On-chain information exhibits that Bitcoin traders have been clearing out their wallets not too long ago because the asset continues to be disappointing on this post-ETF period.

Bitcoin Small Wallets Have Been Displaying Indicators Of Capitulation

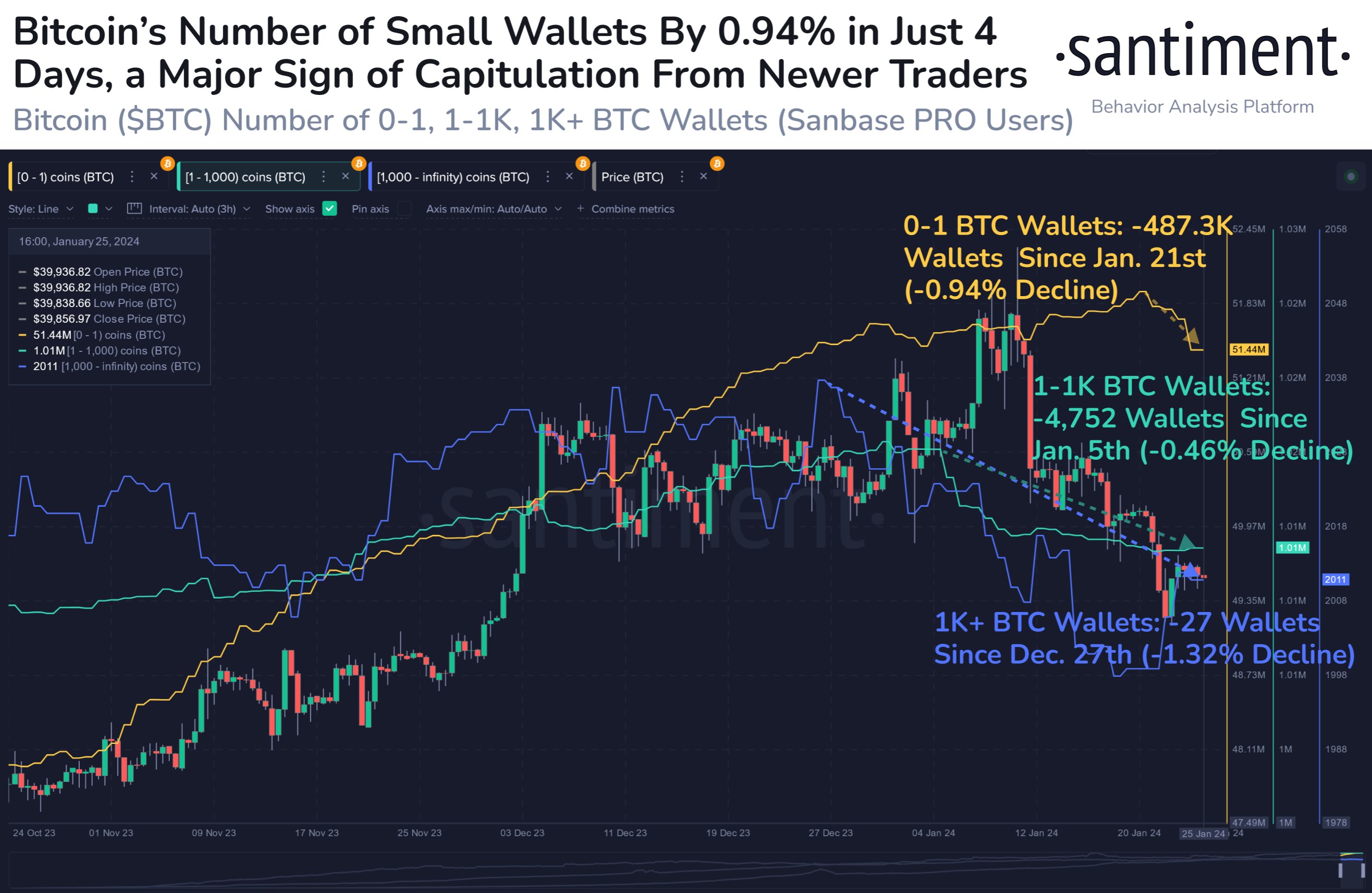

In accordance with information from the on-chain analytics agency Santiment, the variety of small BTC wallets has seen a pointy decline throughout the previous few days. The indicator of relevance right here is the “Provide Distribution,” which tells us concerning the quantity of wallets that at present belong to the completely different holder teams on the Bitcoin community.

The addresses are divided into these teams based mostly on the variety of cash they’re carrying of their stability proper now. A pockets carrying 0.5 BTC, for example, would belong contained in the 0 to 1 BTC cohort.

Now, here’s a chart that exhibits the development within the Provide Distribution for 3 completely different Bitcoin pockets teams over the previous few months:

The development within the wallets of the small, mid, and enormous BTC holders | Supply: Santiment on X

The primary pockets group on the chart is the “0 to 1” cash cohort. The house owners of such small wallets are often the retail traders, popularly generally known as the “shrimps.”

From the graph, it’s seen that these small fingers have seen the entire variety of their wallets go down in the previous few days. To be extra particular, round 487,300 shrimps have cleared out their wallets on this selloff, a decline of virtually 1%.

“Historical past tells us that that is sometimes an indication of capitulation, which may result in a market worth bounce till smaller merchants start to get optimistic towards crypto as an funding car as soon as once more,” explains the analytics agency.

“The frustration of market performances because the 11 ETF approvals over 2 weeks in the past is essentially attributed because the trigger for these pockets liquidations,” Santiment provides.

The spot ETFs have been one of many primary subjects within the cryptocurrency group throughout the previous few months, and the value rally in Bitcoin was partially pushed by anticipation round them. In contrast to what some traders had imagined, although, the market offered on the information, and BTC has been unable to get better thus far.

The shrimps aren’t the one ones which have capitulated not too long ago, although, because the 1-1,000 cash group has seen a decline of 4,752 wallets since January fifth, whereas the 1,000+ BTC entities have shed 27 addresses since December 27.

The previous group consists of the mid-sized Bitcoin holder teams just like the “sharks,” whereas the latter cohort consists of the biggest of the fingers on the community: the “whales.”

Clearly, nevertheless, these bigger entities had began promoting forward of the spot ETF approvals, whereas the shrimps had nonetheless been optimistic concerning the occasion. And curiously, because the smallholders have began their newest capitulation, the whales have, actually, seen some development of their addresses.

BTC Worth

Bitcoin has seen some sharp restoration push previously day because the asset’s worth has now bounced again to the $40,800 mark.

Seems to be like the value of the coin has shot up during the last 24 hours | Supply: BTCUSD on TradingView

Featured picture from Shutterstock.com, charts from TradingView.com, Santiment.internet

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding choices. Use data offered on this web site solely at your individual threat.