Bitcoin worth had beforehand been exhibiting excessive power main up till the debut of the primary spot ETFs. That power has since subsided, resulting in a 20% correction in BTCUSD.

A well-liked technical indicator that measures momentum, nevertheless, may level to highly effective continuation to the upside, however provided that a sure stage is breached. Maintain studying to study extra concerning the Relative Energy Index and the way the highest cryptocurrency behaves as soon as the market reaches an “overbought” stage.

Bitcoin Approaches “Overbought” And Why This Isn’t A Unhealthy Factor

The Relative Energy Index is a momentum-measuring instrument that indicators when a market is “overbought” or “oversold”. When a monetary asset reaches such circumstances, it usually means the development is about to vary.

In Bitcoin and different cryptocurrencies, the weekly RSI is usually a sign that the asset is transferring into its strongest section. For instance, Bitcoin made it above a studying of 70 in October 2023, and solely weeks later noticed an over 60% rally to native 2024 highs.

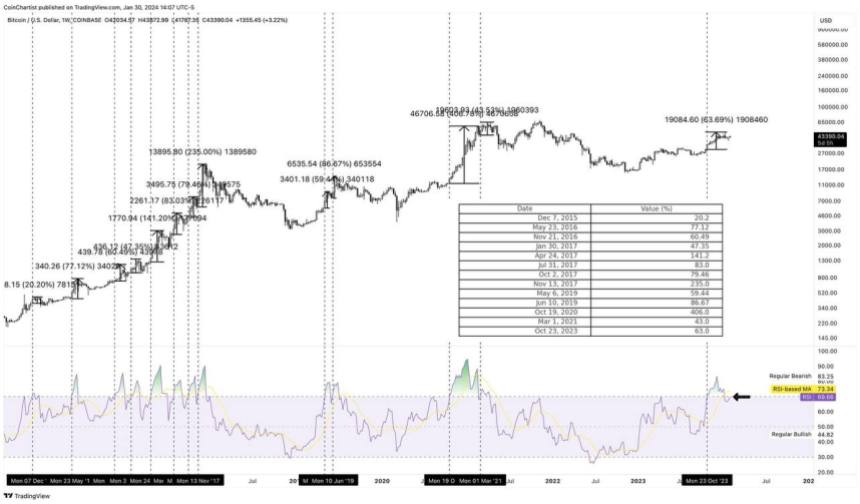

Now 1W BTCUSD charts are exhibiting an RSI studying of just under 70, pointing to a potential shut again above the overbought stage. If bulls can preserve the highest cryptocurrency by market cap above $43,650, the weekly RSI ought to shut above the brink.

The common transfer is 107% | BTCUSD on TradingView.com

BTCUSD Historic 1W Relative Energy Knowledge

Historic information may probably shed some mild on what would possibly occur if the weekly Relative Energy Index will get the shut above 70 as anticipated.

During the last ten years, Bitcoin noticed a 1W RSI shut above 70 a complete of 13 instances. This occurred 8 instances in 2016 and 2017, twice in 2019, and as soon as every in 2020 and 2021. One extra occasion occurred in 2023.

Of the 13 instances, the typical acquire after the RSI closed above 70 to the height of the motion was 107%. The biggest rally was in 2020, bringing over 400% returns. The smallest rally was in 2016 and noticed solely a 20% acquire.

After eradicating the biggest and smallest outliers, the typical drops right down to round 61%. This might imply that Bitcoin may produce on common a transfer between 61 and 107%.

A 61% acquire takes BTCUSD again to simply beneath $68,000 and shy of a brand new all-time excessive, whereas a 107% transfer units a brand new report nearer to $90,000 per coin. The cryptocurrency can be probably engaged on a bull flag sample, with a goal of round $77,000.

The 75% goal is inside historic averages | BTCUSD on TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site fully at your individual danger.