In an evaluation launched through X, Thomas Younger, managing accomplice at RUMJog Enterprises, is projecting a staggering upward trajectory for Bitcoin’s worth by the top of the yr, basing his predictions on the affect of Bitcoin Alternate-Traded Funds (ETFs) inflows. As NewsBTC reported, Grayscale’s GBTC outflows have slowed down considerably lately, leading to fixed internet inflows over the previous 5 consecutive days,starting from $14.8 million to $247.1 million.

The 118 Multiplier Idea

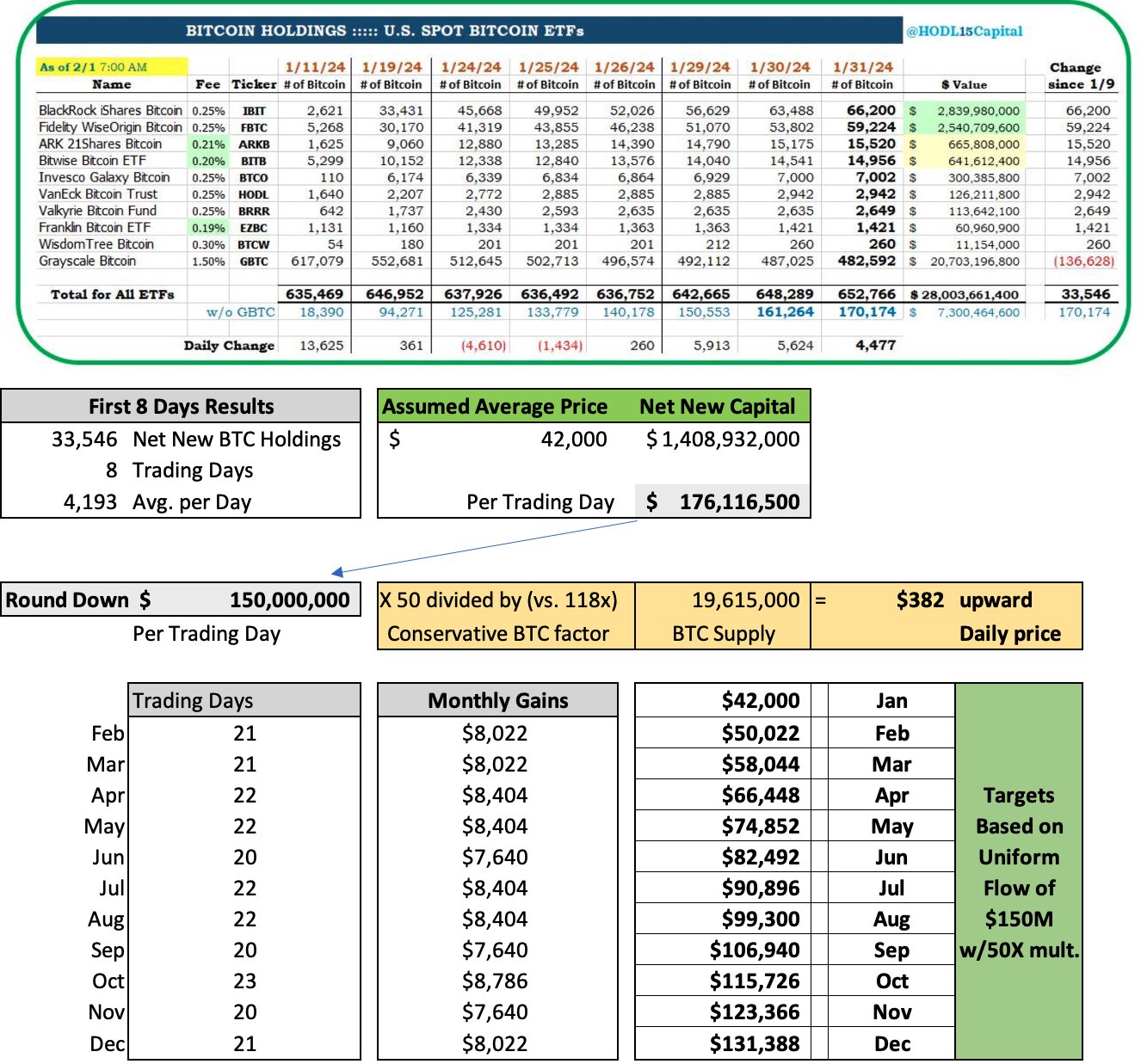

The crux of Younger’s evaluation hinges on the idea of the ‘118 multiplier’, a metric launched by Financial institution of America in March 2021. This multiplier posited that an funding inflow of roughly $92 to $93 million was wanted to maneuver Bitcoin’s worth by 1%. At the moment, Bitcoin’s market capitalization was roughly $1.09 trillion, akin to a unit worth of round $58,332.

Younger’s forecast revisits and modifies this idea, emphasizing its non-static nature. He notes, “The Multiplier is a results of a number of interacting variables, together with the amount and velocity of capital influx, the readily tradable provide of Bitcoin, and exterior elements affecting danger metrics within the broader market.” Thus, the 118x multiplier is usually recommended to be a dynamic, somewhat than a hard and fast, indicator.

Drawing on information from HODL15Capital, Younger observes a constant progress in Bitcoin ETFs, averaging an inflow of 4,193 BTC per day. This interprets to roughly $176 million of internet new capital each day. For forecasting functions, Younger adjusts this determine to $150 million each day, unfold uniformly throughout the buying and selling days of every month (sometimes 20-23 days).

Bitcoin Value May Attain $131,000 By EOY

Making use of a extra conservative multiplier of 50x, versus the unique 118x or 100x, Younger calculates an estimated month-to-month upward worth stress of $8,000 per Bitcoin. This calculation results in a year-end worth goal of not less than $131,000 for Bitcoin. Younger states, “This $131K represents the decrease sure of the forecast, acknowledging that precise capital stream will not be uniform and different elements might enhance the multiplier.”

The adjusted evaluation additionally takes under consideration the irregularities noticed in January, notably the one-time promoting of GBTC. Younger revised the January information to offer a extra correct illustration of the pattern for the rest of the yr. He suggests, “A rule of thumb: the each day common BTC acquire throughout all ETFs instances $2 offers a conservative estimate of the ETF progress’s worth impact.”

Based mostly on this mannequin, Younger’s month-to-month Bitcoin worth predictions, assuming ETF inflows proceed on the fee noticed within the first 15 days, are as follows:

- January: $42,000

- February: $50,022

- March: $58,044

- April: $66,448

- Could: $74,852

- June: $82,492

- July: $90,896

- August: $99,300

- September: $106,940

- October: $115,726

- November: $123,366

- December: $131,388

This meticulous evaluation from Younger not solely highlights the potential influence of ETF inflows on Bitcoin’s worth but additionally underscores the complexity and dynamic nature of cryptocurrency markets. Nevertheless, different occasions that have an effect on provide and demand dynamics, such because the subsequent BTC halving, in addition to macroeconomic developments (Fed fee cuts), amongst others, are different elements that make worth predictions extremely troublesome.

At press time, BTC traded at $43,021.

Featured picture from DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data supplied on this web site fully at your individual danger.