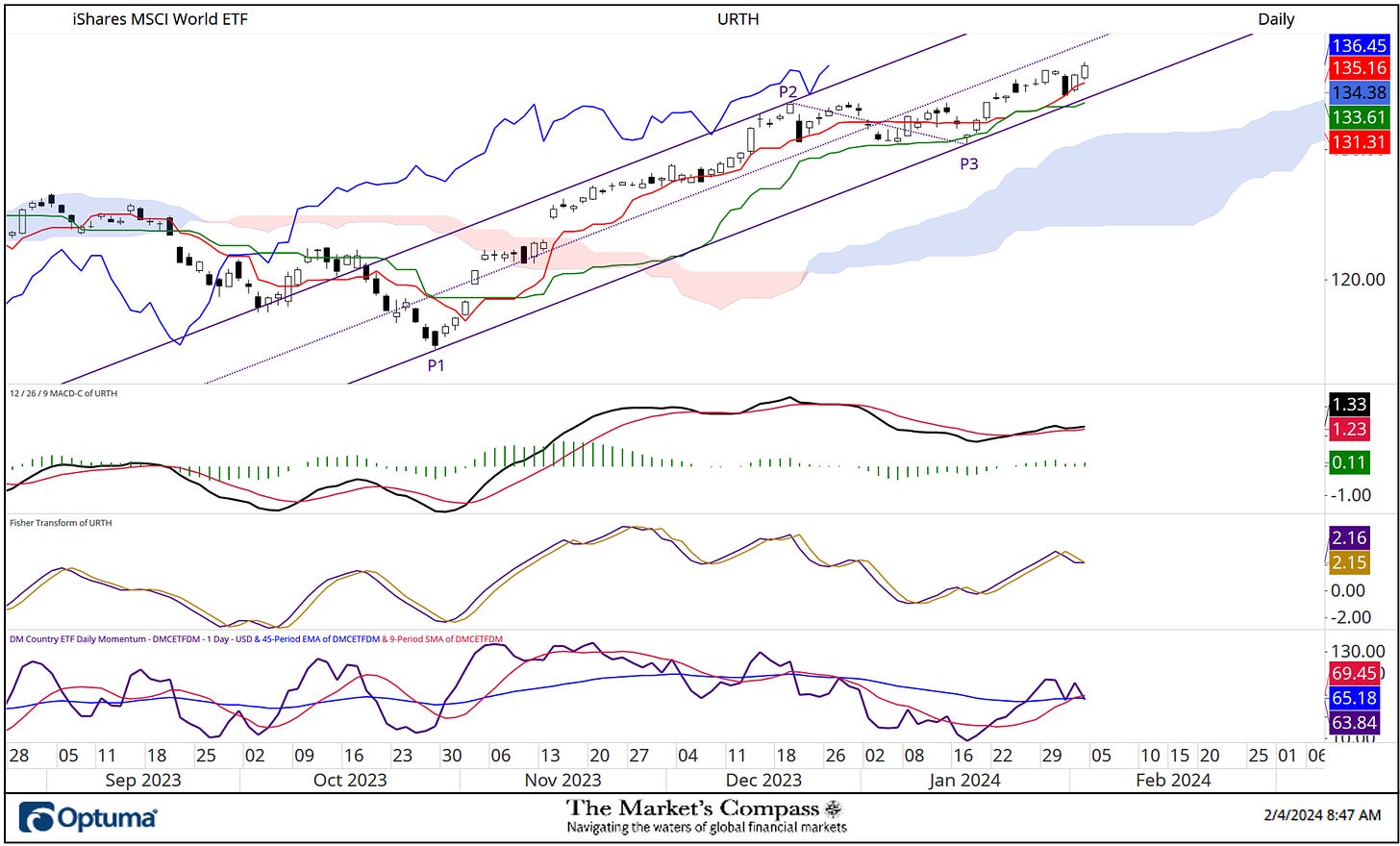

Two weeks in the past, the URTH traded and closed above the Higher Warning Line (pink dashed line) of the Schiff Modified Pitchfork that had capped the continuation of the rally for six weeks and final week the rally adopted by to the upside however the DM Common Technical Rating has not confirmed the transfer larger. The longer-term shifting common (blue line) of the indicator continues to trace larger however the shorter-term shifting common (pink line) has began to roll over and has capped the indicator for the previous 4 weeks. I would want to see the Common DM Technical Rating transfer above the 9-period ma to verify the endurance of the rally from the gold P3 worth pivot low. Extra on the Brief-Time period Technical Situation of the URTH however first…

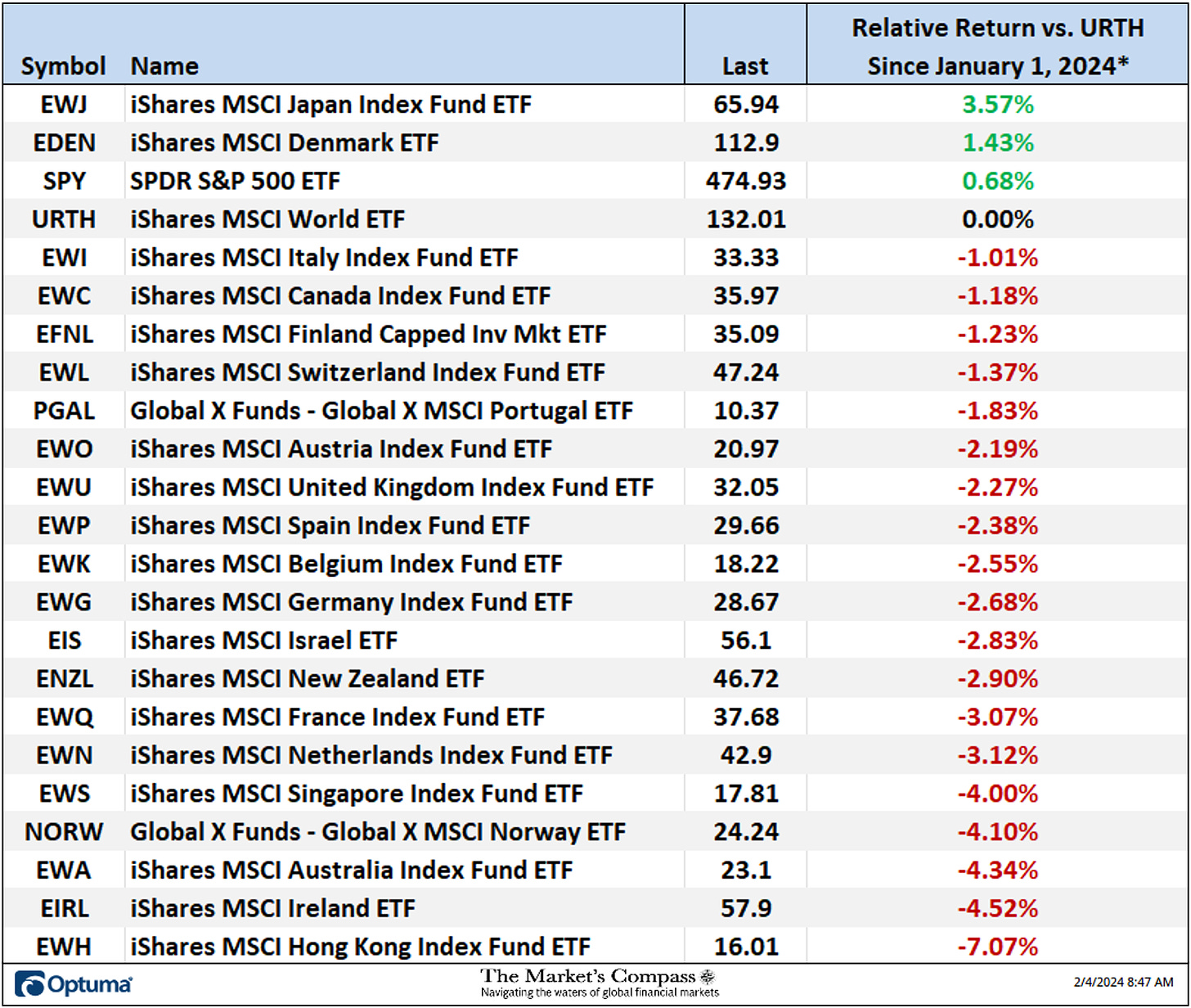

*Doesn’t embrace potential dividends

Eight Developed Markets Nation ETFs gained floor on an absolute foundation final week, 13 misplaced floor and one was unchanged, leading to a median absolute lack of -0.35% versus the earlier week that registered a median absolute acquire of +1.52%. Solely 4 ETFs outperformed the 1.02% acquire within the URTH and eighteen underperformed the acquire within the iShares MSCI World ETF.

There was a gentle grind larger within the URTH for the 13 buying and selling classes after the sideways to decrease corrective worth sample from Violet P2 to the worth pivot at Violet P3 however regardless of the transfer larger since then costs have remained trapped between the Decrease Parallel (stable violet line) and the Median Line (violet dotted line) of the Schiff Modified Pitchfork (violet P1 by P3). MACD is again above its sign line however is simply monitoring barely larger, however the momentum oscillator does stay in optimistic territory. For the reason that finish of January, the DM Nation ETF Each day Momentum / Breadth Oscillator has been anemic however has managed to carry shifting common assist.

*Doesn’t together with dividends

The EWJ, EDEN and SPY proceed to be the one three DM Nation ETF’s which are up relative to the YTD +2.58% acquire within the URTH.

Charts are courtesy of Optuma. Any time sequence information might be imported, charted, and examined in Optuma.

To obtain a 30-day trial of Optuma charting software program go to…

A 3 half tutorial sequence on Andrews Pitchfork could also be learn at my website…. www.themarketscompass.com