Following final week’s launch of 11 spot Bitcoin change Traded-Funds (ETFs) in the USA, Matt Hougan, Chief Funding Officer (CIO) at Bitwise, has supplied a compelling perspective on the potential impression of those ETFs on the Bitcoin market. His remarks come at a crucial juncture, with the following Bitcoin halving occasion anticipated in mid-April 2024.

Spot ETFs Might Have Impression Like 1.4 Bitcoin Halvings

Hougan attracts a parallel between the impression of Bitcoin ETFs and the Bitcoin halving occasions. He states, “Crypto natives have psychological mannequin for the impression of Bitcoin ETFs available on the market: The halving.” He additional explains the historic context, “Roughly each 4 years, the quantity of latest bitcoin being created falls in half. Bitcoin’s worth has traditionally risen within the 12 months +/- surrounding the halving.”

In April, when the block quantity hits 740,000, the reward will fall from 6.25 to three.125 BTC. Highlighting the supply-demand dynamics of Bitcoin, Hougan remarks, “Bitcoin’s worth is ready by provide and demand. For those who scale back new provide, that must be (and traditionally has been) good for costs.” He then quantifies the impression of the following halving, “At present costs, it can take away roughly $7 billion in new provide from the market every year.”

Transferring to the core of his evaluation, Hougan compares the anticipated inflows from ETFs to the halving impact. He notes that estimates for ETF inflows differ, however many individuals assume that these merchandise will pull in someplace round $10 billion per 12 months for the foreseeable future.

“If that occurs, meaning the direct impression of the ETF on Bitcoin’s provide/demand steadiness is one thing like 1.4 halvings,” Hougan claims.

Nonetheless, he cautions concerning the timing of those impacts, saying:

Notice that ‘halvings’ don’t impression costs in a single day. If the following halving takes place on April 22, we don’t anticipate costs to extend sharply on April 23. Traditionally, costs have risen in +/- the 12 months surrounding every halving. The identical will likely be true for ETFs.

An Even Larger Scope?

Hougan additionally highlights the oblique advantages of ETFs. In keeping with him, these merchandise might have oblique advantages that aren’t captured in his analogy. “IMHO, the ETF is a major optimistic for regulation, long-term training, and so on. It would considerably improve the variety of individuals inquisitive about crypto, and subsequently have a multiplier impact.”

Concluding his ideas, Hougan says, “Nonetheless, the halving is a fairly good psychological mannequin for the direct impression of ETFs: ~1.4 halvings, plus the numerous ancillary advantages. We’ll take it.”

Hougan’s estimate of $10 billion per 12 months of web inflows for the spot Bitcoin ETFs is sort of conservative. Analysts from Customary Chartered predicted just a few days in the past that there will likely be inflows of $50 billion to $100 billion this 12 months. If $100 billion does certainly movement into the ETFs, the merchandise might even have an effect as sturdy as 14 BTC halvings.

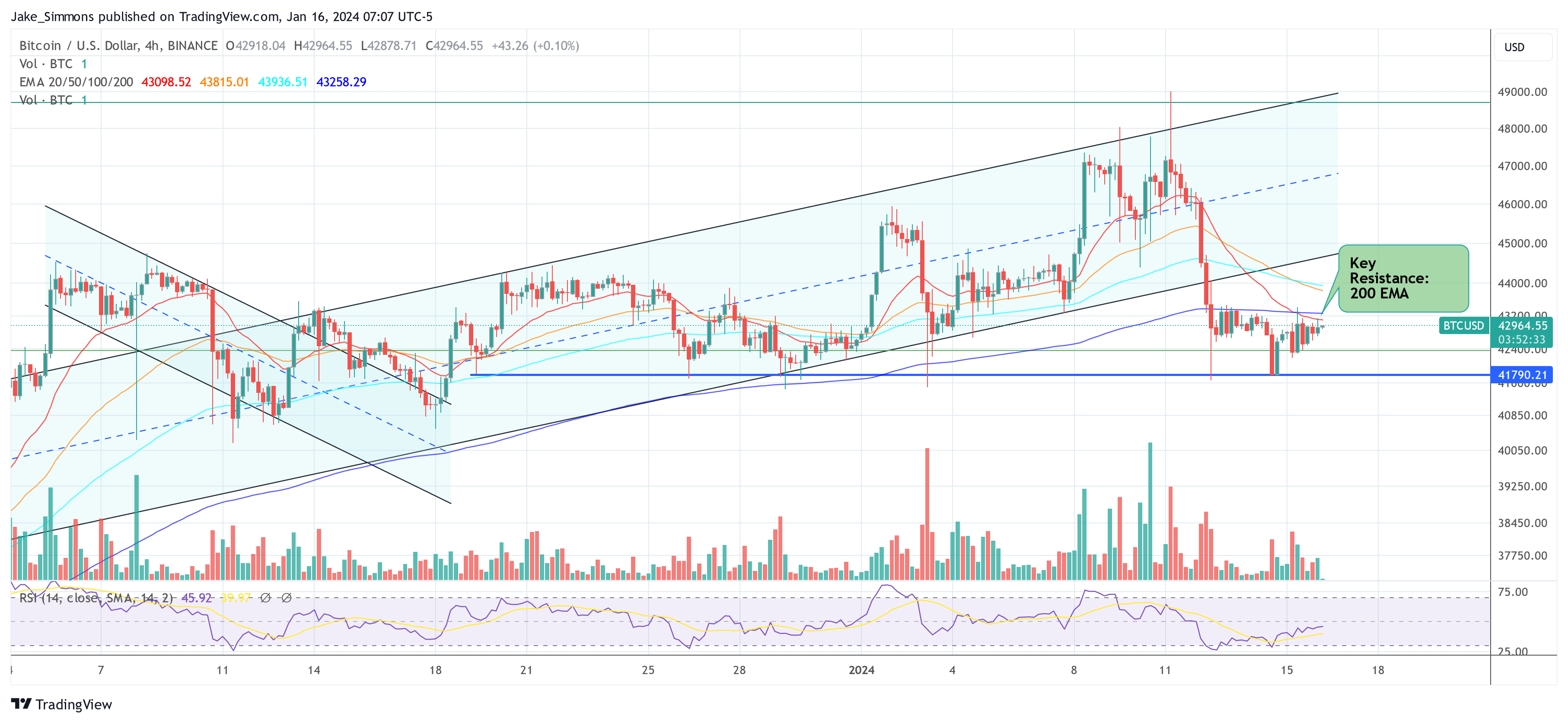

At press time, BTC traded 42,964.

Featured picture created with DALL·E 3, chart from TradingView.com

Disclaimer: The article is offered for academic functions solely. It doesn’t characterize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding selections. Use data offered on this web site totally at your personal threat.