In an in depth evaluation launched by crypto intelligence agency ChainArgos, allegations have surfaced in regards to the Polygon staff’s involvement in secret gross sales of MATIC tokens, doubtlessly resulting in a suppression of the token’s worth. The revelations stem from an in-depth examination of the token allocations and subsequent flows to varied exchanges.

ChainArgos, in a collection of statements on X (previously Twitter), elaborated on discrepancies between Polygon’s publicly acknowledged token allocation plan and the precise flows noticed. Notably, the agency recognized irregular outflows from a “vesting contract” and a basis contract, which ostensibly manages the allocations.

ChainArgos highlighted, “If you have a look at the flows you discover a ‘vesting contract’ which mechanically unlocks all flows… That form is odd and the gaps are all completely different sizes,” ChainArgos reported, indicating potential irregularities.

$1 Billion In MATIC Offered In Stealth Modus?

A important level of concern is the supposed allocation for staking. ChainArgos’s evaluation means that whereas the allocation desk indicated a spread from 400 million to 1.2 billion MATIC for staking, the precise circulate into the staking contract began from zero and solely reached 800 million.

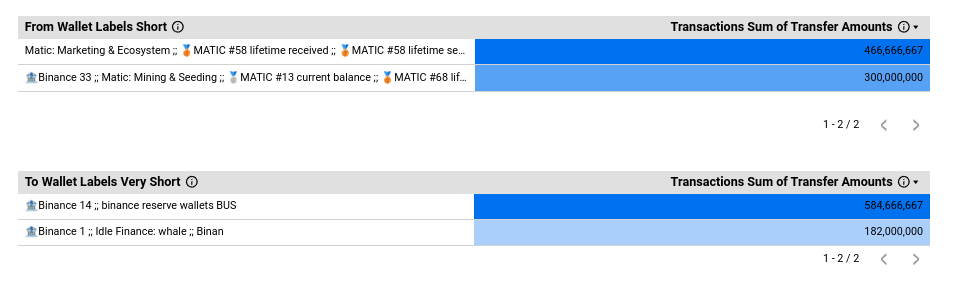

This discrepancy of 400 million MATIC was traced to an tackle labelled ‘Binance 33’ on Etherscan, which ChainArgos asserts isn’t related to staking actions. This tackle, apparently, was additionally concerned in a big circulate of 300 million MATIC to a different tackle, which in flip despatched 767 million MATIC to Binance change wallets.

“467 million [came] from the Etherscan-labeled “Matic: Advertising and marketing & Ecosystem pockets,” ChainArgos notes. The agency additional argues that this sample of outflows is a transparent indicator of worth manipulation, suggesting a coordinated effort by the Polygon staff and Binance to discreetly transfer giant quantities of MATIC.

“So this isn’t just a few Binance-adjacent factor. The staff and Binance are clearly working collectively to feed these tokens out the again, corresponding to it’s. As we’re speaking about 767 million tokens with a worth someplace roughly $1-$2, that is one thing like a billion {dollars}”, the crypto intelligence agency claims.

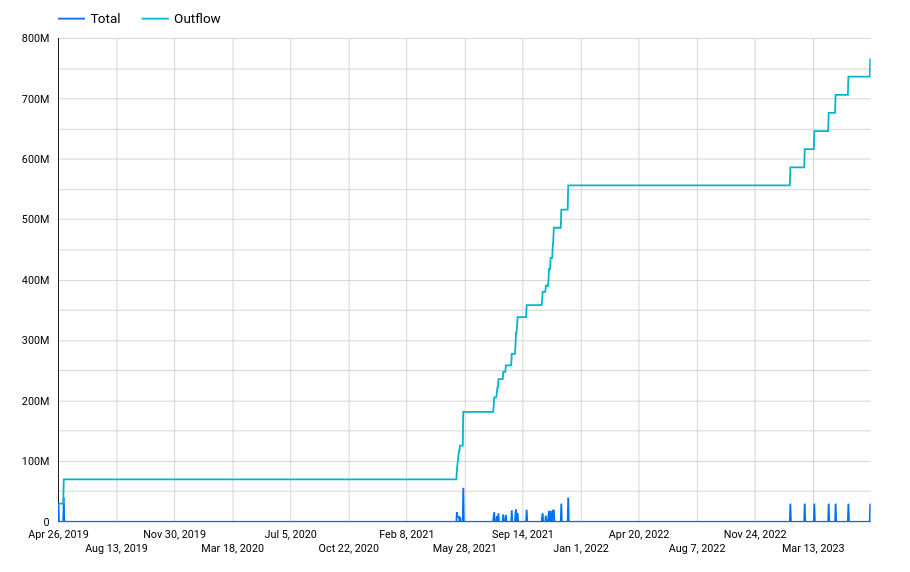

The agency additionally correlated the outflows from the tackle 0x2f4Ee with the MATIC worth chart, suggesting that these actions had been indicative of impending worth tops and subsequent declines. ChainArgos claims, “Now let’s have a look at the outflows from 0x2f4ee over time. Deliver up a worth chart. We go away it as an train for the reader to work out that is *very clearly* an excellent indicator for an upcoming prime and subsequent transfer decrease.”

Lack Of Transparency, Extra Inconsistencies?

ChainArgos criticized the dearth of transparency and oversight in these transactions, urging buyers to be extra diligent and questioning the place their funds are being allotted. “This isn’t even effectively hidden. Once more this has been in our demo for some time. This instance is revealed as a part of our docs. As a result of none of that is tough to seek out. Do higher “buyers.” Additionally, possibly, ask the place your cash went,” ChainArgos states.

For context, the Polygon token provide distribution contains numerous classes corresponding to Personal Sale tokens (3.80% of the full provide), Launchpad sale tokens (19%), Crew tokens (16%), Advisors tokens (4%), Community Operations tokens (12%), Basis tokens (21.86%), and Ecosystem tokens (23.33%). The Launchpad sale, particularly, was performed in April 2019, elevating roughly $5,000,000 USD.

This report raises critical questions in regards to the integrity of token allocations and the potential for market manipulation inside the crypto area.

At press time, the Polygon staff had not but responded to ChainArgos’ report. MATIC traded at $0.86, up 11.6% within the final seven days.

Featured picture from iStock, chart from TradingView.com

Disclaimer: The article is offered for instructional functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info offered on this web site solely at your personal danger.