Regardless of beginning the yr sturdy, MKR has encountered a uneven path in current weeks, leaving traders with a combined bag of alerts to decipher. Whereas the decentralized finance (DeFi) chief has maintained its place above key assist ranges, issues have emerged surrounding a outstanding pockets’s sizeable token sale and a declining buying and selling quantity.

Maker Resilience Faces Unsure Shadows

On the brilliant facet, Maker has demonstrated resilience amidst broader market downturns. After a notable surge on January twenty fourth, the token has held its floor, defying predictions of a deeper correction. This steadfastness has fueled optimism amongst some analysts, who predict a continued upward trajectory for MKR all through 2024.

Nonetheless, a current improvement has forged a shadow of uncertainty. Information from on-chain analytics agency Spot on Chain revealed {that a} well-known pockets, reportedly related to a MakerDAO co-founder, unloaded a hefty 2,235 MKR over the previous two days. This interprets to a staggering $4.5 million at press time, sparking fears of a possible “whale dump” that might set off a worth droop.

Pockets 0xa58 (linked to @RuneKek, #MakerDAO cofounder) has bought 2,235 $MKR for 4.542M $DAI at $2,032 on common prior to now 2 days.

Presently, the pockets nonetheless holds 2,430 $MKR ($4.92M), and should maintain promoting.

The $MKR worth has been down ~3.39% (2D), for the reason that first sale.

Need… pic.twitter.com/iW2A0pMLHx

— Spot On Chain (@spotonchain) January 28, 2024

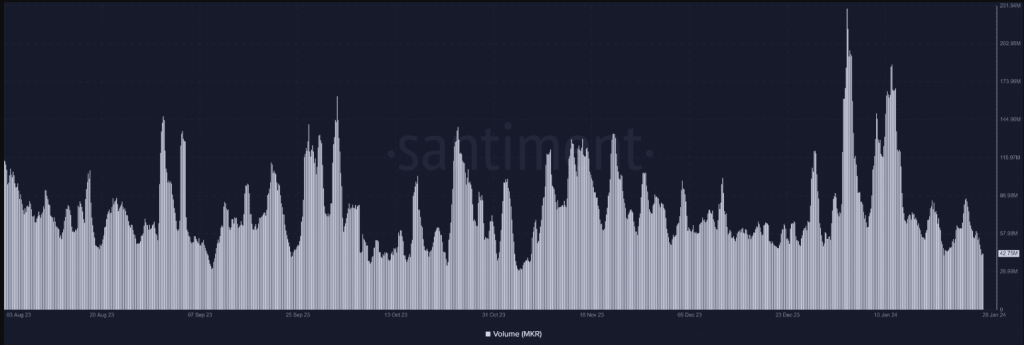

Including to the combined image is a decline in buying and selling quantity. After reaching a excessive of $84 million on January twenty fifth, exercise has steadily dwindled, at present hovering round $43 million. This dampened buying and selling enthusiasm might point out waning investor confidence or just be a brief lull.

Supply: Santiment

A glimmer of hope emerges when analyzing alternate netflow. Regardless of the sizable pockets sale, the general stream of MKR has been dominated by inflows, suggesting that extra tokens are being withdrawn from exchanges than bought. This development, whereas not as pronounced because the earlier outflow witnessed on January twenty fifth, hints at potential accumulation by longer-term holders.

MKR market cap at present at $1.786 billion. Chart: TradingView.com

MKR Technical Struggles Forward

On the technical entrance, Maker’s every day chart paints an image of current wrestle. Following the January twenty fourth positive aspects, costs have launched into a descent, shedding over 3% by January twenty seventh. This marks the steepest decline for the reason that downtrend started two days prior. The continuation of this promoting stress, notably if fueled by additional whale offloads, might pose a major problem for MKR’s instant future.

MKR worth motion right now. Supply: Coingecko

On the time of writing, MKR was buying and selling at $1,939, down 2.6% and 0.7% within the final 24 hours and 7 days, information from Coingecko exhibits.

Maker’s early 2024 journey has been characterised by each encouraging indicators and potential pitfalls. Whereas the token’s resilience and optimistic long-term outlook provide causes for optimism, the current whale sale and declining quantity inject a dose of warning.

Featured picture from iStock, chart from TradingView

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site totally at your personal threat.