XRP Ledger, created by Ripple Labs Inc., is an open-source blockchain know-how and digital asset. Which means that builders can contribute to its improvement and improve its performance. XRP serves because the native cryptocurrency of the XRP Ledger and is the generally acknowledged title for it. The XRP Ledger is purposefully designed to allow swift, cost-effective, and safe transactions. It features as a distributed ledger, the place transaction data are saved throughout a community of validators, that are taking part computer systems, guaranteeing the integrity of the ledger.

XRP has garnered important recognition for its skill to facilitate expeditious and streamlined cross-border funds. Its major goal is to boost liquidity and set up connections between various currencies, enabling seamless worth transfers for each monetary establishments and people throughout worldwide borders. Ripple, the entity answerable for XRP, has cast partnerships with quite a few monetary establishments to analyze the potential of XRP within the realms of remittances and worldwide settlements.

It’s crucial to emphasise that though XRP is often linked with Ripple, the XRP Ledger features autonomously, separate from the corporate. XRP may be exchanged on totally different cryptocurrency platforms and saved in digital wallets which are appropriate with the XRP Ledger.

Moreover, there’s a various vary of cryptocurrency exchanges that help the XRP Ledger (XRP) for people all for shopping for, promoting, or buying and selling XRP. Some notable examples embrace Binance, Coinbase, Kraken, BitStamp, Huobi, and extra.

Founders Of XRP Ledger (XRP)

In early 2011, builders David Schwartz, Jed McCaleb, and Arthur Britto had been intrigued by Bitcoin however involved about its power consumption and scalability points. They aimed to create a extra sustainable system for worth switch. Their predictions about Bitcoin’s power utilization had been confirmed proper when estimates revealed that Bitcoin mining consumed extra power than Portugal in 2019. In addition they foresaw the dangers of 1 miner or collusion of miners gaining over 50% of the mining energy, which stays a priority right now as mining energy concentrates in China.

Undeterred, the builders continued their work and created a distributed ledger referred to as Ripple, with a digital asset initially referred to as “ripples” (later known as XRP). The title Ripple encompassed the open-source venture, the distinctive consensus ledger (Ripple Consensus Ledger), the transaction protocol (Ripple Transaction Protocol or RTXP), the community, and the digital asset.

To remove confusion, the neighborhood began referring to the digital asset as “XRP.” By June 2012, Schwartz, McCaleb, and Britto accomplished the code improvement and finalized the Ledger.

How XRP Ledger (XRP) Works

The XRP Ledger represents a pioneering blockchain know-how that locations a powerful emphasis on scalability and interoperability. This focus allows the ledger to supply a big selection of prospects for various purposes that surpass the realms of conventional monetary programs.

By demonstrating the capability to deal with substantial transaction volumes and foster seamless connectivity amongst totally different property, the XRP Ledger stands poised to deliver a couple of revolution throughout a number of industries and ignite innovation. Its scalable and interoperable nature creates alternatives for novel use instances and transformative options throughout the blockchain ecosystem.

Distinguished Options Of XRP Ledger

Consensus Ledger

Functioning as a distributed and decentralized ledger, the XRP Ledger shops the transaction historical past throughout an unbiased community of validators. Each validator preserves a duplicate of the ledger, and transactions endure validation and settlement by way of the consensus algorithm. This strategy ensures that the ledger’s transaction historical past is securely saved and that transactions are verified and accredited by means of a collaborative course of amongst validators. By using this distributed and decentralized framework, the XRP Ledger establishes a dependable and clear system for recording and validating transactions.

Gateways and Interoperability

The XRP Ledger allows the institution of gateways, that are entities answerable for issuing and redeeming property on the ledger. These gateways play a vital position in bridging numerous currencies and property, fostering seamless interoperability throughout totally different monetary programs.

By facilitating the switch and change of various property, the gateways improve the connectivity and compatibility between totally different types of worth illustration. This function of the XRP Ledger promotes higher effectivity and accessibility in cross-border transactions and opens up alternatives for enhanced liquidity and streamlined monetary operations.

Transaction Pace and Scalability

Engineered with scalability and fast transaction settlement in thoughts, the XRP Ledger (XRP) is adept at processing a considerable variety of transactions per second. With the aptitude to settle transactions inside a matter of seconds, the ledger is well-suited for a variety of use instances that demand swift and environment friendly transaction execution.

Its excessive scalability and speedy transaction settlement empower companies and people alike to conduct seamless and well timed transactions, fostering enhanced productiveness and responsiveness in numerous purposes and industries.

Consensus Algorithm

Throughout the XRP Ledger, a particular consensus algorithm often known as the Ripple Protocol Consensus Algorithm (RPCA) is employed. Diverging from standard proof-of-work (PoW) or proof-of-stake (PoS) algorithms, RPCA depends on a bunch of trusted validators to authenticate and validate transactions. These validators assume the essential position of collectively establishing consensus concerning the sequence and legitimacy of transactions on the community. By leveraging this modern consensus mechanism, the XRP Ledger ensures the integrity and reliability of its transaction validation course of, offering a safe and environment friendly surroundings for conducting enterprise.

Native Cryptocurrency (XRP)

XRP operates because the inherent digital foreign money of the XRP Ledger, serving a number of functions, comparable to facilitating transactions, providing liquidity, and bridging various currencies. As a medium of worth change, XRP may be transferred between numerous entities on the XRP Ledger, enabling seamless transactions and facilitating the change of worth. This versatile cryptocurrency performs a significant position in supporting the performance and effectivity of the XRP Ledger ecosystem.

The Influence Of XRP On The Monetary Trade

Undoubtedly, the XRP Ledger, together with its native foreign money XRP, has made a notable impression on the monetary trade, bringing forth a spread of constructive improvements throughout numerous essential features comparable to:

Decentralized Finance (DeFi)

The XRP Ledger’s utilization of sensible contracts and tokenization creates prospects for decentralized finance (DeFi) purposes, paving the best way for the event of groundbreaking monetary providers like lending, borrowing, and decentralized exchanges. With its fast and scalable nature, the XRP Ledger supplies a super basis for developing DeFi purposes, doubtlessly extending monetary providers to underserved communities and diminishing dependence on standard intermediaries.

Asset Tokenization

The capability of the XRP Ledger to tokenize tangible property like actual property, artwork, and commodities has the potential to unleash liquidity for property which have traditionally lacked it. By the illustration of those property as digital tokens on the ledger, fractional possession turns into possible, enabling enhanced accessibility and transferability. This breakthrough can introduce contemporary funding prospects and improve market effectivity.

Cross-Border Funds

The swift transaction settlement and economical charges provided by the XRP Ledger make it a beautiful alternative for cross-border funds. Its environment friendly currency-bridging capabilities simplify and expedite worldwide transactions, doubtlessly decreasing bills and enhancing liquidity for monetary establishments. This may end up in expedited and cost-effective remittances, benefiting each companies and people.

Liquidity and Market Effectivity

The XRP Ledger’s utilization of XRP as a bridge foreign money and liquidity instrument has the potential to bolster market effectivity and improve liquidity for various property. By enabling seamless worth change throughout totally different currencies, the XRP Ledger contributes to improved market liquidity, simplifying the method of shopping for, promoting, and buying and selling property for customers. This heightened liquidity has the capability to foster extra environment friendly markets and improve the method of worth discovery.

XRP Distribution And Value Dynamics

The distribution of XRP tokens by Ripple Labs is a nuanced course of that goes past a easy month-to-month launch schedule. At the moment, nearly all of XRP is held in 16 escrow contracts, and their launch is influenced by a number of components, comparable to market circumstances and ecosystem adoption. The unique 55-month distribution projection was an estimate, and Ripple has the power to regulate the tempo based mostly on their evaluation.

Actually, this distribution technique impacts the value of XRP. A big inflow of XRP may doubtlessly exert downward stress on its worth. Nonetheless, attributing worth fluctuations solely to this issue could be narrow-minded. The general market sentiment in direction of cryptocurrencies, demand from monetary establishments, regulatory developments, and information associated to Ripple all contribute considerably. To actually perceive the value motion of XRP, a complete evaluation of those intertwined components is critical, recognizing the intricate interaction between Ripple’s distribution technique and the dynamic cryptocurrency panorama.

Tokenomics Of XRP Provide

XRP has a set provide of 100 billion tokens, making it a pre-mined cryptocurrency with no risk of further token creation. Solely a fraction of the tokens are actively traded, whereas 20 billion went to the founders. The distribution includes 55 sensible contracts that launch 1 billion tokens month-to-month over 55 months, leading to a month-to-month increment of 1 billion tokens. The circulating provide is round 53.7 billion tokens, with the remaining held in escrow.

Supply: Messari on X

Over 60% of the whole provide is concentrated within the high 100 wallets, elevating decentralization issues. Ripple owns 6.5 billion XRP, adjusting the circulating provide to roughly 47 billion tokens.

XRP reveals a light deflationary pattern from burning charges, decreasing the whole provide to about 99,988,221,902 XRP.

Shopping for XRP Cash

Buying XRP cash could be a comparatively simple process; nonetheless, the out there decisions cater to various ranges of expertise and luxury. Here’s a breakdown of various approaches tailor-made to fulfill your particular necessities:

Newbie-Pleasant Exchanges

Coinbase and Binance are user-friendly platforms appropriate for newcomers. They supply intuitive interfaces, clear directions, and buyer help to help customers all through the method.

Peer-to-Peer (P2P) Exchanges

Platforms like Paxful are P2P exchanges that allow direct XRP purchases from different people. This decentralized strategy gives privateness and suppleness however requires warning when evaluating counterparties and following security measures.

Decentralized Exchanges (DEX)

Uniswap is an instance of a DEX platform that operates on blockchains. They facilitate direct peer-to-peer buying and selling with out intermediaries, offering enhanced safety and management over funds. Nonetheless, utilizing DEX platforms would require appropriate wallets.

Monitoring Costs of XRP Ledger (XRP)

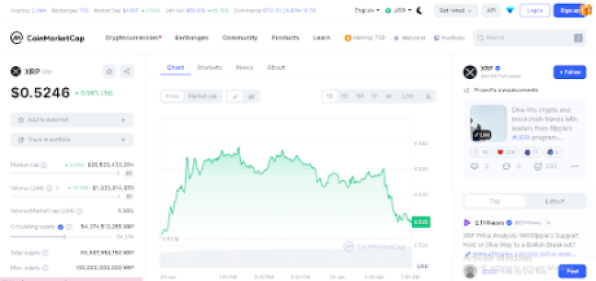

To successfully observe the costs of XRP Ledger (XRP), the digital asset native to the XRP Ledger, and keep updated with its market actions and fluctuations, there are a number of dependable strategies and platforms that you could make the most of, comparable to well known cryptocurrency monitoring platforms like CoinMarketCap

CoinMarketCap is a extremely regarded platform for monitoring cryptocurrencies, providing in depth knowledge on a various vary of digital property, comparable to XRP Ledger (XRP). Customers can discover the XRP web page on CoinMarketCap to entry up-to-the-minute worth updates, historic knowledge, market developments, and different pertinent data referring to XRP. CoinMarketCap serves as a trusted useful resource for people looking for to trace and analyze the efficiency of XRP Ledger throughout the international cryptocurrency market.

Ripple Lawsuit With Securities And Change Fee (SEC)

The Ripple vs. SEC authorized dispute, which started in December 2020, has a profound impression on XRP. The SEC accuses Ripple of conducting an unregistered securities providing by means of XRP gross sales, whereas Ripple argues that XRP is a utility token for cross-border funds and never a safety. This ongoing battle has brought about turbulence for XRP, leading to worth volatility and adoption uncertainty. The result of the case may have important implications for XRP and the broader cryptocurrency trade.

The lawsuit has led to a hesitant market as companies and people are cautious about embracing XRP because of the uncertainty surrounding its classification. The decision will decide whether or not XRP’s utility as a token will prevail or if the SEC’s classification as a safety will solid an extended shadow over its future. Because the market awaits a definitive reply, the trajectory of Ripple’s digital creation stays unsure.

Conclusion

XRP Ledger (XRP) boasts a longtime title, a decentralized community, and lightning-fast, low-cost transactions. This has cemented its position as a most popular bridge foreign money for cross-border funds.

Regardless of going through authorized challenges, XRP has a formidable observe file as one of many pioneering cryptocurrencies, gaining widespread adoption amongst main monetary establishments by means of RippleNet. The neighborhood’s dedication and the venture’s foundational strengths present a stable foundation for potential success. Nonetheless, the result of the SEC lawsuit might be a vital determinant in shaping the way forward for XRP, whether or not it is going to be constructive or unfavorable.

Nonetheless, navigating the world of XRP necessitates cautious consideration. Whereas some could prioritize user-friendly platforms for entry, skilled merchants would possibly search superior options provided by decentralized exchanges (DEXs).

No matter your expertise degree, do not forget that cryptocurrencies stay risky, and accountable investing practices are paramount. Take into account these components, analysis, and select the trail that aligns along with your private monetary targets and threat tolerance.

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use data supplied on this web site fully at your individual threat.