The Bitcoin worth took a draw back flip over the weekend and appears able to re-test essential help ranges. The draw back worth motion was triggered by a spike in promoting strain following the approval of Bitcoin spot Alternate Traded Funds (ETFs) within the US.

As of this writing, the Bitcoin worth trades at $40,900 with a 2% loss previously 24 hours. During the last week, these losses doubled, with different belongings within the crypto prime 10 by market underperforming, aside from Dogecoin (DOGE), which nonetheless information a 4% revenue in the identical interval.

Bitcoin Worth Loses Steam, How Low Can BTC Go?

By way of the social media platform X, the founder and former CEO of crypto alternate BitMEX, Arthur Hayes, shared a forecast for the Bitcoin worth. In line with Hayes, BTC appears poised to lose its present ranges.

The crypto founder and dealer claims that the low timeframe worth motion will doubtless push Bitcoin beneath $40,000 and doubtlessly beneath $35,000 if bulls fail to defend the upper space round these ranges.

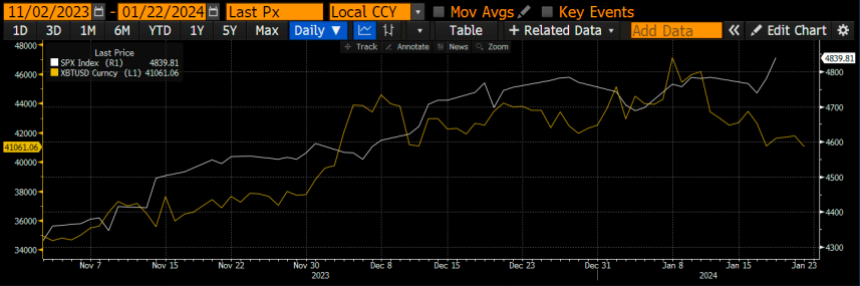

The primary difficulty relating to the present market construction rests upon the liquidity within the Bitcoin market. As seen within the chart beneath and as identified by Hayes, the liquidity within the BTC market has been trending to the draw back because the Bitcoin spot ETF was authorised.

Consequently, and as a result of fixed promoting strain from the Grayscale Bitcoin Belief (GBTC), the market has been trending to the draw back and will keep this course till the subsequent main macroeconomic occasion.

On the above, the BitMEX founder said:

Why has $SPX and $BTC stopped shifting up collectively submit US BTC ETF launch? Each are love extra $ liq, which one is true concerning the future? $BTC is telling us that there are hiccups forward for $ liq, subsequent signpost is thirty first Jan US Treasury refunding annc (announcement).

If Bitcoin Goes South, What Ranges May Maintain The Line?

A pseudonym crypto analyst confirmed a cluster of shopping for orders stacked from the $38,819 to the $40,000 ranges in a separate report. In different phrases, these ranges ought to current opposition and seem to be BTC’s largest alternative to bounce again, at the least on low timeframes.

In that sense, the analyst said the next, anticipating a doable short-term restoration, and displaying the picture beneath:

Some massive zones beginning to construct up round 41K & 42K. Fairly sure we’ll at the least take out that prime half someplace subsequent week. Will see if worth sustains after that.

Cowl picture from Unsplash, chart from Tradingview

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site fully at your personal danger.