Goldman Sachs reported a revenue of $2.01 billion within the final three months of the earlier 12 months, whereas Tether’s This autumn report revealed that its earnings comprised $1 billion from U.S. Treasury payments and $1.85 billion from holdings in Gold and Bitcoin.

This exceptional efficiency could be attributed to the surge within the crypto market, pushed by the keenness surrounding the spot Bitcoin exchange-traded fund (ETF) between October and December 2023. Throughout this era, Bitcoin’s worth skyrocketed to over $42,000 from round $27,000, coinciding with Tether’s USDT provide rising to almost 92 billion from roughly 83 billion tokens.

Observers famous that the elevated demand for Tether’s fiat-backed stablecoin signaled a rising curiosity from institutional traders coming into the market. CryptoSlate’s knowledge exhibits that Tether’s USDT provide has risen to $96.2 billion as of press time.

Nonetheless, regardless of its spectacular efficiency, Tether’s total revenue for the 12 months was $6.2 billion, notably decrease than Goldman Sachs’s earnings of $8.52 billion.

In the meantime, Paolo Ardoino, Tether’s CEO, emphasised that these substantial earnings emphasize the corporate’s monetary power all year long.

“The substantial internet earnings generated not solely within the final quarter of the 12 months however all year long, amounting to $6.2 billion, showcases our monetary power,” Ardoino stated.

Goldman Sachs, a globally famend funding banking agency, holds the standing of the second-largest funding financial institution on the earth by income and is acknowledged as a systemically necessary monetary establishment by the Monetary Stability Board.

Over $5 billion in extra reserves

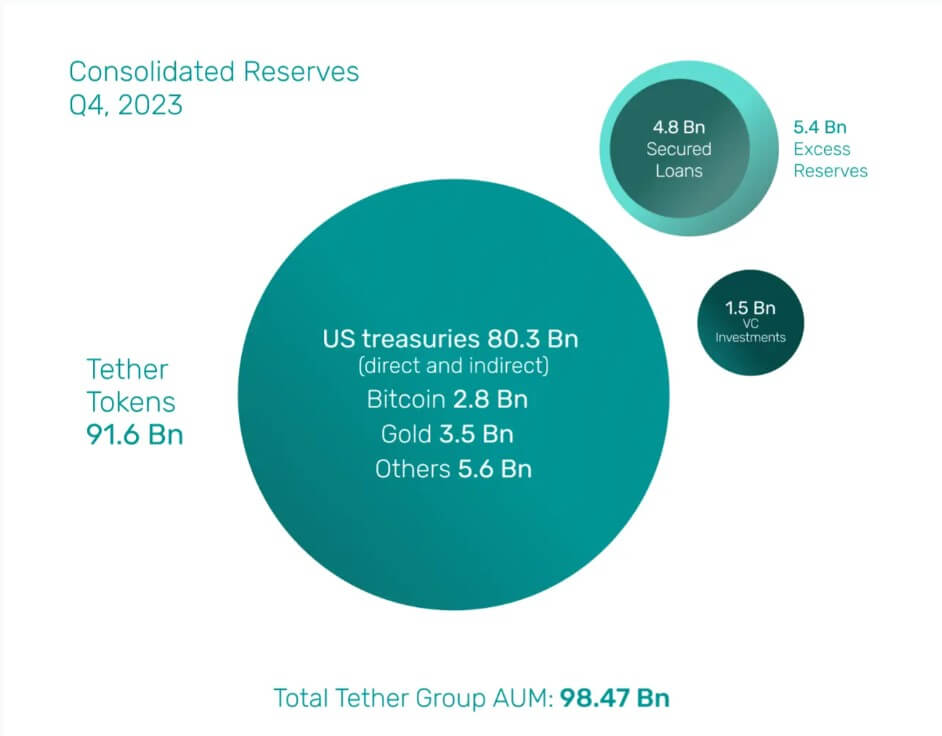

The substantial revenue margin enabled Tether to bolster its extra reserves to $5.4 billion. Of this, $640 million was allotted to numerous mission investments, together with sustainable vitality, Bitcoin mining, AI infrastructure, and P2P communications. Tether doesn’t contemplate these investments a part of its reserves.

“Our investments in sustainable vitality, Bitcoin mining, knowledge, AI infrastructure, and P2P telecommunications know-how illustrate our dedication to a extra sustainable and inclusive monetary future,” Ardoino defined.

BDO Italia, a outstanding world accounting agency conducting Tether’s attestations, verified that the stablecoin’s extra reserves totally coated its $4.8 billion in excellent unsecured loans. Tether highlighted its achievement in eliminating the chance of secured loans from its token reserves.

As of December 31, 2023, Tether’s held belongings had been valued at $98.47 billion, with liabilities amounting to $91.59 billion.