Charles Edwards, the founding father of hedge fund Capriole Investments, supplied an in-depth evaluation of the Bitcoin market yesterday. His evaluate presents a granular perspective on the aftermath of the historic ETF launches, the pivotal position of main gamers like Grayscale, and the interaction of market mechanics shaping Bitcoin’s trajectory.

Bitcoin Market Abstract: ETF Launch

Edwards acknowledged the ETF launches as a pivotal second, characterizing it as “ETF Mania.” He emphasised the hindsight realization that the ETF launch triggered a short-term “promote the information occasion.” Edwards elucidated, “A portion of this may be attributed to the Grayscale outflows of over $4B, roughly half of which was compelled promoting by the FTX chapter property and one other couple billion more likely to cowl Grayscale’s debt obligations.”

Nevertheless, he tasks a shift within the outflow fee from Grayscale, stating, “I count on the present fee of outflow will drop to a extra sustainable trickle over the following few weeks (after one other few billion out).” Edwards additionally highlighted the top of Grayscale’s multi-year lock-up interval, permitting long-term buyers to lastly shut their GBTC positions at market costs.

Concerning Blackrock and Constancy ETFs, Edwards famous their significance, saying, “The model names of those two behemoths within the conventional asset administration house means each billion they convey in, provides an order of magnitude extra credibility (and due to this fact flows) into Bitcoin and crypto as a complete.”

BTC Technical Evaluation

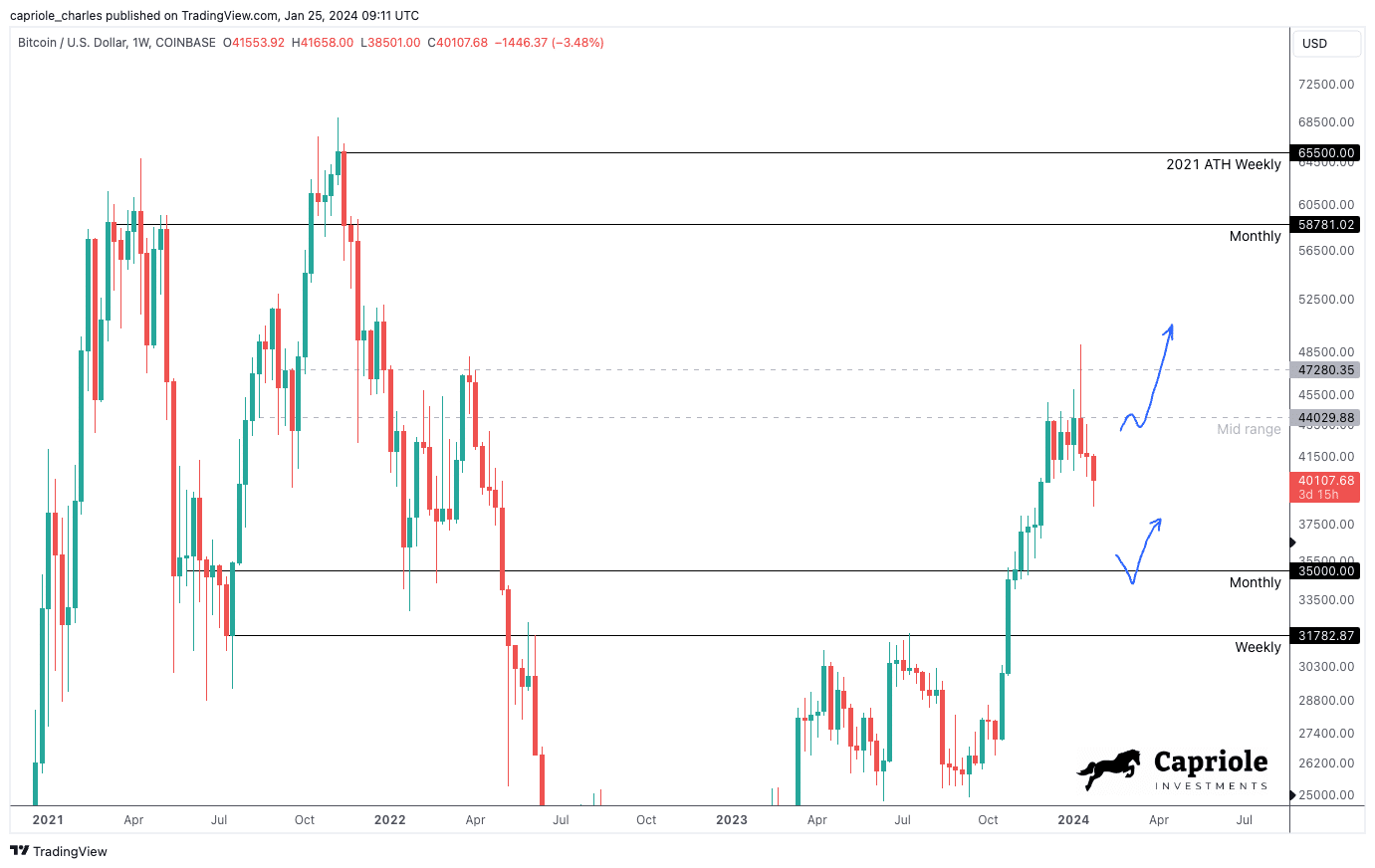

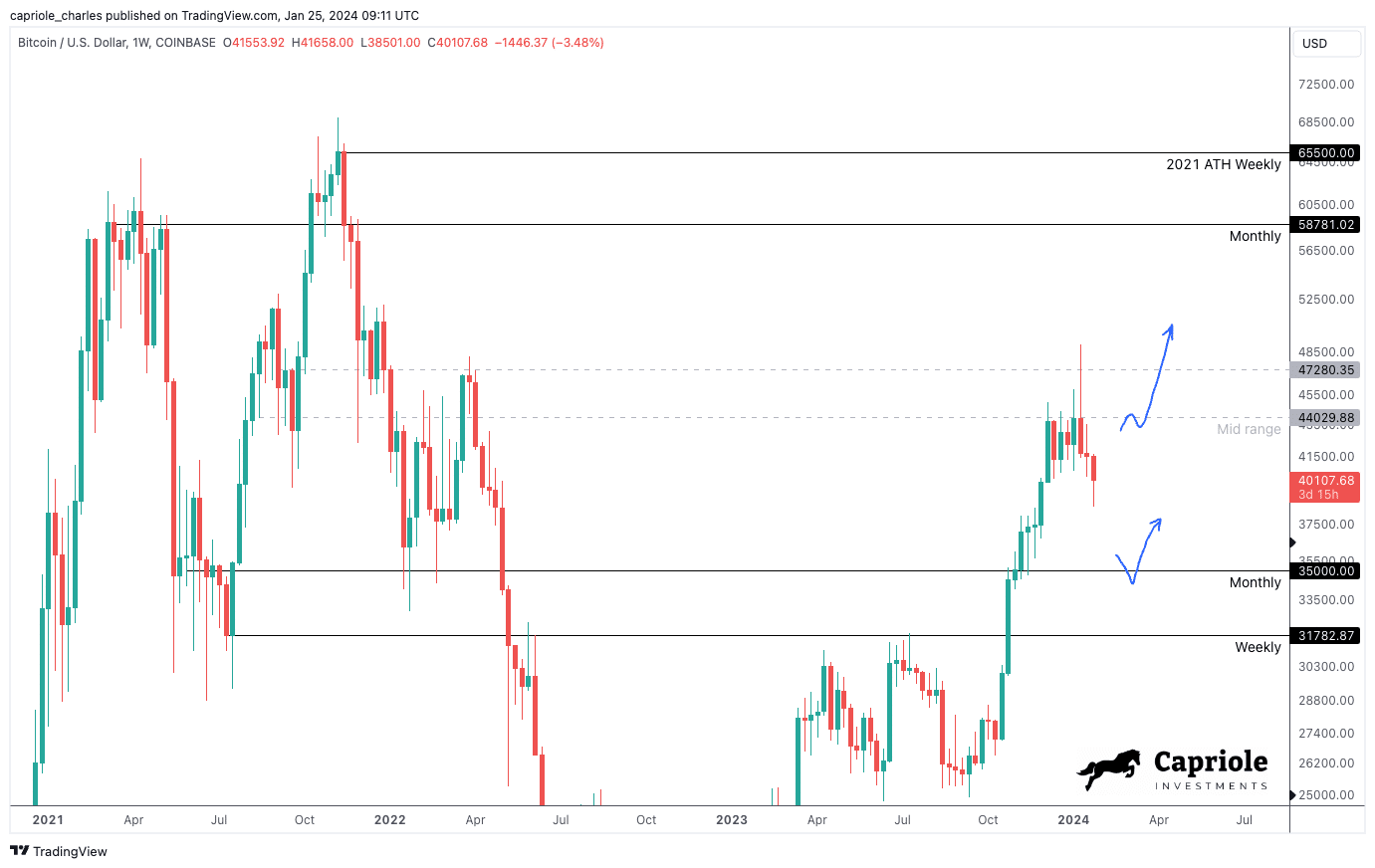

In his excessive timeframe technicals (HTF) evaluation, Edwards noticed a robust rejection at mid-range resistance through the ETF launch. He identified, “The closest HTF help at $35K would possible characterize an excellent alternative to get lengthy for the 2024 Halving 12 months (if we’re fortunate sufficient to get there).” Edwards additionally talked about, “Alternatively, a robust shut above $44K will possible see the pattern proceed to vary highs ($60K).”

For low timeframe technicals (LTF), he dissected the December/January consolidation and the $44K “fakeout” through the ETF launch. Edwards defined, “Fakeouts typically resolve in value actions to the opposite facet of the vary, as we noticed.” He added:

Subsequently, probably the most attention-grabbing value level domestically is $41K. A each day shut above $41K would possible characterize a downtrend fakeout and a swift return to vary excessive at $44K (+). If we merely wick into $41K and begin trending again down, that will be an excellent risk-off set off for a possible transfer decrease towards $35K HTF help.

Fundamentals: The Position Of On-Chain Knowledge

Edwards underscored the significance of fundamentals and on-chain information in understanding market dynamics. He launched Capriole’s Bitcoin Macro Index, stating, “This Index contains over 50 of probably the most highly effective Bitcoin on-chain, macro market and equities metrics mixed right into a single machine studying mannequin. It is a pure fundamentals-only worth investing strategy to Bitcoin. Value isn’t an enter.”

In keeping with him, fundamentals have entered a interval of slowdown which aligned with the close to prime on the ETF launch. “That basic slowdown continues at the moment with value down -20% from the highs in January thus far,” Edwards remarked.

Chart Of The Week

The hedge fund supervisor additionally launched the Advance-Decline (AD) Line as a chart of the week. He defined, “The AD Line is calculated because the cumulative sum by way of time of every day’s depend of advances much less declines.” Edwards highlighted its relevance, stating, “At this time we’re seeing the primary such breakout since 2016.”

He drew parallels between the AD Line’s breakout and Bitcoin’s historic efficiency, noting, “Throughout these intervals in 2013 and 2016, Bitcoin was additionally in a drawdown from all-time-highs (like at the moment) and started two of its largest cyclical rallies in historical past.”

The Alternative Of The 12 months

In conclusion, Edwards supplied a nuanced outlook. He cautioned, “Bitcoin at $39-40K will not be a screaming purchase at the moment.” Nevertheless, he projected, “The chance of the 12 months possible awaits within the $32-35K area, which if we’re fortunate sufficient to see, will most likely be the final time we ever see it.”

Edwards concluded with a forward-looking perspective, stating, “Pending that, we await patiently for a momentum breakout of $41K (aggressive) and $44K (conservative) for resumption of the meat of the first 2024 pattern. Up.”

At press time, BTC traded at $40,003.

Featured picture created with DALL·E, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site completely at your personal danger.