K33 Analysis, a distinguished entity within the cryptocurrency analysis sector, has launched a scathing report on Cardano (ADA), sparking widespread dialogue within the crypto neighborhood. The report bluntly advises traders to divest from Cardano, citing a scarcity of significant use for its native token, ADA.

Promote All ADA Now?

In an in depth examination, K33 Analysis asserts that the Cardano community suffers from a big lack of sensible software, which is crucial for the inherent worth of its native token. The report states, “A sensible contract community wants significant use for its native token to have any worth. The Cardano community, nonetheless, has no significant use or any credible monitor to get it.”

Addressing the counterargument usually offered by Cardano supporters concerning the community’s each day transactions averaging round 90,000, the report argues that these don’t equate to significant blockchain exercise. The report additional elaborates, “There’s nothing else happening within the Cardano Community than trade transfers and a bunch of bagholders fabricating blockchain exercise.”

K33 Analysis highlights the absence of exterior proof supporting any vital exercise on the Cardano community, contrasting it with different protocols the place actual exercise is corroborated by exterior proofs. This lack of exterior validation is termed as ‘proof by contradiction’ by the analysis agency.

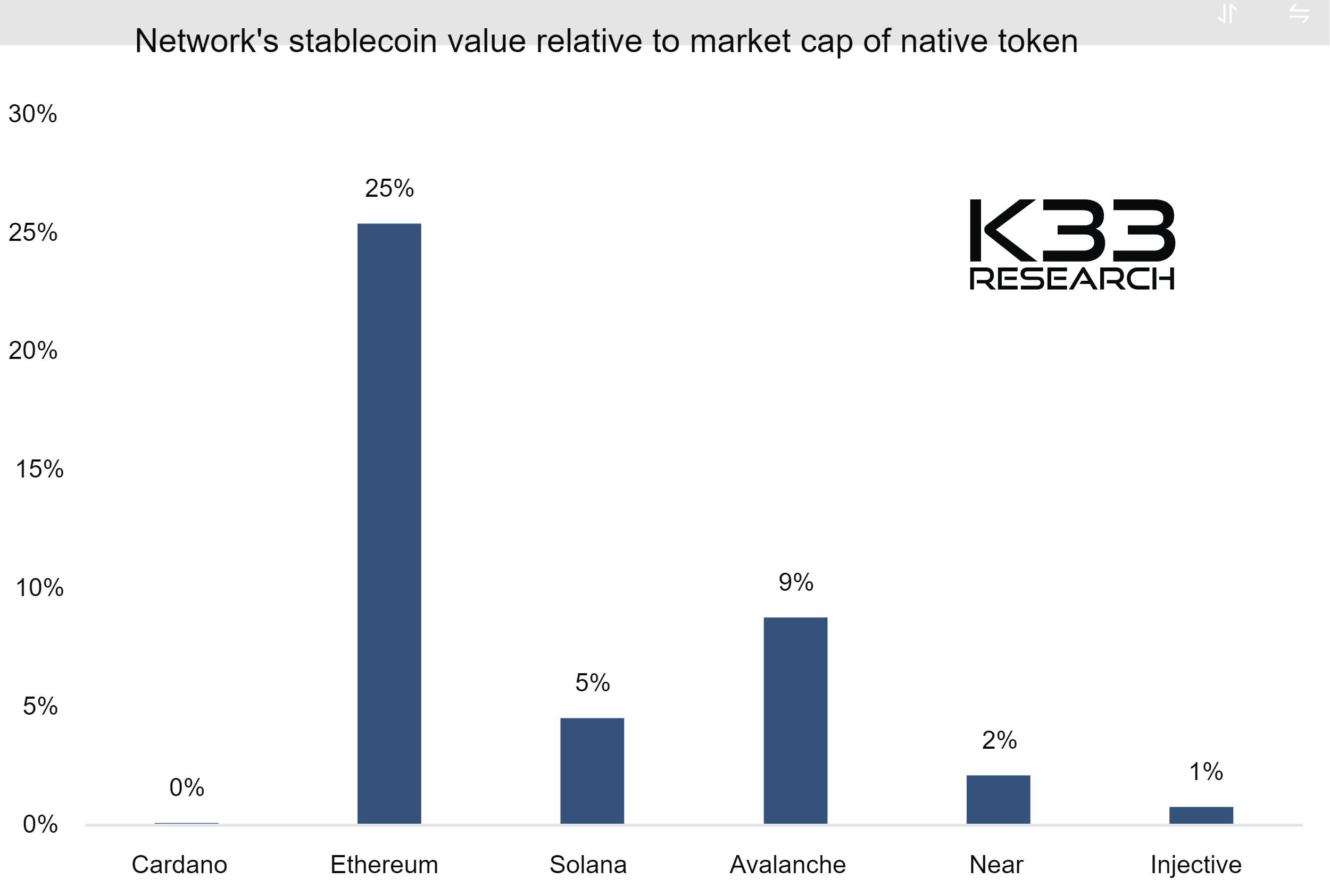

One of the vital telling indicators of inactivity, in accordance with the report, is the scenario of stablecoins on the Cardano community. K33 Analysis factors out that the absence of main stablecoins like USDT and USDC on Cardano is a transparent indicator that no significant decentralized finance (DeFi) actions are going down. The one stablecoins current are reportedly Cardano-collateralized and valued at 76 cents to the greenback, which it refers to as “one other phrase for nothing.”

Future Outlook For Cardano

K33 Analysis is pessimistic about Cardano’s future, drawing parallels with different blockchain initiatives that began with no traction and later light into irrelevance. The report notes that profitable blockchains evolve over time, whereas “creationistic, grand thought, backed bootstrapping, and no actual use-blockchains” finally lose their luster. It cites examples like IOTA, NEO, and EOS as an example this sample.

Regardless of Cardano’s present market valuation of $19 billion, K33 Analysis attributes this to its availability on varied exchanges and its enchantment to new crypto traders. The report critiques the narrative surrounding Cardano, describing it as “scientific mumbo-jumbo” which may mislead newcomers.

“Ada is a well-established coin that’s tradeable ‘in every single place’, additionally on smaller native exchanges, making it one of many cash which can be ‘pushed’ to aspiring crypto traders. Cardano additionally has an attractive story for newcomers, with Cardano being branded as ‘the peer-reviewed research-driven blockchain community’,” the report mentions.

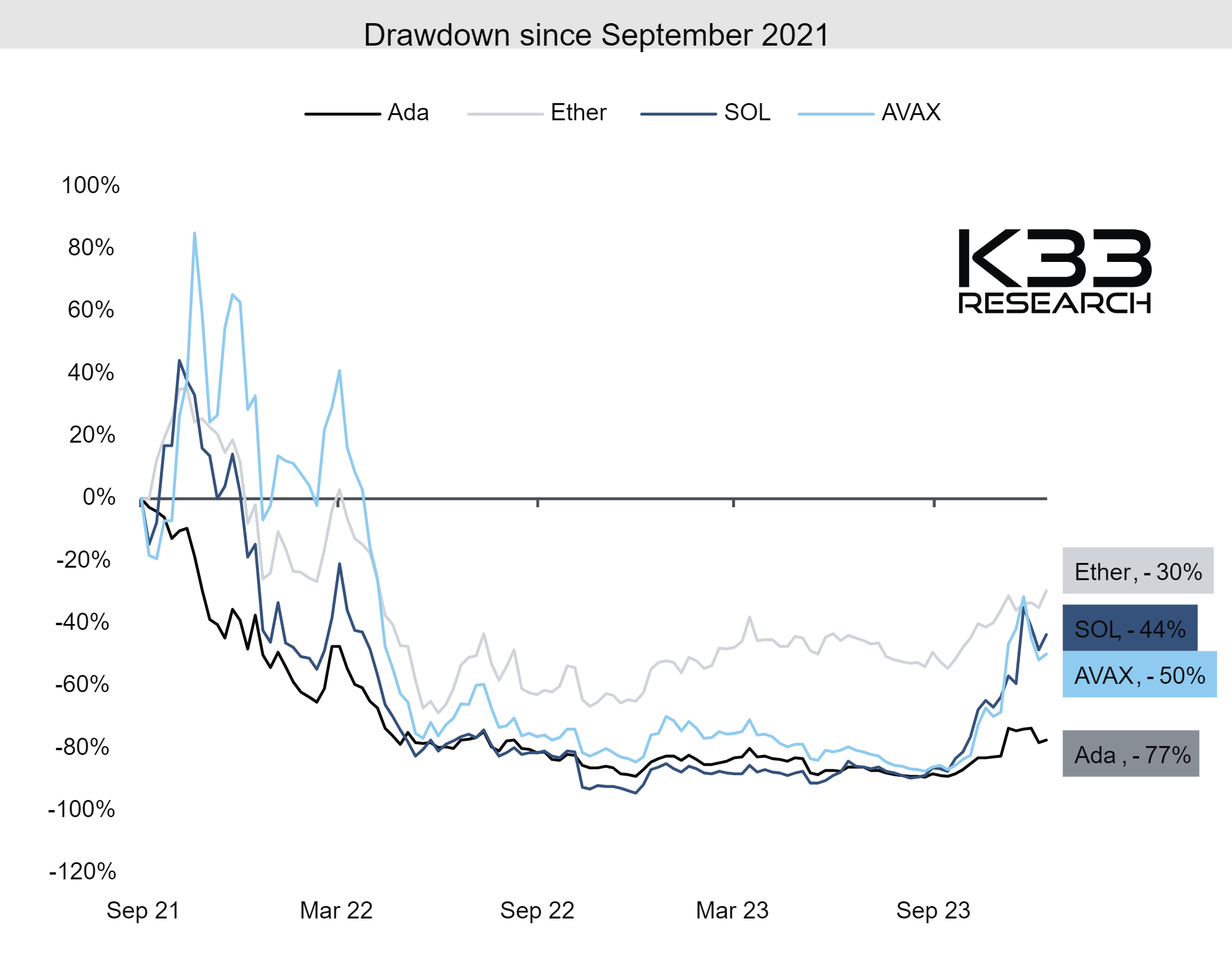

Nonetheless, K33 Analysis foresees a decline on this attract, predicting that the variety of new traders interested in Cardano will dwindle. Furthermore, K33 Analysis casts doubt on the long-term viability of ADA, citing a scarcity of rally in its worth in comparison with different sturdy good contract tokens throughout current market rallies.

“Ada has not rallied consistent with different ‘stronger’ good contract tokens when markets have improved,” the report states, suggesting a gradual fade from relevance reasonably than an abrupt disappearance.

In line with K33 Analysis, the market doesn’t quickly get rid of such cash however as a substitute “bleeds them out” over time. The report concludes, “Issues by no means occur in a single day, and these processes usually take years to play out totally. Nonetheless, all worth alerts additionally level to Ada regularly disappearing from the crypto map.”

At press time, ADA traded at $0.531.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You might be suggested to conduct your personal analysis earlier than making any funding selections. Use info supplied on this web site completely at your personal danger.